Can You Imagine How Chuffed Enanta Pharmaceuticals's (NASDAQ:ENTA) Shareholders Feel About Its 216% Share Price Gain?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA) share price has flown 216% in the last three years. How nice for those who held the stock! On top of that, the share price is up 29% in about a quarter. But this could be related to the strong market, which is up 14% in the last three months.

Check out our latest analysis for Enanta Pharmaceuticals

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

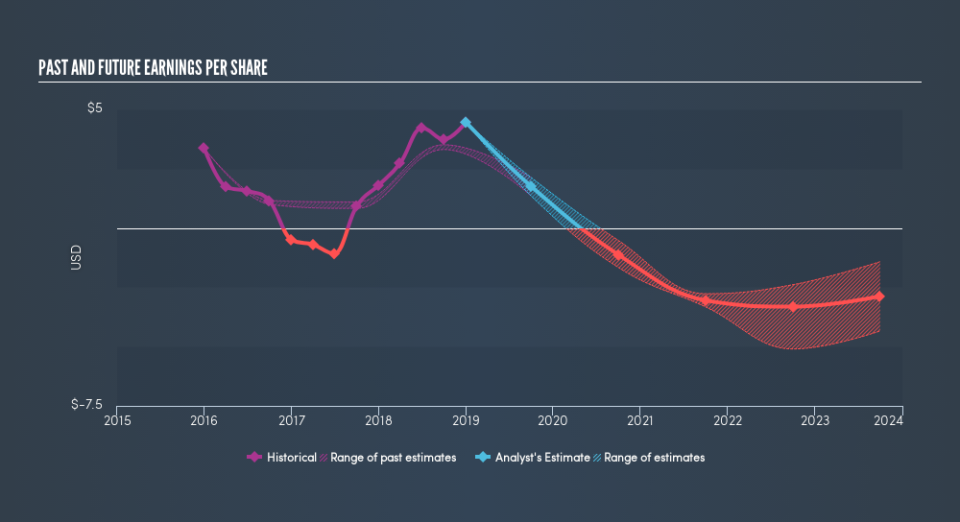

Enanta Pharmaceuticals was able to grow its EPS at 9.8% per year over three years, sending the share price higher. This EPS growth is lower than the 47% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Enanta Pharmaceuticals has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

We're pleased to report that Enanta Pharmaceuticals shareholders have received a total shareholder return of 15% over one year. Having said that, the five-year TSR of 23% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before deciding if you like the current share price, check how Enanta Pharmaceuticals scores on these 3 valuation metrics.

We will like Enanta Pharmaceuticals better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance