Will Industrial Sales Drive 3M Company's (MMM) Q3 Earnings?

3M Company MMM is scheduled to report third-quarter 2017 results before market opens on Oct 24.

Over the last three months, 3M Company’s shares yielded a return of 3.8%, as against the 2.3% loss incurred by the industry.

Over the trailing four quarters, the company recorded an average positive earnings surprise of 1.24%.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

3M Company believes stronger advance materials, automotive and aerospace solutions, Industrial adhesives and tapes abrasives, as well as its automotive aftermarket businesses will likely bolster its Industrial segment’s revenues in the quarters ahead. Notably, higher Heartland business sales and stronger operating leverage are also expected to boost the segment’s competency, going forward. The company generated nearly 34.8% revenues from this segment in second-quarter 2017. The Zacks Consensus Estimate for revenues from 3M Company’s Industrial segment is currently pegged at $2,656 million for third-quarter 2017, higher than $2,582 million reported in the year-ago quarter.

3M Company also believes the top-line performance of its Safety and Graphics segment will improve in the upcoming quarters on the back of better personal safety solutions demand across the world. Also, ongoing actions undertaken to strengthen the transportation safety business will likely benefit in the quarter to be reported.

New contract wins are anticipated to augment sales of the company’s food safety, drug delivery systems and medical consumables businesses in the third quarter. This will likely reinforce the Health Care segment’s revenues. On the other hand, increased penetration in original equipment manufacturing platform and higher consumer electronics sales are expected to support Electronics and Energy segment’s revenues in the to-be-reported quarter. Additionally, increased consumer health care, home care and home improvement sales are anticipated to propel revenues of the company’s Consumer segment in the quarter.

The Zacks Consensus Estimates for revenues from Safety and Graphics, Health Care, Electronics and Energy and Consumer segments are currently pegged at $1,481 million, $1,413 million, $1,302 million and $1,225 million respectively for third-quarter 2017, higher than the corresponding tallies of $1,448 million, $1,361 million, $1,293 million and $1,209 million recorded in the year-ago quarter.

3M Company also anticipates that higher organic volume growth, lower input costs and stronger productivity will continue to drive its operating margin growth in the quarters ahead.

We notice that 3M Company has the right combination of the two key ingredients:

Zacks ESP: 3M Company has an Earnings ESP of +1.05%, as the Most Accurate estimate of $2.21 per share comes above the Zacks Consensus Estimate of $2.19 per share.

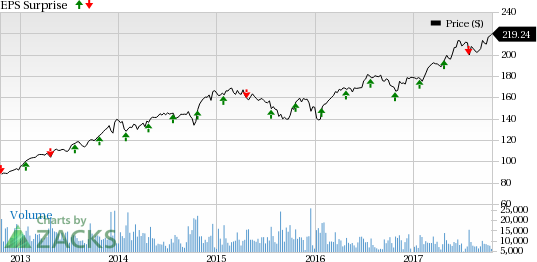

3M Company Price and EPS Surprise

3M Company Price and EPS Surprise | 3M Company Quote

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: 3M Company’s favorable Zacks Rank #3 (Hold), when combined with a positive ESP, predicts a likely earnings beat.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Conversely, we caution against stocks with a Zacks Ranks #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are some stocks within the industry that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Danaher Corporation DHR with an Earnings ESP of +0.36% and a Zacks Rank #2.

Honeywell International Inc. HON with an Earnings ESP of +0.06% and a Zacks Rank #2.

Altra Industrial Motion Corp. AIMC with an Earnings ESP of +7.10% and a Zacks Rank #2.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3M Company (MMM) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance