Imperial Brands reaffirms guidance as demand for tobacco and vapes holds despite pressure

Imperial Brands has said it is “on track” to meet its profit and revenue targets this year despite growing regulatory pressure on tobacco and its next-gen vaping products.

The tobacco giant, which makes Winston and Gauloises cigarettes, said it expected net revenue in its “next generation products (NGP)” business to grow at a low single-digit range for the full year.

Adjusted operating profit will rise at a rate closer to the middle of the firm’s mid-single-digit range in 2024.

It added strong half-year growth had been underpinned by “strong combustibles prices and growth in our NGP business.”

“At the same time, we have delivered strong pricing, more than offsetting wider industry volume pressures in certain markets.”

The growth comes despite growing regulatory pressure on the tobacco and vaping industry. The UK has floated plans to ban tobacco sales to younger generations to prevent them from ever starting smoking.

Shares in a slew of tobacco companies, including BAT and Imperial Brands, fell in October after Rishi Sunak announced the crackdown at a Conservative party conference.

Operating profit in the tobacco business over the first six months will be ahead of last year, based on good performances in Europe and America.

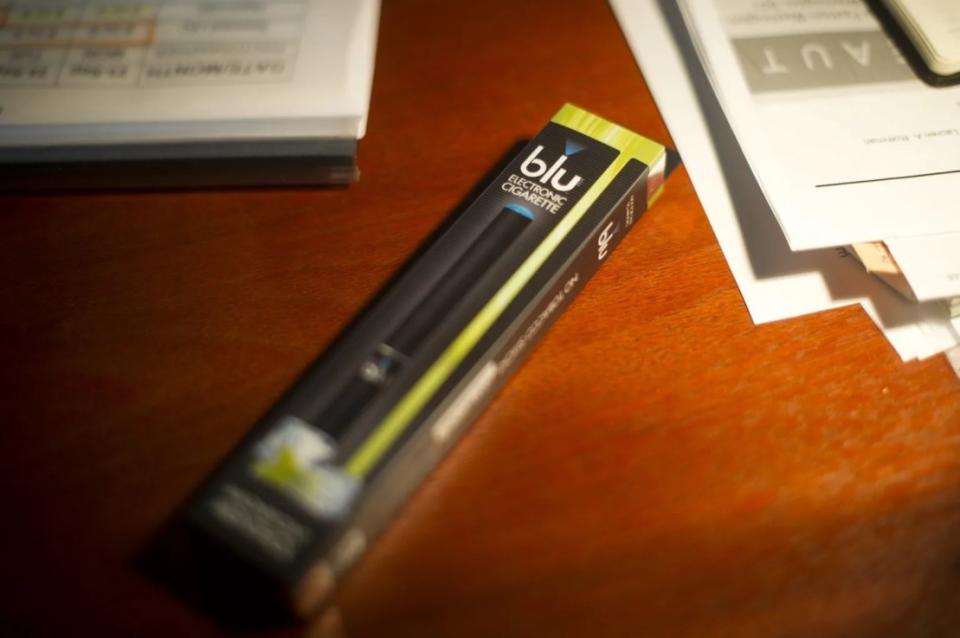

The London-listed firm has been expanding NGP, which produces e-cigarettes and other vaping devices, over the last year and is now present in more than 20 European markets. Other new devices under the blu brand include tobacco heat sticks and oral nicotine pouches sold in the US.

Some £604m of a £1.1bn share buyback programme announced last November had been completed and is on track to finish by October 29.

The company said: “The buyback is on track to complete no later than 29 October. We remain committed to delivering a material reduction in the share capital base over time. This buyback programme represents an ongoing source of shareholder returns alongside our progressive dividend policy.”

Imperial will announce its interim results for the six months to the end of March on 15 May.

Yahoo Finance

Yahoo Finance