Imagine Owning easyHotel And Wondering If The 38% Share Price Slide Is Justified

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in easyHotel plc (LON:EZH) have tasted that bitter downside in the last year, as the share price dropped 38%. That contrasts poorly with the market return of 3.0%. However, the longer term returns haven’t been so bad, with the stock down 23% in the last three years. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days.

See our latest analysis for easyHotel

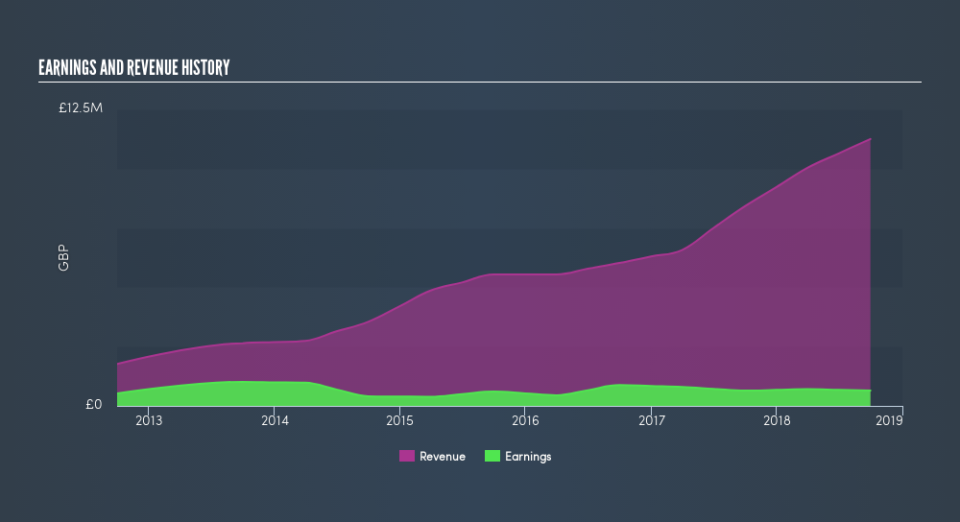

Given that easyHotel only made minimal earnings in the last twelve months, we’ll focus on revenue to gauge its business development. As a general rule, if the market is looking past earnings to focus on revenue, there is a hope for, or expectation of, strong growth. As you can imagine, it’s easy to imagine a fast growing company becoming (potentially very) profitable, but when revenue growth slows, then the potential upside often seems less impressive.

In the last year easyHotel saw its revenue grow by 34%. That’s definitely a respectable growth rate. Meanwhile, the share price is down 38% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

easyHotel shareholders are down 38% for the year (even including dividends), but the broader market is up 3.0%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 8.2% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance