Impressive 1st-Quarter Results Spark PayPal's Comeback

PayPal Holdings Inc. (NASDAQ:PYPL) is just one of the many fintech companies that, over the past three years, have missed its numbers repeatedly. As one of the most popular payment companies offering ways to send and receive money securely, the company has sharply underperformed.

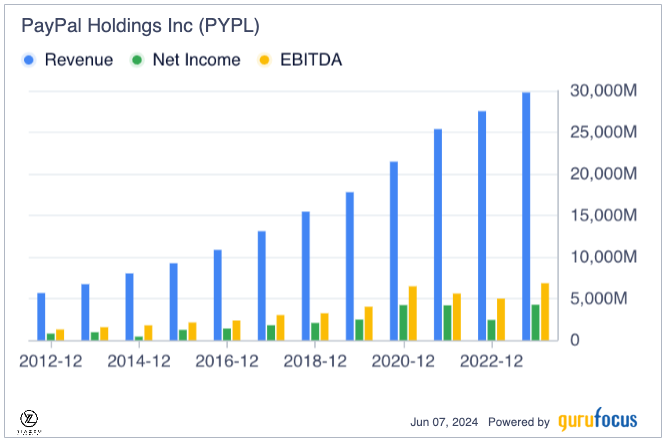

Spun off from eBay (NASDAQ:EBAY) in 2015, this business has grown impressively, doubling from 180 million users in 2015 to 380 million by 2020. The Covid-19 pandemic changed many things that year: it became trendy for payments and receiving money, as most people were forced to work from home and had to shop online. Its user count was growing by 24% year over year.

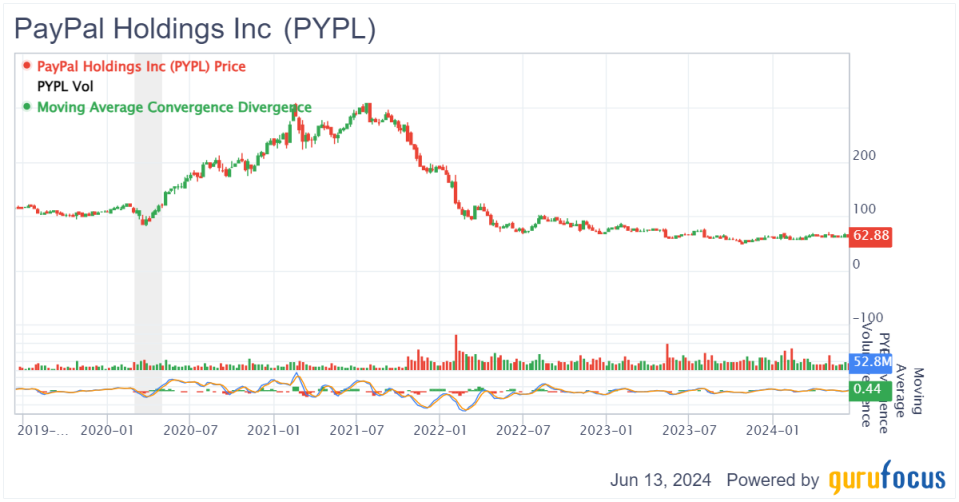

Fast forward, things have changed for the company, and its fortunes have turned sourit no longer grows as it used to when it was the primary payment platform on eBay. The stock, in turn, has plunged from record highs of $308 per share, thus far shedding almost 80% of its market value, to current lows of about $66. The stock, trading at 2.30 times sales, is rated among the worst-performing stocks in the payment sector.

Over the past three years, PayPal has faced significant pressure, but the tide appears to be turning in its favor. After an 80% sell-off, it may now be undervalued. However, the stock has started to show signs of bottoming out, as indicated by the moving average convergence and divergence indicator moving above the zero line, signaling a potential increase in buying pressure.

New CEO drives record-breaking performance

PayPal is powering through 2024 with a bang and outperformed analysts' expectations in the first quarter. With a new CEO, Alex Chriss, who took charge half a year earlier, the fintech giant saw its core business operations gain some tangible growth. The achievement of such a target is largely attributed to its strategic initiatives to curtail operational costs and increase transaction volumes.

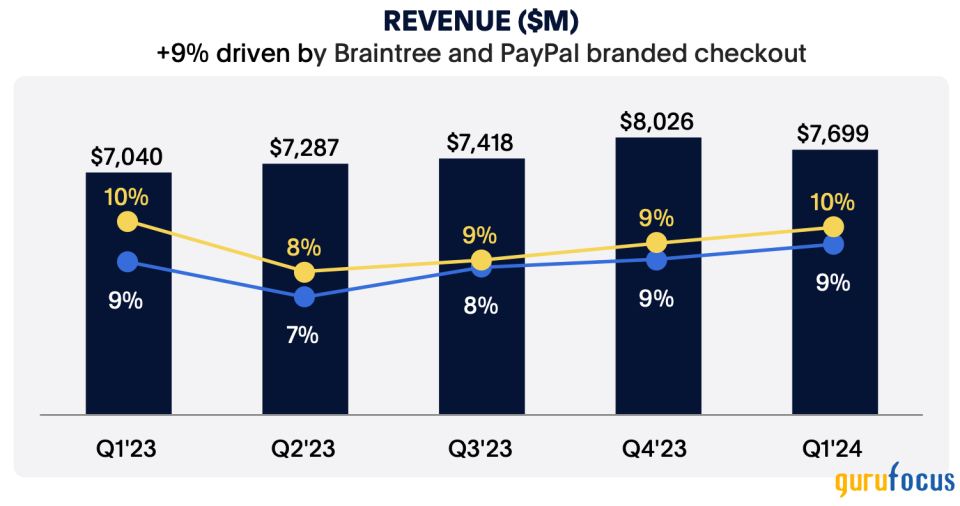

The company's financial performance in the first quarter was impressive, with reported revenue of $7.70 billion, reflecting growth of 9%. This growth was primarily driven by a 14% surge in the total payment volume, which reached $404 billion. The increase in the number of payment transactions per active account to 60 from 53 was a clear indication of the increased engagement and usage of the PayPal platform, marking a 13% increase.

Additionally, the transaction margins in the first quarter significantly improved and increased by 4% to $3.46 billion. Thus, an increasing transaction margin is the key measure the company can use to monetize its transactions, even amid the challenges of the generic market. In turn, non-operating income increased significantly by 18.20% year over year to reach $1.40 billion, representing effective asset management externally to the key PayPal business.

Finally, the strong financial results are also indicative of the tight lid the company has been able to keep on operational expenses, resulting in higher operating margins than forecasted. It recorded the small but important growth of its active accounts, which rose by 1% to 427 million.

Meanwhile, monthly active accounts increased 2% to 220 million, whereas payment transactions increased 11% to 6.50 million, suggesting activity by users has continued to grow and engagement with the platform has increased.

Source: PayPal

PayPal pivots to AI: Revolutionizing checkout with game-changing Fastlane technology

PayPal is pivoting deeper into artificial intelligence as it looks to enhance its operations and address some of the issues that have affected its performance in the past. The push into AI is also part of a plan to rejuvenate the company's appeal and usability in the highly competitive fintech sector.

What PayPal has done now, harnessing the power of AI, is reinvent the checkout experience. Fastlane is completely one-click, username-less and password-lessyou do not even have to share the username or password. And already, with just this checkout timesaver using AI innovation, the company is expected to slice off up to 40% of its checkout times while the cart-to-checkout conversion rate goes up by a further 70%.

As per CPA and strategy consultant Andrew Gosselin, PayPal can regain dominance by leveraging AI to personalize and streamline its checkout process. AI analyzes customer data to make tailored recommendations and cash-back offers, optimizing payment options based on past behavior. This enhances the customer experience and significantly boosts conversion rates, as seen in a test with BigCommerce, where rates increased from a range of 40% to 45% to 70%. Hence, these AI-driven innovations drive higher sales and engagement, positioning PayPal as a leader in fintech.

Therefore, with the revolutionary technology, PayPal also offers smart receipts that will help users efficiently track their purchases. Merchants will also include AI-powered personalized recommendations and reward offers in receipts.

Launch of PYUSD Stablecoin unlocks new growth and cross-border potential

PayPal became the first significant financial services company to launch its stablecoin last year as part of its push for growth opportunities in the burgeoning sector.

While the company does not post crypto-related earnings on its fillings, the unit has been growing in strength, with the CEO insisting there are compelling unit economics and market upside. For starters, PayPal has already confirmed its cross-border money payment unit, Xoom, will allow customers to send and receive PYUSD stablecoin abroad with zero fees.

PayPal's venture into stablecoins is not just a response to the growing interest in cryptocurrencies and blockchain technology, but a strategic move to capitalize on this trend. Thus, leveraging its robust regulatory framework compliance history and its focus on enhancing fiat-to-crypto processes, the company is positioning itself to attract a substantial share of institutional investment dollars.

Therefore, the company remains well-positioned to tap into the growing demand for stablecoins and their potential role in transforming financial systems.

Market expectations and operational efficiency

At the same time, it also became clearer how efficient PayPal has been on an operational basis, with adjusted operating expenses plummeting 6.40% on a quarter-over-quarter basis to $1.73 billion.

This decline underscores PayPal's strategic direction in terms of cost control and improvement in efficiency, which is set to continue into the next quarter. Such practices are very important in that they reduce the margin dilution effect arising from the operations of Braintree. Moreover, the company is intensively expanding its Branded Checkout business, which has grown by 7% year over year and is starting to add positively to the financial metrics.

Though Braintree is a low-margin operation, it is now contributing 37% of PayPal's total payment volume, compared with a lesser share in years past. This has diluted PayPal's overall margins a bit now that it is integrated, but Braintree is more than pulling its weightit has grown 26% by TPV year over year.

Lastly, new in-app offerings and user-experience improvements drive an ongoing relationship with users, increase reach and attract new customers, all of which support TPV growth and financial health.

Concluding thoughts

Analysts remain bullish on the company's prospects, with consensus forward estimates indicating a compound annual growth rate of 7.70% for top-line growth and 11.10% for bottom-line growth through fiscal 2026.

The new projections have come far ahead of the previous estimate and, therefore, reflect a confident response to the strategic direction of PayPal and the pace of profitability growth. Also, the company has a solid track record of returns to shareholders, having retired 5.40% of its float in the past 12 months and significantly deleveraging its balance sheet.

These last three years were when PayPal underperformed; the growth metrics took a hit. On the other hand, the current valuation of the stock makes it more attractive: shares have dropped over 80% from the 2021 highs and now reflect a deep market correction.

The first-quarter 2024 results indicate PayPal is indeed going into a year of transition, but is also on track for revenue and earnings growth recovery. As the new management team starts to take on a turnaround strategy, it now appears PayPal is going for a major overhaul.

Lastly, the stock is presently undervalued, so it may be a good opportunity for long-term investors to pick up PayPal as a value proposition in technology.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance