Can You Imagine How Audax Renovables's (BME:ADX) Shareholders Feel About The 18% Share Price Increase?

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Audax Renovables, S.A. (BME:ADX) share price is up 18% in the last year, clearly besting the market return of around 9.0% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Audax Renovables for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Audax Renovables

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Audax Renovables actually saw its earnings per share drop 0.5%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

We think that the revenue growth of 17% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

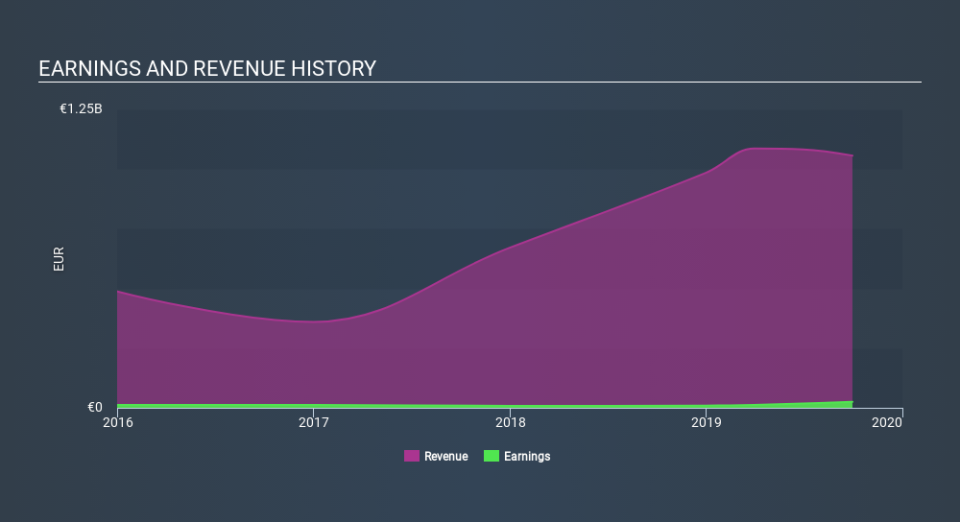

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Audax Renovables stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Audax Renovables shareholders should be happy with the total gain of 18% over the last twelve months. And the share price momentum remains respectable, with a gain of 50% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Audax Renovables (of which 2 are a bit unpleasant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance