India Two Wheeler Market 2023-2029 | A $16.63 Billion Market Opportunity | Vehicle Type, Propulsion Type, and Granular Region-Wise Analysis

Indian Two Wheeler Market

Dublin, March 26, 2024 (GLOBE NEWSWIRE) -- The "India Two Wheeler Market, By Region, Competition, Forecast and Opportunities, 2019-2029F" report has been added to ResearchAndMarkets.com's offering.

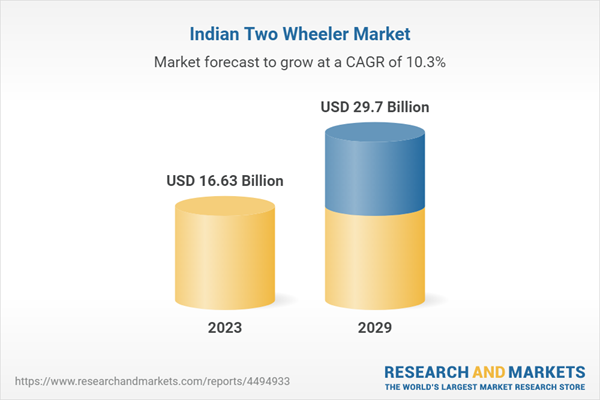

The Indian Two Wheeler market is experiencing a significant upswing, with a projected CAGR of 10.29% through the period leading up to 2029. Fueled by various economic, cultural, and regulatory drivers, the sector anticipates robust growth, bolstering its already valued status at USD 16.63 billion in 2023.

Economic growth coupled with rising disposable incomes across the Indian subcontinent is motivating a considerable share of the population to invest in personal mobility solutions. The demographic trend indicating a substantial young population with a growing penchant for stylish, efficient, and affordable personal mobility adds to the market's volume growth. Furthermore, increased availability of financing options with consumer-friendly schemes is expediting vehicle ownership among potential buyers.

With the progression of urbanization and the ensuing traffic congestion, two-wheelers are emerging as a preferred mode of traversal through busy cityscapes. Government initiatives are also playing a pivotal role. Stricter emission and safety norms are propelling technology upgrades, favoring eco-friendly and safer two-wheelers. Meanwhile, cultural underpinnings have positioned two-wheelers as more than just transportation means, embedding them as a symbol of family dynamics and bonds.

India's two-wheeler market is marked by fierce competition, with numerous players—both domestic and international—jockeying for greater market shares. This environment of competitiveness is fostering innovation and technological advancements, offering consumers an abundance of choices regarding design, performance, and affordability. Marketing strategies and brand building are becoming central to establishing a presence in this crowded marketplace.

Trends Shaping the Market Landscape

Electrification on the Fast Lane: With environmental concerns on the rise and policy incentives from the government, electric two-wheelers are gaining traction. Initiatives like the FAME scheme and advancements in battery technology are poising the electric two-wheeler segment for a promising trajectory.

Shift Toward Premiumization: A segment of the Indian consumer population is gravitating towards premium motorcycles, endorsed by higher disposable income and a taste for performance and luxury.

Enhanced Focus on Safety: As road safety becomes paramount, the market sees heightened adherence to safety norms and an increased incorporation of safety features in two-wheeler models.

The report delineates the various facets of the India Two Wheeler Market, categorized by vehicle type, propulsion type, and provides a granular analysis region-wise. The motorcycle segment continues to lead, attributed to its multi-purpose functionality, affordability, fuel efficiency, and adaptability to diverse Indian terrains.

Western India claims the lion's share in the market, backed by its established cities being central hubs for economic activity and possessing robust road infrastructures. The surge in disposable incomes in this region perfectly aligns with the market's offering of practical and economical transportation options, further solidifying its dominance.

Key Attributes

Report Attribute | Details |

No. of Pages | 82 |

Forecast Period | 2023-2029 |

Estimated Market Value (USD) in 2023 | $16.63 Billion |

Forecasted Market Value (USD) by 2029 | $29.7 Billion |

Compound Annual Growth Rate | 10.2% |

Regions Covered | India |

A selection of companies mentioned in this report includes:

Hero MotoCorp

Honda Motorcycle & Scooter India

Yamaha Motor

Eicher’s Motor

Bajaj Auto

TVS Motor Company

Suzuki Motorcycle India, Private Limited

Piaggio vehicles Pvt. Ltd.

Hero Electric

Okinawa

For more information about this report visit https://www.researchandmarkets.com/r/f3y533

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance