Important GBP Pairs’ Technical Overview: 01.11.2017

GBP/USD

While speculations concerning BoE’s once in a decade rate-hike presently propels the GBPUSD, the pair might find it hard to clear the 1.3335-40 horizontal-line that confines follow-on north-run towards 1.3410 and then to the 1.3455 resistances. Should the quote successfully trade beyond 1.3455, the 1.3500, the 1.3565 and the 1.3600 can become buyers’ favorite. On the downside, the 1.3265 and the 1.3215 are likely supports that the pair can test during its pullback, breaking which it could dip to 1.3130 and to the 1.3100 round-figure. Though, the 1.3070-75 horizontal-region may restrict the pair’s additional decline, failing to which can flash 1.3025, the 1.3000 and the 61.58% FE level of 1.2945 on the chart.

GBP/JPY

Even after breaking the 151.50-60 resistance-line, the GBPJPY can’t be termed strong to challenge the September high of 152.85 unless it provides a daily closing beyond short-term ascending trend-channel resistance of 152.00. However, pair’s sustained trading above 152.85 could strengthen it to aim for 153.70, the 154.50 and the 61.8% FE level of 155.30. In case if prices fail to clear 152.00 and close beneath 151.50, the 150.90 and the 150.00 can entertain counter-trend traders before threatening them with channel support of 148.70. Moreover, break of 148.70 opens the gate for the pair’s extended south-run to 50-day SMA level of 147.50.

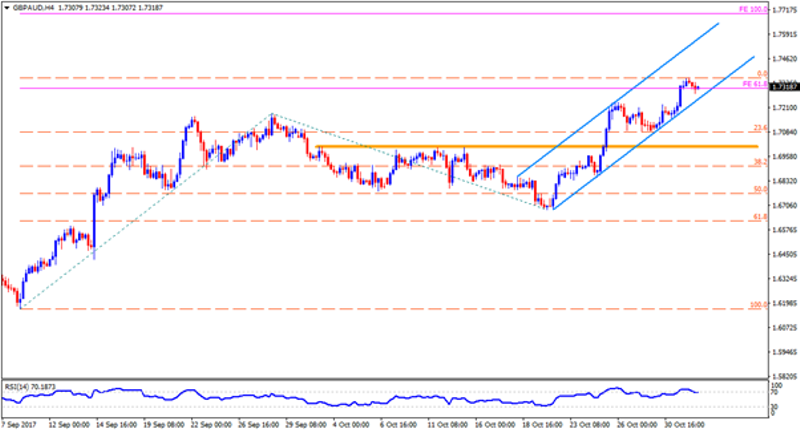

GBP/AUD

GBPAUD’s inability to surpass 1.7365 could well fetch the pair to immediate channel-support of 1.7250 but its further declines become questionable, which if at all happens can quickly signal the 1.7160 and the 1.7090 to sellers. Given the pair Bears stretch their downward bias below 1.7090, the 1.7010 – 1.7000 horizontal-line becomes crucial to watch. Alternatively, 1.7365 and the 1.7470 are expected upside numbers to please buyers ahead of making them confront the channel-resistance of 1.7570. Further, during the pair’s north-run above 1.7570, the 100.00% FE level of 1.7700 may appear in Bulls radar.

GBP/CHF

Having breached 1.3200 – 1.3210 area, the GBPCHF didn’t respect the 1.3260 resistance and it seems rising in the direction to 1.3400 ahead of targeting the 1.3495 – 1.3500 region that comprises upper-line of near-term “Rising-Wedge” formation. If the 1.3500 also fails to conquer optimist traders, the 1.3640 and the 1.3720 may well be aimed. Meanwhile, 1.3260 and the 1.3200 can act as adjacent rests if the overbought RSI play its role but the pair’s following drop can be challenged by 1.3060 and the Bearish pattern support of 1.2970. Should the quote plunges below 1.2970, it becomes wise to favor its test to the 50-day SMA level of 1.2810 and then to the 1.2650 support-levels.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance