Inari Medical Inc (NARI) Q1 2024 Earnings: Surpasses Revenue Estimates Amidst Rising Operating ...

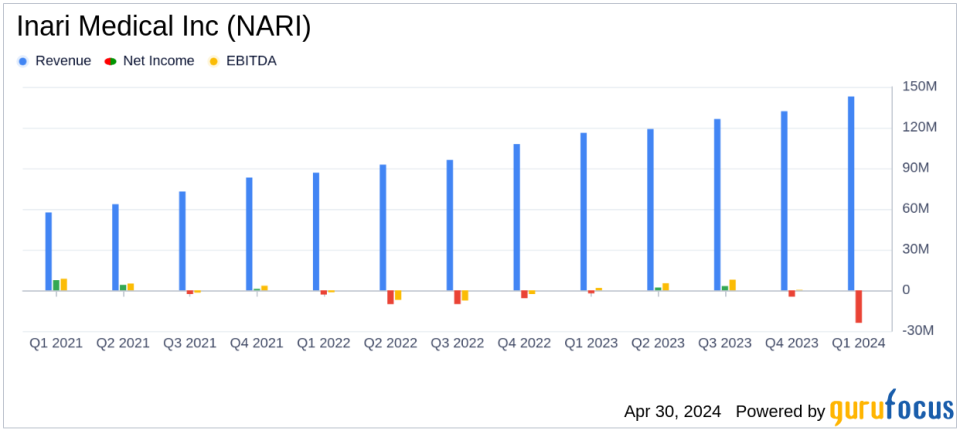

Revenue: $143.2M, up 23.3% year-over-year from $116.2M, exceeding estimates of $138.37M.

Net Loss: Increased to $24.2M from $2.2M in the previous year, significantly below estimates of an $11.00M loss.

Earnings Per Share: Reported a net loss per share of $0.42, falling short of the estimated loss per share of $0.20.

Gross Margin: Decreased to 86.8% from 88.2% year-over-year, attributed to increased internationalization and new product ramp-up costs.

Operating Expenses: Rose to $141.5M, driven by higher personnel-related expenses and costs from the LimFlow acquisition.

Full Year Revenue Guidance: Raised to $592.5M to $602.5M, indicating expected growth of 20% to 22% over the previous year.

Operating Profitability: Projected to achieve sustained operating profitability in the first half of 2025.

Inari Medical Inc (NASDAQ:NARI) released its 8-K filing on April 30, 2024, showcasing a robust revenue increase but also a significant rise in operating losses for the first quarter ended March 31, 2024. The company, a pioneer in medical devices for venous diseases, reported a revenue of $143.2 million, marking a 23.3% increase from the previous year and surpassing the estimated $138.37 million. However, the net loss widened to $24.2 million from $2.2 million in the same quarter last year, with a net loss per share of $0.42, significantly missing the estimated loss per share of $0.20.

Company Overview

Inari Medical Inc focuses on developing products for patients with Chronic Venous Disease. Its innovative portfolio includes devices like ClotTriever and FlowTriever for deep vein thrombosis and pulmonary embolism treatments, respectively. The company primarily operates in the United States, with expanding international reach influencing its financial strategies and operational focus.

Detailed Financial Performance

The increase in revenue reflects higher adoption of Inari's procedures and expansion into global markets. Despite this, the company faced a gross margin decrease to 86.8% from 88.2% due to internationalization, new product ramp-up costs, and a changing product mix. Operating expenses surged to $141.5 million, up from $107.8 million, driven by higher personnel costs, stock-based compensation, and expenses from the recent LimFlow acquisition.

The GAAP operating loss deepened to $17.2 million, compared to a loss of $5.3 million in the prior year's quarter. Non-GAAP adjustments included changes in the fair value of contingent consideration and acquisition-related expenses, leading to a non-GAAP operating loss of $5.6 million, consistent with the previous year.

Strategic Initiatives and Future Outlook

CEO Drew Hykes emphasized the company's commitment to its growth pillars and the ongoing PEERLESS study, expected to bolster its clinical data in H2 2024. Inari Medical now projects full-year 2024 revenue to be between $592.5 million and $602.5 million, anticipating 20% to 22% growth over 2023. This updated guidance reflects confidence in continued robust sales performance and market expansion.

Investor and Analyst Perspectives

While Inari's revenue growth is commendable, the widening losses may concern investors. The increased operational costs and investment in research and development are integral to the company's long-term strategy, yet they underscore the challenges of balancing expansion with profitability. Inari expects to achieve operating profitability in the first half of 2025, marking a critical future milestone for financial health.

In conclusion, Inari Medical Inc's first quarter of 2024 demonstrates a dynamic yet challenging phase of growth and investment. The company's ability to exceed revenue expectations is a positive indicator, but the deepening losses highlight the costs associated with its ambitious expansion and development goals. Investors and stakeholders will likely watch closely as Inari strives towards profitability in the coming year.

Explore the complete 8-K earnings release (here) from Inari Medical Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance