Industrial Machinery Stocks Q1 Teardown: Desktop Metal (NYSE:DM) Vs The Rest

Let's dig into the relative performance of Desktop Metal (NYSE:DM) and its peers as we unravel the now-completed Q1 industrial machinery earnings season.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, generating new demand for industrial machinery and components. Companies that innovate and create digitized solutions can spur sales and speed up replacement cycles while those resting on their laurels can see dwindling market positions. Like the broader industrials sector, industrial machinery and components companies are also at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 42 industrial machinery stocks we track reported an ok Q1; on average, revenues were in line with analyst consensus estimates. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and industrial machinery stocks have had a rough stretch, with share prices down 5.6% on average since the previous earnings results.

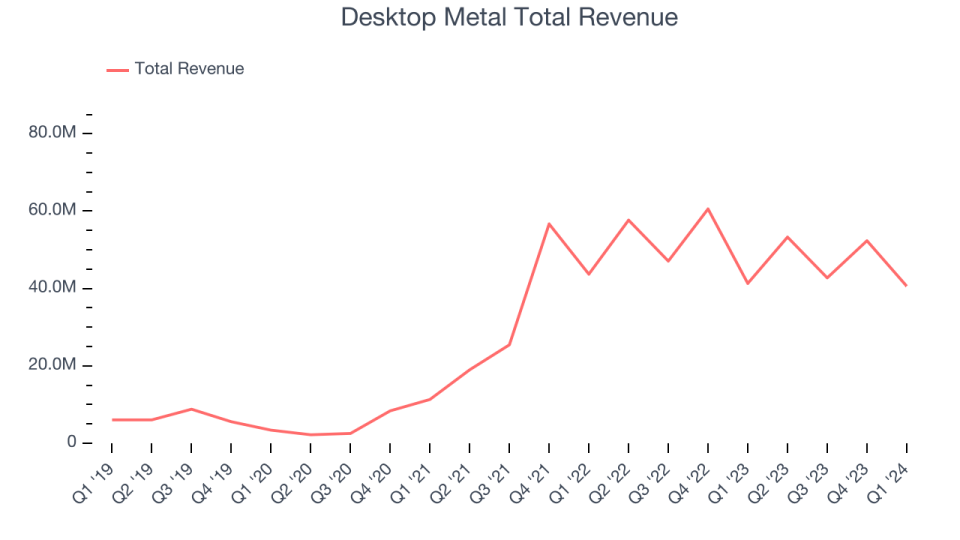

Desktop Metal (NYSE:DM)

Originating from a research lab at MIT, Desktop Metal (NYSE:DM) offers 3D printers, production materials, and software to many industries.

Desktop Metal reported revenues of $40.6 million, down 1.7% year on year, in line with analysts' expectations. It was a good quarter for the company with an impressive beat of analysts' earnings estimates and optimistic EBITDA guidance for the full year.

“We started 2024 on a solid foot, despite persistent challenges across the capital investment backdrop, which has been a headwind to our overall demand function. The DM team has shown a continued ability to improve operational performance as we decrease our operating expenses for the ninth consecutive quarter,” said Ric Fulop, Founder and CEO of Desktop Metal.

Desktop Metal scored the highest full-year guidance raise of the whole group. The stock is down 40.8% since reporting and currently trades at $5.

Is now the time to buy Desktop Metal? Access our full analysis of the earnings results here, it's free.

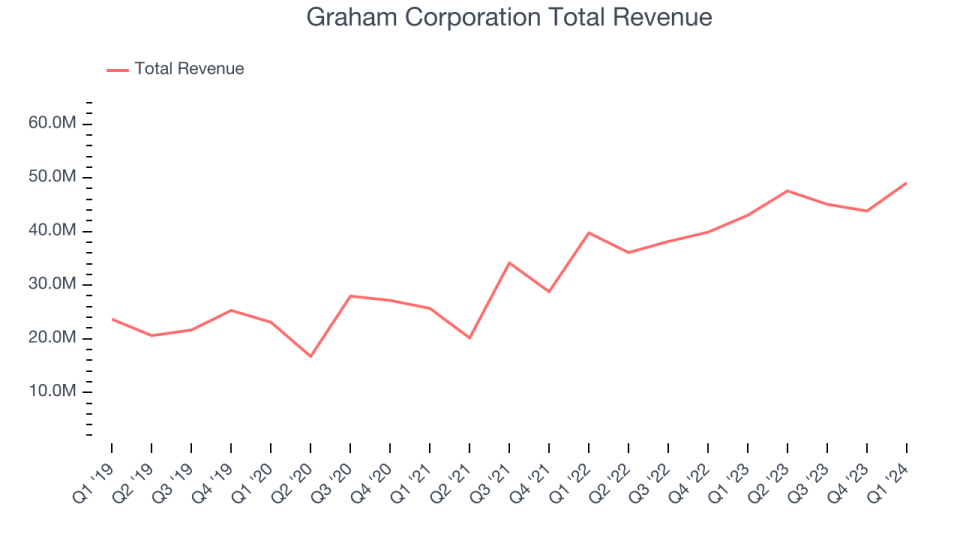

Best Q1: Graham Corporation (NYSE:GHM)

Founded when its founder patented a unique design for a vacuum system used in the sugar refining process, Graham (NYSE:GHM) provides vacuum and heat transfer equipment for the energy, petrochemical, refining, and chemical sectors.

Graham Corporation reported revenues of $49.07 million, up 14% year on year, outperforming analysts' expectations by 10.3%. It was an incredible quarter for the company with an impressive beat of analysts' earnings estimates.

The market seems content with the results as the stock is up 4.4% since reporting. It currently trades at $27.17.

Is now the time to buy Graham Corporation? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Middleby (NASDAQ:MIDD)

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE:MIDD) is a food service and equipment manufacturer.

Middleby reported revenues of $926.9 million, down 8% year on year, falling short of analysts' expectations by 5.5%. It was a weak quarter for the company with a miss of analysts' earnings and organic revenue estimates.

As expected, the stock is down 15.9% since the results and currently trades at $119.36.

Read our full analysis of Middleby's results here.

Helios (NYSE:HLIO)

Originally named Sun Hydraulics, Helios (NYSE:HLIO) designs, manufactures, and sells motion and electronic control components to various sectors.

Helios reported revenues of $212 million, flat year on year, surpassing analysts' expectations by 3.2%. Looking more broadly, it was a stunning quarter for the company with an impressive beat of analysts' organic revenue and earnings estimates.

The stock is down 14.7% since reporting and currently trades at $41.26.

Read our full, actionable report on Helios here, it's free.

ESAB (NYSE:ESAB)

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE:ESAB) manufactures and sells welding and cutting equipment for numerous industries.

ESAB reported revenues of $689.7 million, flat year on year, surpassing analysts' expectations by 5.5%. Looking more broadly, it was a strong quarter for the company with a solid beat of analysts' earnings estimates and in-line EBITDA guidance for the full year.

The stock is down 13% since reporting and currently trades at $92.07.

Read our full, actionable report on ESAB here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance