Important AUD Pairs’ Technical Checks: 06.12.2018

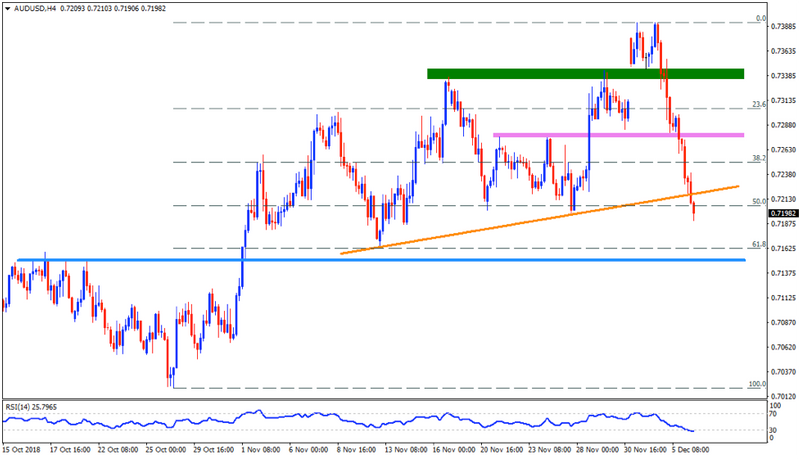

AUD/USD

Considering AUDUSD’s dip beneath a month-old ascending trend-line, the pair is likely to visit the 0.7180 support but the 0.7150 horizontal-stop could confine its further downside. In case there prevails additional weakness on the part of the pair past-0.7150, the 0.7120 and the 0.7050 seem crucial rest-points to watch as break of which highlights the 0.7020 and the 0.7000 come-back. On the upside, the 0.7240 and the 0.7260 can restrict the pair’s near-term advances ahead of fueling it to 0.7275-80 region. Moreover, successful break of 0.7280 may escalate the recovery to the 0.7320 and then to the 0.7335-45 area prior to flashing 0.7395 on Bulls’ radar.

EUR/AUD

Even after trading near fortnight high, the EURAUD has to justify its strength by conquering the 1.5755-65 resistance-confluence in order to aim for the 1.5850, the 1.5915 and the 1.5955 numbers to north. Though, 1.6000 & 1.6035-45 might challenge the buyers after 1.5955, failing to which could recall 1.6140 & 1.6200 on the chart. If at all prices take a U-turn from current levels, the 1.5680, the 1.5630 and the 1.5520-10 are expected supports to play their roles. Should sellers refrain to respect the 1.5510 mark, the 1.5460, the 1.5400 and the 1.5345 can become their favorites.

GBP/AUD

Alike EURAUD, the GBPAUD also needs to provide a daily closing beyond 1.7675 resistance-line if it is to revisit the 1.7770 and the 1.7820 levels. Given the pair’s ability to cross aforementioned barriers, the 200-day SMA level of 1.7935 and the 1.8000 psychological magnet can please the optimists. Alternatively, the 1.7500-1.7490 and the 1.7370 may offer immediate supports to the pair, breaking which the 1.7210-1.7200, the 1.7095 and the 1.7000 round-figure can lure the Bears.

AUD/NZD

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance