IDEX's (IEX) Earnings and Revenues Miss Estimates in Q4

IDEX Corporation IEX reported lackluster fourth-quarter 2019 results, with earnings and sales missing estimates by 1.48% and 1.46%, respectively.

The company’s adjusted earnings per share were $1.33, lagging the Zacks Consensus Estimate of $1.35. The bottom line excluded 9 cents per share of restructuring expenses and 2 cents of related tax benefits. However, the bottom line increased 1.5% from the year-ago quarter’s $1.31.

In 2019, adjusted earnings were $5.80 per share, reflecting an increase of 7.2% from last year’s figure of $5.41.

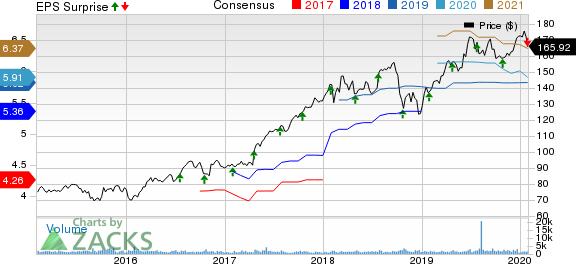

IDEX Corporation Price, Consensus and EPS Surprise

IDEX Corporation price-consensus-eps-surprise-chart | IDEX Corporation Quote

Organic Sales Decline Y/Y

IDEX generated revenues of $606 million in the quarter, down 1.3% from the year-ago quarter. Acquisitions had a positive impact of 2% on sales while forex woes affected results by 1%. Organic sales in the quarter declined 2% due to weakening global demand for industrial products along with prevailing uncertainties related to the soft global economy.

In addition, the company’s revenues lagged the Zacks Consensus Estimate of $615 million.

In the reported quarter, orders jumped 1% year over year to $616.6 million. As noted, orders were flat organically. Forex woes hurt orders by 1%, while acquisition boosted the same by 2%.

IDEX reports revenues under the segments discussed below:

Fluid & Metering Technologies’ (“FMT”) net sales were $227.5 million, down 4.1% year over year. Organic net sales declined 3%, while forex headwinds had a 1% impact.

Revenues from Health & Science Technologies (“HST”) totaled $227.3 million, reflecting year-over-year growth of 0.8%. Results reflected 3% organic sales decline and 4% gain from acquisitions.

Fire & Safety/Diversified Products’ (“FSDP”) revenues were $152 million, up 0.2% from the year-ago quarter. Organic sales increased 1% and currency translation had an adverse 1% impact.

In 2019, the company’s revenues were $2,494.6 million, roughly flat year over year. Organic sales increased 1% and acquisitions had a positive impact of 1%, partially offset by 2% adverse impact of foreign currency movements.

Margins Improve Y/Y

In the reported quarter, IDEX’s cost of sales dipped 0.4% year over year to $339.1 million. It represented 56% of the quarter’s revenues compared with 55.4% in the year-ago quarter. Adjusted gross margin improved 20 basis points (bps) year over year to 45.2%. Selling, general and administrative expenses declined 3.5% to $125.8 million. It represented 20.8% of revenues compared with 21.2% in the year-ago quarter.

Adjusted operating income in the quarter dipped 1.5% year over year to $141.1 million with margin remaining flat at 23.3%. On a segmental basis, adjusted operating income for FMT declined 7.7% to $63.7 million and that for HST dipped 1.8% to $51.8 million, while for FSDP it declined 1% to $39.8 million. Effective tax rate in the reported quarter was 20.6%.

Balance Sheet and Cash Flow

Exiting the fourth quarter, IDEX had cash and cash equivalents of $632.6 million, up 35.6% from $466.4 million recorded at the end of 2018. Long-term borrowings were relatively flat at $848.9 million compared with $848.3 million a year ago.

In 2019, the company generated $528.1 million of net cash from operating activities, reflecting growth of 10.2% from 2018. Capital spending on the purchase of property, plant and equipment was roughly $50.9 million, down 9.2% year over year. Free cash flow in the quarter declined 0.2% to $137 million.

In 2019, the company bought back 389,000 shares worth $54.7 million and distributed dividends totaling $147.2 million.

Outlook

For 2020, IDEX anticipates growth investments and solid restructuring actions amid challenging industrial markets (mainly in the first half of the year). Restructuring initiatives will provide $15 million savings in 2020.

Adjusted earnings for the year are anticipated to be $5.55-$5.85. First-quarter earnings are estimated to be $1.30-$1.34. Organic revenue growth is anticipated to be flat to roughly 2% lower for the full year, with 4-5% fall in the first quarter of 2020.

In addition, M&A remains a key priority as the company recently announced an agreement to acquire Phoenix, AZ-based Flow Management Devices, LLC (Flow MD) for a cash consideration of $125 million. Subject to customary closing conditions and regulatory approvals, the contract will be effective first-quarter end.

Zacks Rank & Stocks to Consider

IDEX currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industry are DXP Enterprises, Inc. DXPE, Tennant Company TNC and Barnes Group Inc. B. While DXP Enterprises sports a Zacks Rank #1 (Strong Buy), Tennant and Barnes carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DXP Enterprises surpassed earnings estimates thrice in the trailing four quarters, the positive surprise being 17.7%, on average.

Tennant surpassed earnings estimates in each of the trailing four quarters, the positive surprise being 28.7%, on average.

Barnes surpassed earnings estimates thrice in the trailing four quarters, the positive surprise being 4.2%, on average.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barnes Group, Inc. (B) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance