Indie Semiconductor Inc (INDI) Posts Record Revenue Growth in Q4 and Full Year 2023

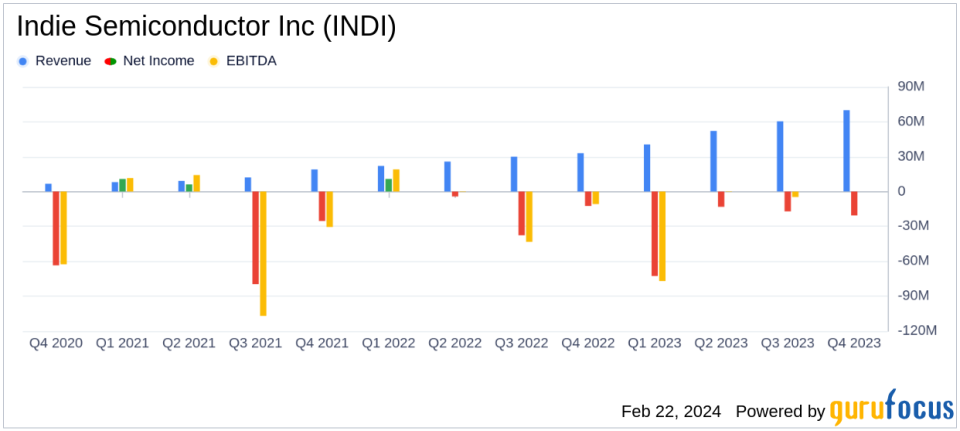

Revenue: Q4 revenue soared to $70.1M, a 112% increase year-over-year and a 16% sequential rise.

Gross Margin: Non-GAAP gross margin expanded by 50 basis points year-over-year to 52.7%.

Annual Performance: 2023 revenue reached a record $223.2M, marking a 101% increase from the previous year.

Net Loss: GAAP net loss for Q4 was $0.09 per share, while Non-GAAP net loss was $0.01 per share.

Outlook: Q1 2024 revenue is expected to be up 38% year-over-year but down 20% sequentially.

On February 22, 2024, Indie Semiconductor Inc (NASDAQ:INDI) released its 8-K filing, announcing a significant year-over-year growth in both the fourth quarter and full-year revenue for 2023. The company, a trailblazer in automotive semiconductors and software platforms, has been at the forefront of the Autotech revolution, focusing on edge sensors for Advanced Driver Assistance Systems (ADAS), connected car, user experience, and electrification applications.

Indie Semiconductor's financial achievements in the fourth quarter and throughout 2023 are pivotal for a company in the semiconductor industry, which is characterized by rapid innovation and intense competition. The growth in revenue and expansion of gross margins are indicative of the company's ability to scale its operations and enhance profitability amidst challenging market conditions.

Despite facing industry-wide inventory corrections and a general automotive end market weakness, Indie Semiconductor has managed to outperform its industry peers, as noted by CEO Donald McClymont. The company's strategic focus on vehicle safety systems, sensor fusion, and Artificial Intelligence (AI) has positioned it to capitalize on the strategic Autotech opportunity and create shareholder value.

Financial Overview

Indie Semiconductor's record-breaking revenue in Q4 2023 was primarily driven by product revenue, which amounted to $63.2 million, and contract revenue of $7 million. The full-year revenue for 2023 was equally impressive, with product revenue accounting for $195.6 million and contract revenue contributing $27.5 million. The company's non-GAAP gross profit for Q4 stood at $37 million, translating to a non-GAAP gross margin of 52.7%, a slight increase from the previous year's 52.2%.

The balance sheet reflects a robust financial position with $151.7 million in cash and cash equivalents as of December 31, 2023. Total assets were reported at $818.1 million, with a notable increase in goodwill and intangible assets, indicating the company's investment in strategic acquisitions and intellectual property.

Despite the positive revenue trajectory, Indie Semiconductor reported a GAAP net loss of $14.1 million for Q4 2023, equating to a loss per share of $0.09. The non-GAAP net loss was considerably lower at $2.6 million, or $0.01 per share, demonstrating the company's ability to manage expenses and improve operational efficiency on an adjusted basis.

Looking Ahead

For Q1 2024, Indie Semiconductor anticipates a 38% year-over-year increase in revenue, although it expects a 20% sequential decrease due to market seasonality and current industry softness. CFO Thomas Schiller projects that Q1 will be the trough quarter, with a recovery expected in Q2 and a return to sequential growth in the second half of the year.

The company's strategic partnerships, such as the one with Ficosa on AI-based automotive camera solutions, and design wins with major automotive OEMs like BMW, Ford, General Motors, and Toyota, underscore its continued innovation and market penetration. Indie Semiconductor's focus on smart connectivity and ADAS technologies is expected to drive future growth, particularly as the automotive industry shifts towards more automated and electrified vehicles.

Value investors may find Indie Semiconductor's growth trajectory and strategic positioning in the Autotech industry compelling, especially given the company's resilience in a challenging market and its potential for future profitability.

For more detailed financial information and to listen to the conference call discussing these results, please visit the Financials tab on the Investors page of Indie Semiconductor's website.

Media and investor relations inquiries can be directed to media@indiesemi.com and ir@indiesemi.com, respectively.

Explore the complete 8-K earnings release (here) from Indie Semiconductor Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance