Can You Imagine How Elated Capstone Mining's (TSE:CS) Shareholders Feel About Its 524% Share Price Gain?

While Capstone Mining Corp. (TSE:CS) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 524% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. Only time will tell if there is still too much optimism currently reflected in the share price.

We love happy stories like this one. The company should be really proud of that performance!

Check out our latest analysis for Capstone Mining

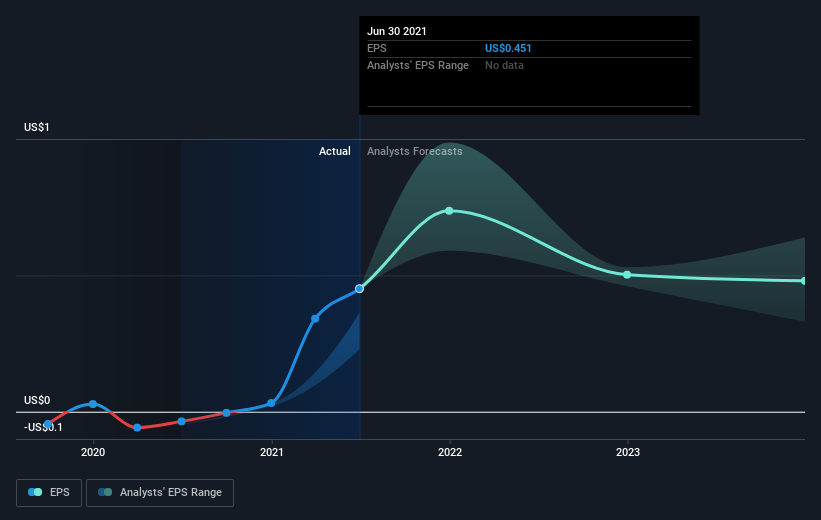

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the five years of share price growth, Capstone Mining moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Capstone Mining share price is up 435% in the last three years. In the same period, EPS is up 38% per year. Notably, the EPS growth has been slower than the annualised share price gain of 75% over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Capstone Mining's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Capstone Mining shareholders have received a total shareholder return of 369% over the last year. That's better than the annualised return of 44% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Capstone Mining that you should be aware of.

Capstone Mining is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance