What impact will the social care reforms have on your payslip?

Around one in seven adults aged 65 face lifetime care costs of more than £100,000, it has been estimated.

Here is a look at how a new health and social care levy announced on Tuesday will help to protect families from catastrophic care costs – as well as what it will mean for workers’ payslips.

– What has been announced?

A UK-wide 1.25% health and social care levy based on National Insurance (NI) contributions will be introduced, ringfenced for health and social care.

It will also apply to people working above the state pension age.

The UK Government will increase dividend tax rates by 1.25% to help fund the package.

– How will the reforms put an end to spiralling care costs?

Currently, anyone in England with assets over £23,250 must pay for their care in full.

From October 2023, people starting adult social care in England will pay no more than £86,000 for their own care over their lifetime.

Those with assets under £20,000 will not have to make any contribution for their care from their savings or the value of their home. People with between £20,000 and £100,000 will be eligible for some means-tested support.

– Who will shoulder the biggest burden of the tax hike?

According to Treasury modelling, in 2022-23, more than a third of the overall tax increases and over half the increase in dividend tax rates will come from the top 10% of households, with the majority coming from the top 20% of households.

Treasury documents say lower-income households will be large net beneficiaries, with the poorest households gaining most as a proportion of income.

– What will the NI rise mean for payslips?

Additional contributions will be shown on payslips.

A typical basic-rate taxpayer earning £24,100 will contribute around £180 in 2022-23, while a typical higher-rate taxpayer earning £67,100 will contribute £715.

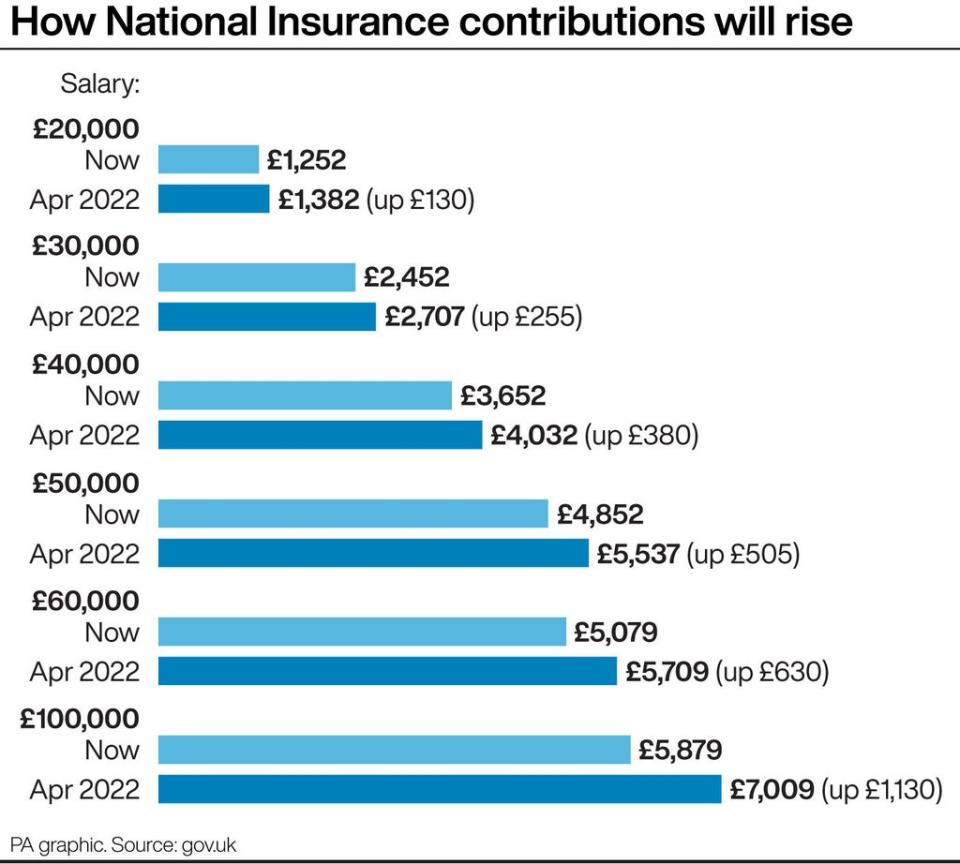

Someone on a £50,000 salary, meanwhile, could pay just over £500 more in annual NI contributions next year, while an earner on £20,000 could pay an extra £130.

A worker on £100,000 could see their contributions increase by more than £1,000 next year while someone on £30,000 could see contributions increase by around £250.

– Will some workers not pay any extra?

The Government said the progressive nature of the levy meant that 6.2 million people earning less than a threshold of £9,568 in 2021-22 will not pay the levy.

– What about other financial pressures on households?

Many workers have suffered pay cuts, wage freezes and job losses during the coronavirus pandemic.

Rises in living costs are also affecting households, with the Consumer Prices Index (CPI) measure of inflation up by 2% annually in July.

Cash savings rates have been sitting at rock bottom.

Housing costs are also squeezing people’s finances, with the average UK house price hitting a record high of £262,954 in August, according to Halifax.

Phil Kinzett-Evans, partner at UHY Hacker Young, said: “Inflation is hitting everyone, fuel prices are creeping back up to their highest ever, house prices are literally through the roof.”

– What other impacts could tax increases have?

Shaun Moore, tax and financial planning expert at Quilter, warned that the policy “could have a huge knock-on effect on the entrepreneurial spirit of the nation”.

He said: “There are hundreds of thousands of directors of limited companies who pay themselves an income through dividends.”

Mr Moore added: “For those looking for a tax-efficient income, particularly in retirement, the options have become pensions or property as the Government has not yet decided to go after this wealth, yet.”

Yahoo Finance

Yahoo Finance