IMF Raises Global Growth Forecast Amid High Inflation: 5 Picks

On Apr 16, the International Monetary Fund raised its global growth forecast for 2023 to 3.2% from 3.1% in January. More importantly, the agency projected that global growth will remain static at 3.2% in both 2024 and 2025 despite elevated inflation and geopolitical uncertainties.

The IMF projected that the global headline inflation will decline gradually from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025. However, the average global growth rate for the next five years will be 3.1%, marking the lowest medium-term growth forecast in decades.

IMF Chief Economist Pierre-Olivier Gourinchas urged central bankers to be on track to bring down the inflation rate to their respective target levels. According to Gourinchas, “As the global economy approaches a soft landing, the near-term priority for central banks is to ensure that inflation touches down smoothly, by neither easing policies prematurely nor delaying too long and causing target undershoots.”

The IMF said that the U.S. economy will remain resilient and is likely to grow at 2.7% annually in 2024 after growing 2.5% in 2023. However, the GDP growth rate is expected to converge to the pre-pandemic level of 1.9% in 2025.

On Apr 16, speaking to a policy forum focused on U.S.-Canada economic relations, Fed Chairman Jerome Powell said that the U.S. economy remains strong and the inflation rate has failed to reduce to the level expected by the Fed. For that, the central bank is compelled to keep a higher interest rate for a longer period.

The Fed fund rate is at its 23-year high in the range of 5.25-5.5%. In late February, the CME FedWatch tool showed a nearly 80% probability of the first rate cut in June. At present, that probability is a mere 13%. The majority of market participants are now anticipating the first rate cut to happen in September.

Our Top Picks

We have narrowed our search to five U.S. corporate giants (market capital >$100 billion) as these companies have a robust business model, a solid financial position and globally acclaimed brand value.

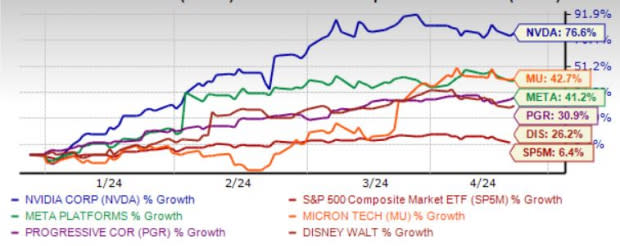

These stocks have popped more than 25% year to date with strong potential left for 2024. Further, these stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

NVIDIA Corp.’s NVDA Compute & Networking revenues are gaining from the strong growth of AI, high-performance and accelerated computing. The data center end-market business is likely to benefit from the growing demand for generative AI and large language models using graphic processing units based on NVIDIA Hopper and Ampere architectures.

A surge in hyperscale demand and higher sell-ins to partners across the Gaming and ProViz end markets following the normalization of channel inventory are acting as tailwinds for NVDA. Collaborations with Mercedes-Benz and Audi are likely to advance NVDA’s presence in autonomous vehicles and other automotive electronics space.

Zacks Rank #1 NVIDIA has an expected revenue and earnings growth rate of 73.8% and 84%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 1.5% over the last 30 days. The stock price of NVDA has soared 76.6% year to date.

The Progressive Corp. PGR continues to gain on higher premiums, given its compelling product portfolio, leadership position and strength in both Vehicle and Property businesses. Focus on becoming a one-stop insurance destination, catering to customers opting for a combination of home and auto insurance, augurs well for PGR’s growth.

Policies in force and retention ratio should remain healthy. Competitive pricing to retain current customers and address customer needs with new offerings should continue to drive policy life expectancy.

Zacks Rank #1 The Progressive has an expected revenue and earnings growth rate of 17.2% and 75.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.5% over the last seven days. The stock price of PGR has surged 30.9% year to date.

Meta Platforms Inc. META is benefiting from steady user growth across all regions, particularly Asia Pacific. Increased engagement with its offerings like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver. META is leveraging AI to recommend Reels content, which is driving traffic on Instagram and Facebook.

META’s innovative portfolio, which includes Threads, Reels, Llama 2 and Ray-Ban Meta smart glass, and mixed reality device Quest 3, is likely to aid growth. Reels continue to do very well across Instagram and Facebook. People reshared Reels 3.5 billion times every day during the fourth quarter.

Zacks Rank #2 Meta Platforms has an expected revenue and earnings growth rate of 18% and 35%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days. The stock price of META has climbed 41.2% year to date.

Micron Technology Inc. MU has enhanced its chip packages with AI, machine learning and deep learning. Using AI and analytics, MU has produced hardware with increased storage capacity, faster memory, and high-quality data filtering.

The expectation of supply normalization by mid-year 2024 is likely to drive pricing, while the boom in AI spending is expected to fuel demand for MU’s chips in the data center end market. Additionally, 5G adoption in the IoT devices and wireless infrastructure is likely to spur demand for MU’s memory and storage.

Zacks Rank #2 Micron Technology has an expected revenue and earnings growth rate of 57.8% and more than 100%, respectively, for the current year (ending August 2024). The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days. The stock price of MU has jumped 42.7% year to date.

The Walt Disney Co. DIS is benefiting from a solid revival in the domestic and international theme park businesses. Recent attractions like the Frozen theme land at Hong Kong Disneyland and Walt Disney Park in Paris, as well as the Zootopia theme land at Shanghai Disney, are expected to boost the prospects of the theme park business. We expect fiscal 2024 net sales to increase 2.5% from 2023.

DIS’ expanding streaming service offerings — Disney+, ESPN+, Hulu, Disney+ Hotstar (India, Indonesia, Malaysia and Thailand) and Star+ (Latin America) — are expected to be major growth drivers in the long run. These services are driving DIS’ Direct-to-Consumer subscription fees.

Zacks Rank #2 The Walt Disney has an expected revenue and earnings growth rate of 2.9% and 23.9%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 30 days. The stock price of DIS has advanced 26.2% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance