IDEX (IEX) Beats Q3 Earnings Estimates, Lowers Organic View

IDEX Corporation IEX reported better-than-expected results for the third quarter of 2019, with earnings surpassing estimates by 4.11%. However, sales lagged estimates by 2.73%.

The company’s adjusted earnings per share in the reported quarter were $1.52, surpassing the Zacks Consensus Estimate of $1.46. The bottom line excluded 16 cents per share of restructuring expenses, 4 cent of related tax benefits and 3 cents of miscellaneous charges.

Further, the bottom line rose 7.8% from the year-ago quarter’s $1.41. The improvement was driven by the diligent execution of productivity initiatives.

Organic Sales Flat Y/Y

IDEX generated revenues of $624.2 million in the quarter under review, flat compared with the year-ago quarter figure. Acquisitions had a positive impact of 1% on sales while forex woes affected results by 1%. Organic sales in the quarter were flat year over year due to prevailing uncertainties related to the soft global economy.

However, the company’s revenues lagged the Zacks Consensus Estimate of $641.8 million.

In the reported quarter, orders dipped 5% year over year to $586.1 million. As noted, orders were down 5% organically. Forex woes declined orders by 1%, while acquisition boosted the same by 1%.

IDEX reports revenues under the segments discussed below:

Net sales of Fluid & Metering Technologies (“FMT”) were $240.9 million, up 0.7% year over year. Organic net sales grew 2%, while forex headwinds had a 1% impact.

Revenues from Health & Science Technologies (“HST”) totaled $229.6 million, reflecting year-over-year growth of 3.2%. Results were driven by 1% organic sales growth and 3% gain from acquisitions, partially offset by forex woes of 1%.

It is worth mentioning here that the company acquired Velcora Holding AB from FSN Capital Partners for approximately $137 million in July 2019. The integration of this acquired asset with the segment’s sealing solutions business is in progress.

Fire & Safety/Diversified Products’ (“FSDP”) revenues were $154.5 million, down 4.5% from the year-ago quarter. Organic sales declined 3% and currency translation had an adverse 2% impact.

Margins Improve Y/Y

In the reported quarter, IDEX’s cost of sales dipped 0.1% year over year to $342.3 million. It represented 54.8% of the quarter’s revenues compared with 55% in the year-ago quarter. Adjusted gross margin improved 70 basis points (bps) year over year to 45.7% on benefits of productivity actions and favorable pricing. However, rise in engineering costs played spoilsport. Selling, general and administrative expenses declined 1.7% to $128.3 million. It represented 20.6% of revenues compared with 21% in the year-ago quarter.

Adjusted operating income in the quarter rose 4.9% year over year to $157.1 million and margin improved 120 bps to 25.2%. On a segmental basis, adjusted operating income for the FMT segment grew 9.8% to $77.5 million and that for HST expanded 4.7% to $54.7 million, while for FSDP it declined 6.1% to $42.1 million. Effective tax rate in the reported quarter was 18.6%.

Balance Sheet and Cash Flow

Exiting the third quarter, IDEX had cash and cash equivalents of $516 million, down 5% from $543.2 million recorded at the end of the last reported quarter. Long-term borrowings were flat sequentially at $848.7 million.

In the first three quarters of 2019, the company generated net cash of $376.9 million from operating activities, reflecting growth of 15.7% from the year-ago period. Capital spending on the purchase of property, plant and equipment was roughly $36.8 million, down 7.7% year over year. Free cash flow in the quarter improved 27.6% to $146 million.

During the first nine months of 2019, the company bought back shares worth $54.7 million and distributed dividends totaling $109.2 million.

Outlook

For 2019, IDEX anticipates growth investments and solid execution abilities to aid performance. However, geopolitical uncertainties and prevalent trade issues are concerning.

Adjusted earnings for the year are anticipated to be $5.80-$5.82 versus previously mentioned $5.78-$5.85. Organic revenue growth is anticipated to be roughly 2%, down from 3-4% stated previously.

For the fourth quarter, earnings per share are anticipated to be $1.33-$1.35, with organic sales likely to be flat.

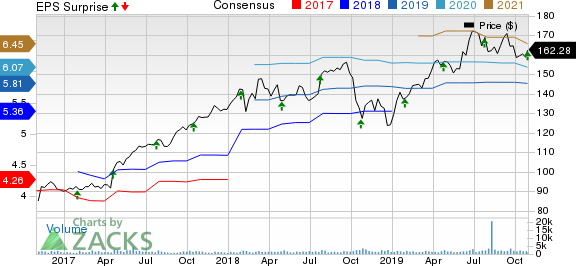

IDEX Corporation Price, Consensus and EPS Surprise

IDEX Corporation price-consensus-eps-surprise-chart | IDEX Corporation Quote

Zacks Rank & Stocks to Consider

With a market capitalization of approximately $12.1 billion, IDEX currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the industry are Brady Corporation BRC, Dover Corporation DOV and Graham Corporation GHM. All these stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for Brady and Dover improved for the current year, while have been unchanged for Graham. Further, positive earnings surprise for the last reported quarter was 11.48% for Brady, 4.58% for Dover and 100% for Graham.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance