Inari Medical (NARI) Q2 Earnings Beat, CEO Transition in 2023

Inari Medical, Inc. NARI reported second-quarter 2022 net loss per share of 19 cents, narrower than the Zacks Consensus Estimate of a loss of 23 cents. The company had reported earnings of 7 cents per share in the year-ago quarter.

Revenue Details

The company reported revenues of $92.7 million, which surged 46.2% from the prior-year quarter. The top line outpaced the Zacks Consensus Estimate by 5.3%. Product introductions and continued U.S. commercial expansion contributed to the improvement.

Q2 Highlights

The company derived almost two-thirds of its revenues from the sale of FlowTriever product lines and the rest from sales of ClotTriever product lines.

Margins

Gross profit in the reported quarter was $82.4 million, up 40.6% year over year. As a percentage of revenues, the gross margin in the quarter was 88.8%, down 360 basis points (bps).

Research and development expenses were $18.6 million, up 59.7% from the year-ago quarter. Meanwhile, selling, general and administrative expenses amounted to $73.2 million, up 70.5% on a year-over-year basis.

Operating loss totaled $9.3 million against the year-ago quarter’s operating income of $4.1 million.

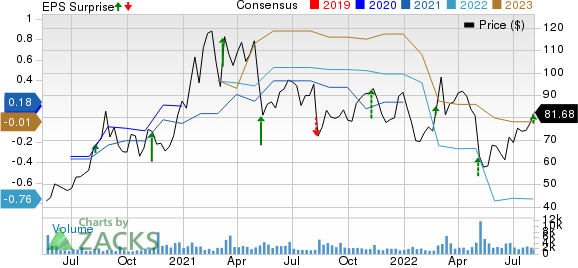

Inari Medical, Inc. Price, Consensus and EPS Surprise

Inari Medical, Inc. price-consensus-eps-surprise-chart | Inari Medical, Inc. Quote

Financial Position

The company exited the second quarter with cash, cash equivalents and short-term investments of $330.5 million, down from $338.7 million on a sequential basis.

Net cash used by operating activities at the end of the second quarter was $12.2 million, compared to $16.1 million net cash provided by operating activities in the prior-year quarter.

2022 Revenue Outlook

For 2022, the company reiterated its guidance for revenues in the range of $360 million to $370 million. The Zacks Consensus Estimate for the same is pegged at $362.92 million.

Our Take

Inari Medical exited the second quarter on a strong note, wherein both earnings and revenues beat the consensus mark. Apart from treating a large number of patients in the quarter under review, the company made substantial progress on all its growth drivers. The company’s plans to launch several products later this year buoy optimism.

However, the incurrence of operating loss remains a concern. Contraction in gross margin is a woe.

In a separate press release, Inari announced the transition of its chief executive officer (CEO). Effective Jan 1, 2023, Drew Hykes will succeed the current CEO — Bill Hoffman. Hykes will also join Inari’s board of directors effectively. Hoffman will continue to serve on the board.

Zacks Rank and Stocks to Consider

Currently, Inari carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the pharma/biotech sector include Lantheus LNTH, ShockWave Medical SWAV and Alkermes ALKS. While Lantheus and ShockWave Medical sport a Zacks Rank #1 (Strong Buy), Alkermes carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Lantheus have improved from earnings of $3.04 to $3.08 for 2022 and $3.33 to $3.62 for 2023 in the past 60 days. LNTH stock has surged 162.7% so far this year.

Lantheus delivered an earnings surprise of 77.82%, on average, in the last four quarters.

ShockWave Medical’s earnings per share estimates have improved from $1.84 to $2.02 for 2022 and from $2.82 to $2.95 for 2023 in the past 60 days. SWAV has gained 23.2% so far this year.

ShockWave Medical delivered an earnings surprise of 189.99%, on average, in the last four quarters.

Alkermes’ earnings per share estimates have improved from loss of 17 cents to earnings of 20 cents for 2022 and from 31 cents to 33 cents for 2023 in the past 60 days. ALKS has gained 8.9% so far this year.

Alkermes delivered an earnings surprise of 350.48%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance