Income Investors Shouldn't Ignore These 3 Utilities Stocks

The Zacks Utilities sector has performed relatively well in 2022, down roughly 6% vs. the S&P 500’s decline of 17%.

Consumers have a never-ending need for the services these companies provide, helping explain why the sector has been a brighter spot during a historically-volatile 2022.

In addition to being defensive in nature, stocks in the Utilities sector generally carry solid dividend payouts, providing the cherry on top for investors seeking an income stream.

For those interested in strong stocks from the realm, three top-ranked companies that reward their shareholders handsomely – NW Natural NWN, FirstEnergy Corp. FE, and American Electric Power Company, Inc. AEP – could all be considered.

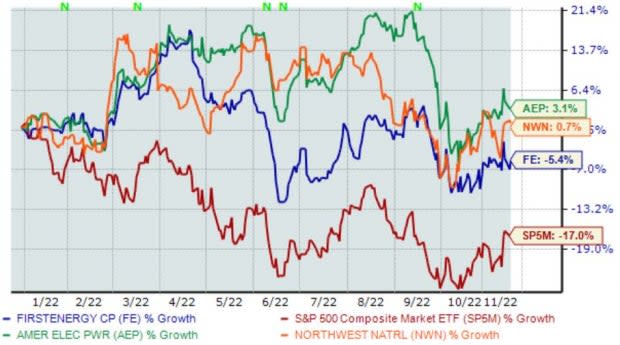

Below is a chart illustrating the year-to-date performance of all three stocks with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three stocks have outperformed the S&P 500 in 2022, putting their defensive nature on full display.

Let’s take a deeper dive into each one.

NW Natural

NW Natural (formerly known as Northwest Natural Gas Company) is a local distribution company that provides utility services and renewable energy to millions of consumers.

Analysts have taken a bullish stance on the company’s earnings outlook as of late, helping land the stock into a favorable Zacks Rank #1 (Strong Buy).

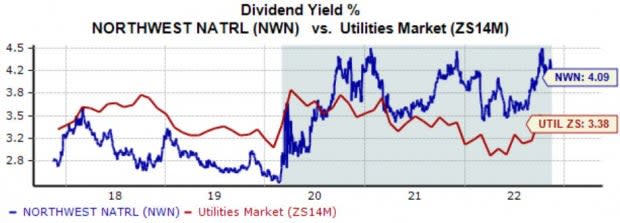

Image Source: Zacks Investment Research

NWN’s annual dividend yield currently sits at 4.1%, modestly above its Zacks Utilities sector average of 3.4%.

Further, in its latest earnings release, the company laid out growth targets for the next five years, with one of them focusing on a strong and growing dividend – definitely what income-focused investors like to hear.

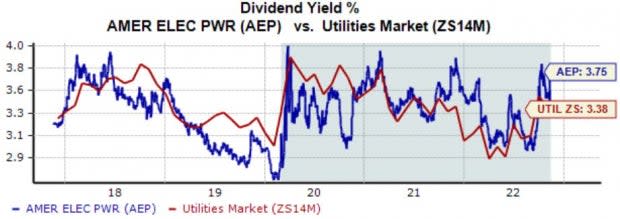

Image Source: Zacks Investment Research

American Electric Power Company

American Electric Power Company is a public utility holding company that, through directly and indirectly owned subsidiaries, generates, transmits, and distributes electricity, natural gas, and other commodities. AEP boasts a Zacks Rank #2 (Buy).

The company’s annual dividend yields a solid 3.7% paired with a 5.5% five-year annualized dividend growth rate and a payout ratio sitting at 62% of earnings.

AEP’s targeted payout ratio is 60% – 70%, precisely what it has achieved.

Image Source: Zacks Investment Research

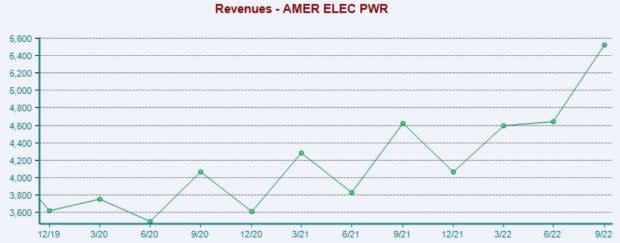

AEP posted a solid quarter in its latest release, exceeding the bottom-line estimate by more than 3% and revenue expectations by nearly 11%. In fact, AEP has exceeded revenue and EPS estimates in each of its last four quarters.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

For the cherry on top, the company carries a favorable growth profile; earnings are forecasted to climb 6% in its current fiscal year (FY22) and a further 5.8% in FY23.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 12% and 2.3% in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

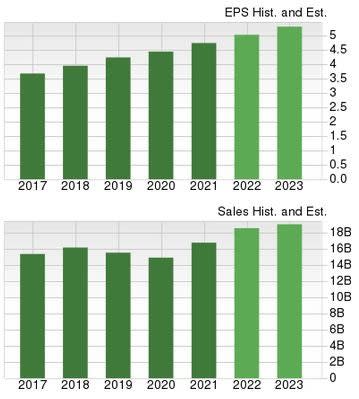

FirstEnergy Corp.

Through its subsidiaries and affiliates, FirstEnergy engages in electricity transmission, distribution, and generation. FE sports a Zacks Rank #2 (Buy).

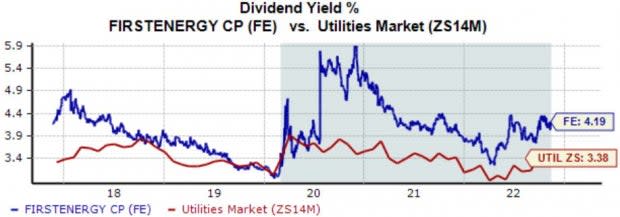

FE rewards its shareholders via its annual dividend that currently yields a sector-beating 4.2% paired with a payout ratio sitting at 64% of its earnings.

Further, the company has upped its dividend payout twice over the last five years, translating to a 2% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Shares currently trade at a 15.3X forward earnings multiple, precisely at its five-year median value and just modestly above its Zacks Utilities sector average of 14.9X.

FE carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Bottom Line

The Zacks Utilities sector has put its defensive nature on display year-to-date, outperforming the general market by a fair margin.

And in a historically volatile 2022, adding an extra layer of defense into portfolios is something investors should highly consider.

Companies in the realm experience reliable, predictable demand thanks to their services constantly being in need.

In addition, stocks in the Utilities sector generally pay dividends, providing a cushion to drawdowns in other positions.

For those looking to tap into the defensive sector – NW Natural NWN, FirstEnergy Corp. FE, and American Electric Power Company, Inc. AEP – could all be considered.

All three stocks are highly-ranked, telling us that they’ve witnessed positive earnings estimate revisions as of late.

And to top it off, all three reward their shareholders handsomely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

Northwest Natural Gas Company (NWN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance