Illinois Tool (ITW) Q2 Earnings and Sales Beat Estimates

llinois Tool Works Inc. ITW has delivered better-than-expected results for second-quarter 2020, with an earnings surprise of 55.71%. This was the eighth consecutive quarter of impressive results. Also, the quarter’s sales surpassed estimate by 8.66%.

The industrial tool maker’s earnings in the reported quarter were $1.09 per share, surpassing the Zacks Consensus Estimate of 70 cents. However, the bottom line declined from the year-ago reported number of $2.00.

Revenue Details

Illinois Tool generated revenues of $2,564 million in the reported quarter, reflecting a decline of 29% from the year-ago figure. Top-line results were affected by a 1.5% impact of unfavorable foreign currency movement, 1% from divestitures/acquisitions, and a 26.5% drop in organic sales.

However, the top line surpassed the Zacks Consensus Estimate of $2,360 million.

Illinois Tool reports revenues under the segments discussed below:

Test & Measurement and Electronics’ revenues in the second quarter decreased 14.7% year over year to $455 million. Revenues from Automotive OEM (Original Equipment Manufacturer) declined 54.1% to $361 million. Food Equipment generated revenues of $336 million, decreasing 38.6% year over year.

Welding revenues were $298 million, declining 29.4% year over year. Construction Products’ revenues were down 11.4% to $376 million. Further, revenues of $387 million from Specialty Products reflected a decline of 18.2%. Polymers & Fluids’ revenues of $354 million declined 17.2% year over year.

Margin Profile

In the reported quarter, Illinois Tool’s cost of sales declined 24.1% year over year to $1,594 million. Selling, administrative, and research and development expenses declined 18.7% year over year to $486 million. It represented 19% of the second quarter’s revenues.

Operating margin was 17.5% in the quarter, down from 24.1% reported in the year-ago quarter due to lower volumes. However, enterprise initiatives contributed 100 bps to operating margin and cost reduction of $140 million aided.

Interest expenses in the quarter declined 7.3% year over year to $51 million.

Balance Sheet and Cash Flow

Exiting the second quarter, Illinois Tool had cash and cash equivalents of $1,812 million, up 26.7% from $1,430 million recorded at the end of the last reported quarter. Long-term debt inched up 1% sequentially to $7,765 million.

In the second quarter, the company generated net cash of $737 million from operating activities, reflecting growth of 7.6% from the year-ago quarter. Capital spending on the purchase of plant and equipment was $56 million, down 27.3% year over year. Free cash flow was $681 million, reflecting a year-over-year increase of 12%.

In the second quarter, the company’s dividend payments amounted to $1.07 per share.

Outlook

In the quarters ahead, Illinois Tool anticipates benefiting from its diversified businesses, solid product offerings, cost-management actions and healthy liquidity position. However, due to uncertainties related to the pandemic, the company kept its 2020 projections suspended.

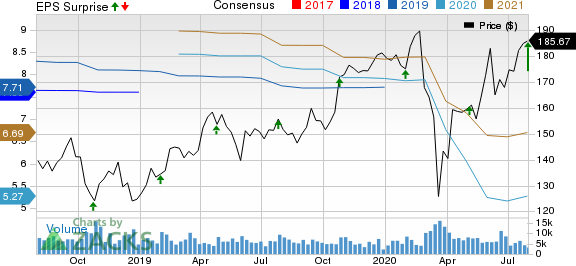

Illinois Tool Works Inc. Price, Consensus and EPS Surprise

Illinois Tool Works Inc. price-consensus-eps-surprise-chart | Illinois Tool Works Inc. Quote

Zacks Rank & Stocks to Consider

With a market capitalization of $58.7 billion, Illinois Tool currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Industrial Products sector are Altra Industrial Motion Corp. AIMC, Chart Industries, Inc. GTLS and Graco Inc. GGG. All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 76.47% for Altra Industrial, 46.51% for Chart Industries and 37.04% for Graco.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Graco Inc. (GGG) : Free Stock Analysis Report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance