Illumina (ILMN) Q1 Earnings Beat Estimates, Gross Margin Down

Illumina’s ILMN first-quarter 2022 adjusted earnings per share (EPS) of $1.07 surpassed the Zacks Consensus Estimate by 22.9%. However, the bottom line declined 43.4% from the year-ago quarter’s earnings of $1.89.

The adjustments exclude certain amortization costs, expenses and benefits related to COVID-19 and restructuring costs, among others.

Including one-time items, the company’s GAAP earnings per share were 55 cents, down 45% year over year.

Revenues

In the quarter under review, Illumina’s revenues were $1.22 billion, up 11.9% year over year. The top line also exceeded the Zacks Consensus Estimate by 0.8%.

Segment Details

Post the acquisition of GRAIL on Aug 18, 2022, Illumina has two reportable segments -- Core Illumina and GRAIL.

Core Illumina revenues surged 11.7% year over year to $1.1221 billion. Core Illumina Sequencing Consumable revenues totaled $784 million in the reported quarter, up 13% year over year on a growing NovaSeq installed base across clinical and research markets.

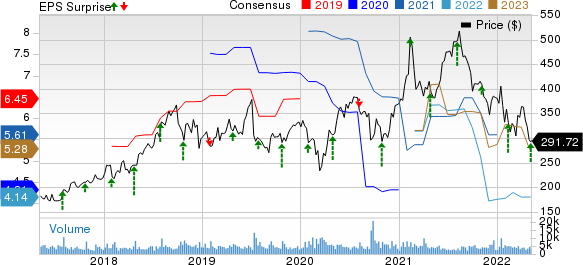

Illumina, Inc. Price, Consensus and EPS Surprise

Illumina, Inc. price-consensus-eps-surprise-chart | Illumina, Inc. Quote

Sequencing Instrument revenues for core Illumina were $212 million, reflecting a surge of 20% from the year-ago figure. The upside was driven by record NovaSeq shipments resulting from high demand in oncology testing.

Core Illumina sequencing service and other revenues were $111 million, up slightly year over year, led by growth in instrument service contracts.

GRAIL contributed $10 million to revenues during the reported quarter.

Margins

Adjusted gross margin (excluding amortization of acquired intangible assets) was 69.9% in the reported quarter, highlighting a contraction of 54 basis points (bps) year over year.

Research and development expenses increased 63.9% year over year to $323 million, whereas selling, general & administrative expenses plunged 17.6% to $308 million. These pushed up operating costs by 10.5% to $631 million.

Adjusted operating income in the quarter was $224 million, reflecting a surge of 12.6% from the prior-year quarter’s $199 million. Operating margin expanded 11 bps year over year to 18.3%.

Financial Update

Illumina exited first-quarter 2022 with cash and cash equivalents plus short-term investments of $1.42 billion compared with $1.34 billion at the end of 2021.

The company did not repurchase any common stock in the quarter.

Cumulative net cash provided by operating activities at the end of the quarter was $172 million compared with $282 million a year ago.

2022 Guidance

For 2022, Illumina has maintained its consolidated revenue growth expectation at the range of 14-16% year over year. The Zacks Consensus Estimate for the same is currently pegged at $5.23 billion.

The company has also reaffirmed its adjusted EPS guidance for 2022 at the range of $4.00-$4.20. The Zacks Consensus Estimate for the same is currently pegged at $4.14.

The guidance considered both Core Illumina and GRAIL segments’ expected performances.

Our Take

Illumina exited first-quarter 2022 with better-than-expected earnings and revenues. The robust year-over-year improvement in Core Illumina businesses looks encouraging. Revenue contributions from the newly-formed GRAIL business, primarily from Galleri test fees, seem promising. NovaSeq consumable and instrument shipments reached new highs during the quarter as the company witnessed robust demand for NextSeq 1000, 2000 from new customers. The company also saw significant growth in the installed base as well as a record backlog, instilling optimism. An increase in short-term cash levels raises investors’ confidence.

However, the significant year-over-year decline in adjusted EPS does not bode well. Contraction of gross margin is worrisome. Meanwhile, mounting operating expenses are building pressure on the bottom line.

Zacks Rank & Key Picks

Illumina currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Alkermes plc ALKS, Medpace Holdings, Inc. MEDP and UnitedHealth Group Incorporated UNH.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which surpassed the Zacks Consensus Estimate of a penny. Revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. It currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%.

Medpace reported first-quarter 2022 adjusted EPS of $1.69, which surpassed the Zacks Consensus Estimate by 34.1%. Revenues of $330.9 million outpaced the Zacks Consensus Estimate by 1.1%. It currently has a Zacks Rank #2.

Medpace has a historical growth rate of 27.3%. MEDP’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%.

UnitedHealth, having a Zacks Rank #2, reported first-quarter 2022 adjusted EPS of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 1.9%.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance