Can You Imagine How UniFirst's (NYSE:UNF) Shareholders Feel About The 63% Share Price Increase?

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term UniFirst Corporation (NYSE:UNF) shareholders have enjoyed a 63% share price rise over the last half decade, well in excess of the market return of around 41% (not including dividends).

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Check out our latest analysis for UniFirst

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

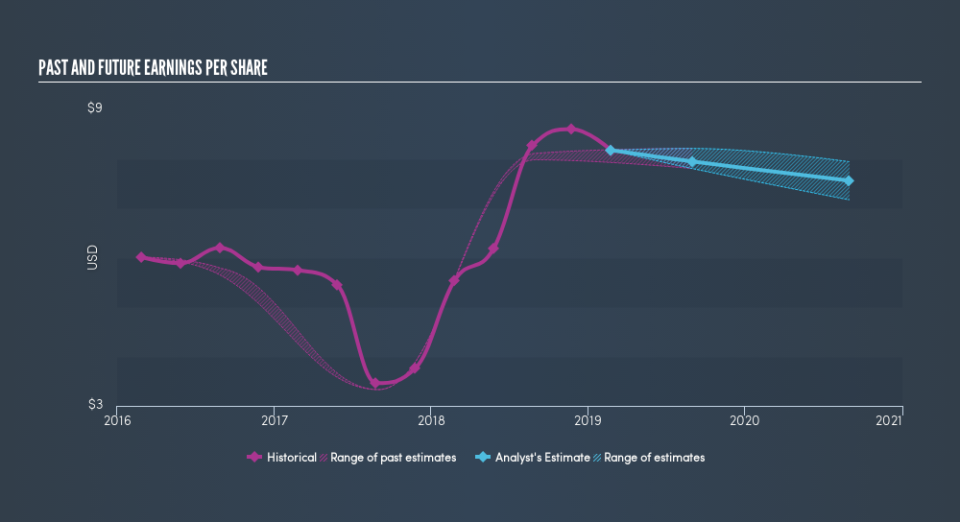

During five years of share price growth, UniFirst achieved compound earnings per share (EPS) growth of 6.5% per year. This EPS growth is slower than the share price growth of 10% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in UniFirst had a tough year, with a total loss of 8.3% (including dividends), against a market gain of about 3.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research UniFirst in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: UniFirst may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance