Identiv Inc Reports Q1 2024 Results: Misses Revenue and Earnings Expectations

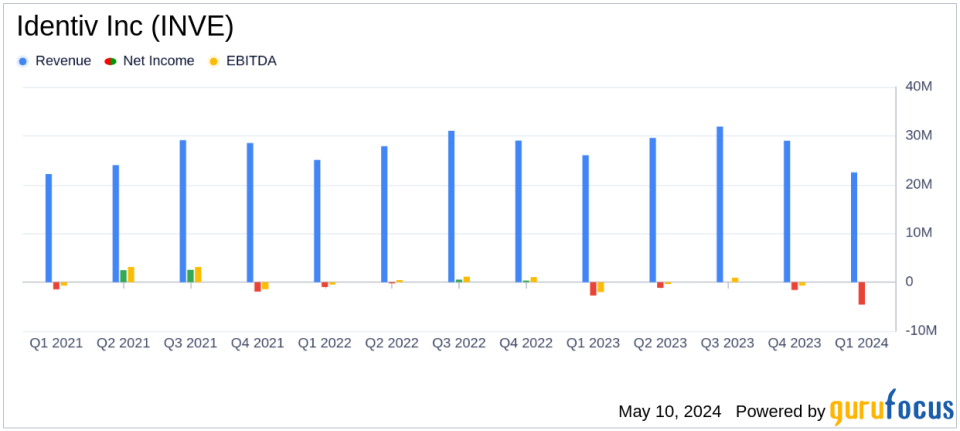

Revenue: Reported at $22.5 million for Q1 2024, down from $26.0 million in Q1 2023 and below estimates of $23.0 million.

Net Loss: GAAP net loss widened to $4.6 million or -$0.21 per share, compared to a net loss of $2.7 million or -$0.13 per share in Q1 2023, and worse than estimates of -$3.09 million.

Gross Margin: GAAP gross margin improved to 37.3%, with non-GAAP gross margin reaching 39.9%, marking the highest levels since Q3 2021.

Operating Expenses: GAAP operating expenses increased to $12.6 million from $11.9 million in Q1 2023.

Strategic Asset Sale: Entered into a $145 million asset sale agreement expected to close in Q3 2024, aiming to bolster financial position and focus on specialty IoT solutions.

Management Changes: Welcomed a new President for IoT Solutions, who is set to become CEO following the closure of the asset sale transaction.

Future Outlook: Anticipates Q2 2024 revenues to be in the range of $23 million to $25 million, reflecting normal seasonality.

On May 8, 2024, Identiv Inc (NASDAQ:INVE), a leader in digital security and identification for the Internet of Things (IoT), disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company, known for securing access to physical places, things, and information, reported a revenue of $22.5 million for the quarter, which is below the analyst's expectation of $23.00 million.

Financial Performance Overview

Identiv's revenue saw a decrease from $29.0 million in the previous quarter and $26.0 million in the first quarter of 2023, settling at $22.5 million this quarter. The GAAP net loss widened to $4.6 million, or $0.21 per share, compared to a net loss of $2.7 million, or $0.13 per share, in the same period last year. This loss was significantly greater than the estimated net loss of $3.09 million and earnings per share of -$0.15.

The company's gross margin improved, reaching 37.3% on a GAAP basis and 39.9% on a non-GAAP basis, marking the highest levels since Q3 2021. However, GAAP operating expenses increased to $12.6 million from $11.9 million in Q1 2023, driven by heightened research and development, sales, and marketing costs.

Strategic Developments and Management Commentary

Amidst financial challenges, Identiv made strategic moves, including a significant agreement to sell its physical security, access card, and identity reader operations for $145 million, expected to close in Q3 2024. This sale is anticipated to bolster Identiv's balance sheet, enabling further investment in specialty IoT solutions.

In the first quarter, our total business net revenue was within our guidance range, and we delivered our highest GAAP and non-GAAP gross margins in ten quarters, stated Identiv CEO Steven Humphreys. We also brought in a world-class business leader, Kirsten Newquist, who has the ideal profile to lead our IoT business. Our previously announced strategic review culminated in a definitive agreement signed on April 2. We believe this transaction positions Identiv with a strong balance sheet to invest in the future growth of our specialty IoT solutions business and look forward to its expected close in the third quarter.

Looking Ahead

For Q2 2024, Identiv forecasts revenues between $23 million and $25 million, reflecting normal seasonal patterns. This guidance is crucial as it indicates management's expectations in navigating current market conditions and fueling growth despite recent financial strains.

Conclusion

Identiv's Q1 2024 performance reflects a challenging period with revenue and earnings not meeting analyst expectations. However, strategic initiatives such as the significant asset sale agreement signal a potential turnaround, focusing on core growth areas in IoT solutions. Investors and stakeholders will be watching closely to see if these strategic decisions will stabilize the companys financials in the upcoming quarters.

For detailed insights and further information, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Identiv Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance