ICICI Bank's (IBN) Q4 Earnings Rise Y/Y, Provisions Decline

ICICI Bank’s IBN fourth-quarter fiscal 2021 (ended Mar 31) net income was INR44.03 billion ($602 million), up substantially from INR12.21 billion ($167 million) in the prior-year quarter.

The company’s shares on the NYSE have rallied 3.5% in the pre-market trading. A full day’s trading session will provide a better picture.

Results were driven by a rise in net interest income, non-interest income, and growth in loans and deposits. Further, provisions declined during the quarter. However, higher operating expenses posed a headwind.

In fiscal 2021, net income of INR161.93 billion ($2.21 billion) jumped significantly from the prior year.

Net Interest Income Up, Expenses Rise

Net interest income rose 17% year over year to INR85.65 billion ($1.2 billion). Net interest margin was 3.84%, down 3 basis points (bps).

Non-interest income (excluding treasury income) was INR41.37 billion ($566 million), up 3% from the prior-year quarter. Fee income increased 6% to INR38.15 billion ($522 million).

Further, treasury loss was INR0.3 billion ($3 million) versus treasury profit of INR2.42 billion ($33) in the year-ago quarter. The loss in the reported quarter reflected the increase in yields on fixed income and government securities.

Operating expenses totaled INR60.03 billion ($821.09 million), up 4% year over year.

Loans & Deposits Increase

As of Mar 31, 2021, ICICI Bank’s total advances amounted to INR7,337.29 billion ($100.4 billion), up 14% year over year. Total deposits grew 21% to INR9,325.22 billion ($127.6 billion).

Credit Quality: Mixed Bag

As of Mar 31, 2021, net nonperforming assets (NPA) ratio was 1.14%, down 27 bps. Recoveries and upgrades (excluding recoveries from proforma NPAs, write-offs and sale) from non-performing loans were INR25.60 billion ($350 million) in the quarter.

Further, gross NPA additions were INR55.23 billion ($755 billion).

Provisions (excluding provision for tax) plunged 52% from the prior-year quarter to INR28.83 billion ($394 million). During the quarter, the company utilized contingency provision amounting to INR35.09 billion ($480 million) toward proforma NPAs as of Dec 31, 2020.

Further, the company made Covid-19 related provisions of INR10 billion ($137 million) during the reported quarter. As of Mar 31, 2021, ICICI Bank held Covid-19-related provision of INR74.75 billion ($1 billion).

Capital Ratios Strong

In compliance with the Reserve Bank of India's guidelines on Basel III norms, ICICI Bank's total capital adequacy was 19.12% and Tier-1 capital adequacy was 18.06% as of Mar 31, 2021. Both the ratios were well above the minimum requirements.

Our Take

ICICI Bank’s quarterly performance was decent. Growth in net interest income was a major tailwind, which is expected to support the company's financial performance going forward. However, elevated expenses are likely to adversely impact the bank’s bottom line. Also, coronavirus-induced market mayhem is a major headwind.

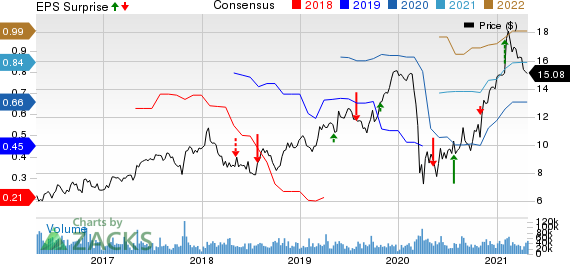

ICICI Bank Limited Price, Consensus and EPS Surprise

ICICI Bank Limited price-consensus-eps-surprise-chart | ICICI Bank Limited Quote

ICICI Bank currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Dates of Other Foreign Banks

UBS Group AG UBS and HSBC Holdings HSBC are scheduled to announce first-quarter 2021 results on Apr 27, while Barclays BCS will report on Apr 30.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create ""the world's first trillionaires."" Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance