Illumina (ILMN) Beats on Q1 Earnings, Lifts '18 Guidance

Illumina, Inc. ILMN reported adjusted earnings per share (EPS) of $1.45 in the first quarter of 2018, beating the Zacks Consensus Estimate of $1.22 by 40.8%. Also, the bottom line exceeded the year-ago number by a stupendous 126.6%.

Including one-time items, the company reported EPS of $1.41 compared with $2.48 a year ago. The year-ago figure included the impact of a pre-tax gain of $453 million as a result of the GRAIL repurchase of shares from Illumina.

Revenues

In the quarter under review, Illumina's revenues surged 30.8% year over year to $782 million. The top line surpassed the Zacks Consensus Estimate by 5.2%. This huge upside can be attributed to strong consumables growth across Illumina’s sequencing portfolio with notable strength in high throughput family. Moreover, the NovaSeq platform continued the growth momentum.Excluding the $19-million stocking order in fourth-quarter 2017, NovaSeq consumables soared approximately 60% sequentially with a strong performance from both the S2 and S4 flow cells.

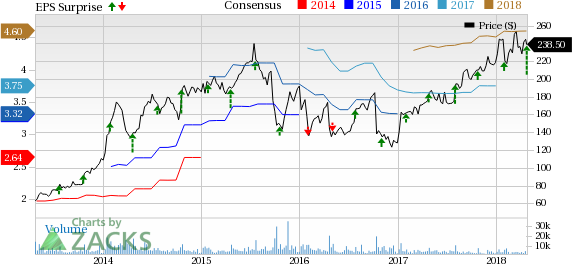

Illumina, Inc. Price, Consensus and EPS Surprise

Illumina, Inc. Price, Consensus and EPS Surprise | Illumina, Inc. Quote

While Product revenues (80.3% of total revenues) increased 27.9% year over year to $628 million, Service and Other (19.7%) revenues were up 43.9% year over year to $154 million.

Operational Update

Adjusted gross margin (excluding amortization of acquired intangible assets and including stock-based compensation expenses) came in at 69.8%, reflecting an expansion of 340 basis points (bps) year over year owing to a favorable product mix within sequencing consumables. Also, microarrays contributed 19% of overall revenues in the reported quarter as compared to 16% a year ago.

While research and development expenses declined 5.5% year over year to $137 million, selling, general & administrative expenses rose 7.01% to $183 million. The adjusted operating margin of 28.9% expanded 1837 bps from the year-ago quarter.

Financial Update

Illumina exited the first quarter with cash and cash equivalents plus short-term investments of $2.37 billion, up from $2.15 billion last year. Net cash provided by operating activities as of Mar 31, 2018 was $255 million compared with $168 million as of Mar 31, 2017.

2018 Guidance

For 2018, the company projects 15-16% revenue growth, GAAP earnings per share attributable to Illumina stockholders of $4.45-$4.55 and non-GAAP earnings attributable to Illumina stockholders of $4.75-$4.85.

Illumina has raised its full-year revenues 15-16% as compared to the earlier projection of 13-14% rise. Meanwhile, the Zacks Consensus Estimate for the metric is pegged at $3.14 billion.

Adjusting for certain net specified items for the full year, the EPS is expected in the band of $4.75-$4.85, a raise from the earlier forecast of $4.50-$4.60. The consensus mark for the metric stands at $4.60, below the predicted range.

Our Take

Illumina exited the first quarter of 2018 on a solid note with better-than-expected earnings as well as revenues. We are encouraged by the year-over-year increase on both counts. Moreover, management is hopeful about the recently launched NovaSeq S1 flow cell reagent kit. The company also received a product approval certificate for the NextSeq 550Dx instrument from the Ministry of Food and Drug Safety (MFDS) in South Korea. In the field of oncology, Illumina’s collaboration with Bristol-Myers Squibb and Loxo Oncology are expected to garner positive results down the line.

Additionally, improving margins buoy optimism. Meanwhile, the company is operating in a tough competitive landscape which is a concern.

Zacks Rank & Other Key Picks

Illumina has a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader medical sector include Abaxis, Inc. ABAX, Bio-Rad Laboratories, Inc. BIO and ResMed Inc. RMD. While Abaxis and Bio-Rad sport a Zacks Rank #1 (Strong Buy), ResMed carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abaxis is expected to release fourth-quarter fiscal 2018 results on Apr 26. The Zacks Consensus Estimate for adjusted EPS is 32 cents and for revenues, the same is pegged at $67 million.

Bio-Rad is expected to report first-quarter 2018 results on May 3. The Zacks Consensus Estimate for adjusted EPS is 90 cents and for revenues, $529.5 million.

ResMed is slated to release third-quarter fiscal 2018 results on Apr 26. While the consensus mark for adjusted EPS is 83 cents, the same for revenues stands at $564.9 million.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Abaxis,Inc. (ABAX) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance