Can You Imagine How Chuffed Pure Cycle's (NASDAQ:PCYO) Shareholders Feel About Its 145% Share Price Gain?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Pure Cycle Corporation (NASDAQ:PCYO) share price has flown 145% in the last three years. Most would be happy with that.

View our latest analysis for Pure Cycle

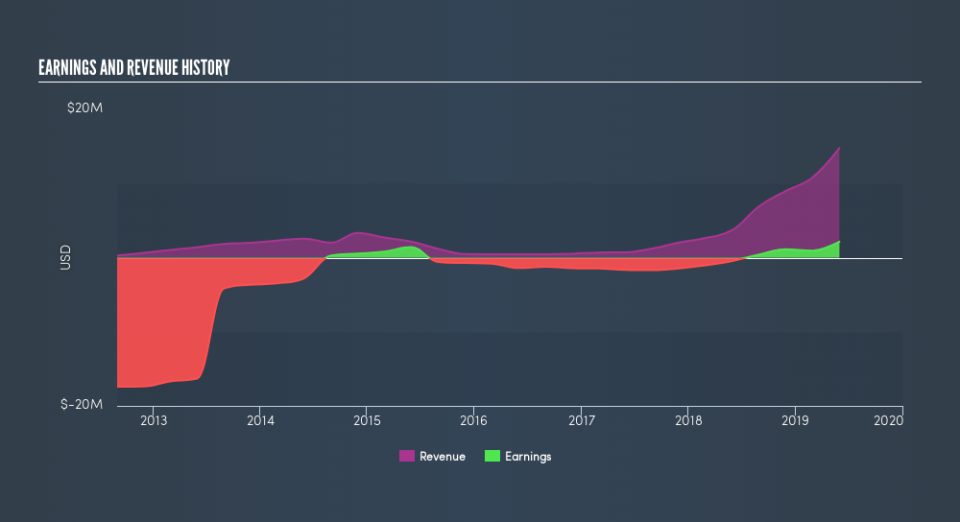

While Pure Cycle made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Pure Cycle saw its revenue grow at 105% per year. That's much better than most loss-making companies. Along the way, the share price gained 35% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Pure Cycle is still worth investigating - successful businesses can often keep growing for long periods.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Pure Cycle stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Pure Cycle provided a TSR of 3.4% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 9.9% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. If you would like to research Pure Cycle in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance