IHS Markit (INFO) to Report Q4 Earnings: What's in the Cards?

IHS Markit Ltd. INFO is scheduled to release fourth-quarter fiscal 2021 results on Jan 21, before the bell.

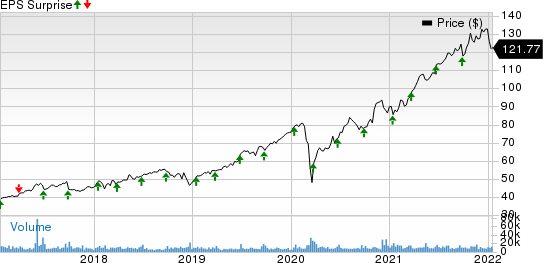

The company has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in all of the last four quarters. It has a trailing four-quarter earnings surprise of 3.1%, on average.

IHS Markit Ltd. Price and EPS Surprise

IHS Markit Ltd. price-eps-surprise | IHS Markit Ltd. Quote

Expectations This Time Around

The Zacks Consensus Estimate for the to-be-reported quarter’s revenues is pegged at $1.14 billion, indicating year-over-year growth of 2.9%. The top line is likely to have gained from strong performance in the Transportation, Resources and Consolidated Markets & Solutions (CMS) segments.

In the transportation segment, IHS Markit’s automotive offerings is likely to have experienced robust growth across CARFAX and automotive Mastermind in the quarter. The Zacks Consensus Estimate for Transportation segment’s revenues indicates an increase of 8.3% on a year-over-year basis. The Zacks Consensus Estimate for Resources segment’s revenues indicates an increase of 1.9% on a year-over-year basis. Per the Zacks Consensus Estimate, CMS segment revenues indicate a surge of 9.5% from the year-ago period’s levels. The CMS segment is likely to have benefitted from two strategic initiatives, namely MarkitSERV and CMEs optimization businesses.

The consensus mark for earnings per share in the to-be-reported quarter is pegged at 84 cents per share, indicating year-over-year growth of 16.7%. The bottom line is projected to have benefited from improvement in operating performance.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for IHS Markit this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

IHS Markit has an Earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks from the broader Zacks Business Services sector that investors may consider, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Booz Allen Hamilton BAH has an Earnings ESP of +7.77% and a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 12.7%, on average.

BAH is focusing on areas such as artificial intelligence, advanced engineering, directed energy and modern digital platforms to drive innovation. It is developing mechanics and infrastructure for new and disruptive business models to enhance service quality and client satisfaction.

Clean Harbors CLH has an Earnings ESP of +7.20% and a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 50.5%, on average.

Clean Harbors’ consistent record of returning value to shareholders in the form of share repurchases is impressive. In 2020, 2019 and 2018, CLH had repurchased shares worth $74.8 million, $21.4 million, $45.1 million, respectively. Such moves indicate the company’s commitment to create value for shareholders and underline its confidence in its business.

WEX WEX has an Earnings ESP of +1.21% and a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 8.6%, on average.

WEX’s top line continues to grow organically driven by its extensive network of fuel and service providers, transaction volume growth, product excellence, marketing capabilities, sales force productivity and other strategic revenue-generation efforts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

IHS Markit Ltd. (INFO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance