Incyte (INCY) to Report Q1 Earnings: What's in the Cards?

Incyte Corporation INCY is scheduled to release first-quarter 2024 results on Apr 30, before the opening bell.

The company's earnings beat estimates in two of the trailing four quarters and missed the same in the other two, delivering an average negative surprise of 13.54%. In the last reported quarter, Incyte delivered a negative earnings surprise of 12.40%.

Let's see how things might have shaped up prior to the announcement.

Factors to Consider

Incyte primarily derives product revenues from sales of its lead drug, Jakafi (ruxolitinib), in the United States and other marketed drugs.

An increase in the sales of Jakafi, a first-in-class JAK1/JAK2 inhibitor in all approved indications (polycythemia vera, myelofibrosis and refractory acute graft-versus-host disease [GvHD]), is likely to have boosted revenues in the first quarter. However, competition from other approved drugs might have inhibited sales growth potential to some extent.

The Zacks Consensus Estimate for Jakafi's sales in first-quarter 2024 is pegged at $642.2 million.

Incyte earns product royalty revenues from Novartis AG NVS for the commercialization of Jakafi in ex-U.S. markets. Novartis licensed ruxolitinib for its development and commercialization outside the United States.

While Incyte markets Jakafi in the United States, Novartis promotes the same drug as Jakavi outside the country. INCY is expected to have received higher royalties from NVS in the to-be-reported quarter on higher Jakavi sales.

Novartis reported a strong performance of Jakavi in the first quarter, with sales of the drug witnessing an 18% increase on a constant currency basis. Hence, royalties from the same are likely to be higher.

Incyte also receives royalties from the sales of Tabrecta (capmatinib), which is approved for treating adult patients with metastatic non-small cell lung cancer. Novartis has exclusive worldwide development and commercialization rights to Tabrecta.

Importantly, incremental sales from newly approved drugs like Opzelura (ruxolitinib) cream and Zynyz are expected to have boosted Incyte’s revenues in the to-be-reported quarter.

Growth in Opzelura sales is likely to have been driven by factors like increasing patient demand, refills and expansion in payer coverage in the first quarter of 2024. The Zacks Consensus Estimate for Opzelura sales in the to-be-reported quarter is pegged at $107.83 million.

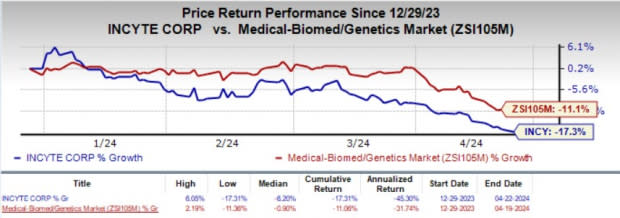

Shares of INCY have plunged 17.3% year to date compared with the industry’s decline of 11.1%.

Image Source: Zacks Investment Research

While Jakafi’s sales and royalties are the key catalysts for INCY’s revenue growth, sales of other drugs like Minjuvi, Pemazyre, Iclusig and Olumiant’s royalties from Eli Lilly are also likely to have contributed to Incyte’s top line in the to-be-reported quarter.

The Zacks Consensus Estimate for Iclusig, Minjuvi and Pemazyre sales in the first quarter is pinned at $27.98 million, $19.19 million and $22.08 million, respectively.

Higher research and development expenses, as well as increased selling and general and administrative costs, are likely to have escalated operating expenses in the first quarter of 2024.

Incyte Corporation Price, Consensus and EPS Surprise

Incyte Corporation price-consensus-eps-surprise-chart | Incyte Corporation Quote

Key Development

During the first quarter, Incyte gained worldwide exclusive global rights for tafasitamab from MorphoSys AG, which is marketed as Monjuvi in the United States and as Minjuvi in the ex-U.S markets. Per the 2020 agreement with MorphoSys, Incyte only enjoyed exclusive rights to tafasitamab outside the United States.

Per the terms of the new agreement, Incyte is liable to pay $25 million to MorphoSys in consideration of the transfer of global rights for tafasitamab. This is expected to boost sales for Incyte as it now has complete control over tafasitamab’s development and commercialization. The company also expects significant operating efficiencies and cost synergies in the United States in the commercialization of the drug.

Earnings Whisper

Our proven model does not conclusively predict an earnings beat for Incyte this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Incyte has an Earnings ESP of -7.21% as the Most Accurate Estimate of 80 cents per share is lower than the Zacks Consensus Estimate of 87 cents.

Zacks Rank: Incyte currently carries a Zacks Rank #3.

Stock to Consider

Here are some stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Sarepta Therapeutics SRPT has an Earnings ESP of +104.86% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Sarepta Therapeutics have risen 21.3% in the year-to-date period. SRPT’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 464.56%.

CytomX Therapeutics CTMX has an Earnings ESP of +188.89% and a Zacks Rank #3 at present.

CytomX Therapeutics’ shares have risen 7.7% year to date. CTMX beat on earnings in three of the trailing four quarters and missed the same in one, delivering an average surprise of 57.94%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance