Imagine Holding EQTEC (LON:EQT) Shares While The Price Zoomed 954% Higher

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, EQTEC plc (LON:EQT) has generated a beautiful 954% return in just a single year. Also pleasing for shareholders was the 17% gain in the last three months. Also impressive, the stock is up 315% over three years, making long term shareholders happy, too.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for EQTEC

EQTEC wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year EQTEC saw its revenue shrink by 72%. So it's very confusing to see that the share price gained a whopping 954%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

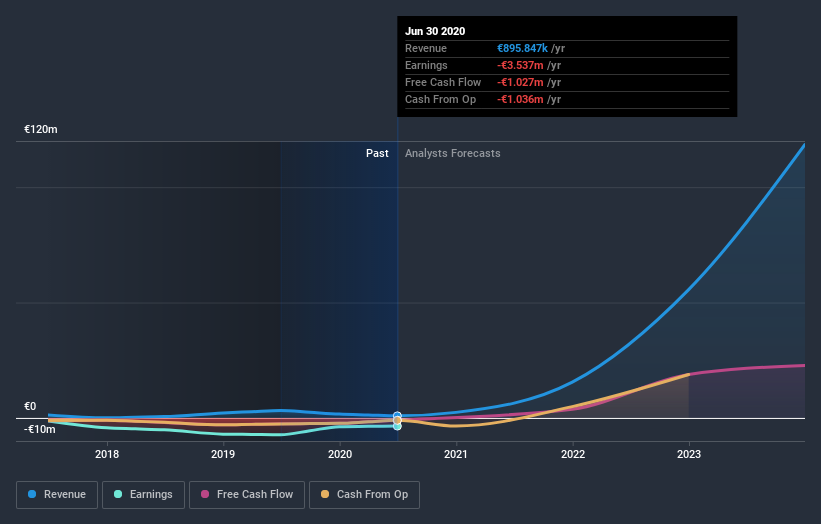

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for EQTEC in this interactive graph of future profit estimates.

A Different Perspective

Pleasingly, EQTEC's total shareholder return last year was 954%. That's better than the annualized TSR of 61% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand EQTEC better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with EQTEC (including 2 which are a bit unpleasant) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance