Ideanomics (NASDAQ:IDEX) shareholders are up 11% this past week, but still in the red over the last year

This week we saw the Ideanomics, Inc. (NASDAQ:IDEX) share price climb by 11%. But that hardly compensates for the shocking decline over the last twelve months. Indeed, the share price is down a whopping 81% in the last year. Arguably, the recent bounce is to be expected after such a bad drop. The bigger issue is whether the company can sustain the momentum in the long term. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

The recent uptick of 11% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

See our latest analysis for Ideanomics

Ideanomics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Ideanomics saw its revenue grow by 528%. That's a strong result which is better than most other loss making companies. So on the face of it we're really surprised to see the share price down 81% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

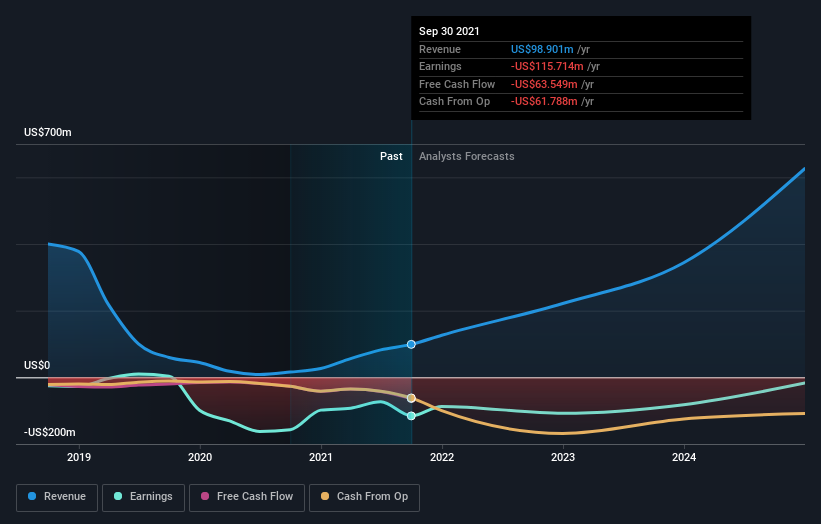

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Ideanomics stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market lost about 12% in the twelve months, Ideanomics shareholders did even worse, losing 81%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Ideanomics better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Ideanomics you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance