Industrial Stock Q3 Earnings Due on Oct 22: GPK, IRBT & MLI

Industrial stocks, grouped under the Zacks Industrial Products sector, earnings are anticipated to decline 3.8% year over year in the third quarter of 2019 against 1.2% growth registered in the previous quarter. Also, the sector’s revenues are expected to edge down 1.2% compared with a 1.7% decline reported in the previous quarter. Margins will likely be down 0.3%, whereas the sector registered 0.3% growth in the second quarter.

Tariff woes, uptick in commodity prices and inflation in other costs are expected to have bumped up expenses for many companies. This in turn will likely get reflected in their margin results for the July-September quarter.

In addition, difficulty in sourcing skilled labors, high logistic costs and forex woes are expected to have impacted the performance of some of the companies. Further, increasing geopolitical tensions — including Brexit — and softness in the construction market in Canada are anticipated to have built pressure on revenues of a few.

Notwithstanding the woes, use of sophisticated technologies in manufacturing process, demand for remodeling activities, infrastructural development, growing adoption of e-retailing and favorable changes in tax policy might have driven revenues for some industrial players.

Below, we briefly discuss what we expect from three industrial stocks, which are slated to report their third-quarter 2019 numbers on Oct 22.

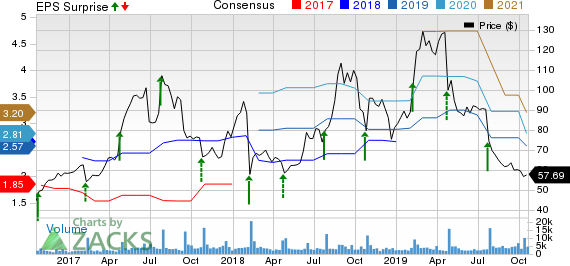

Graphic Packaging Holding Company GPK will release results before the market opens. It delivered better-than-expected results in three of the last four quarters, while lagged estimates once. The average earnings surprise was a positive 8.7%.

Graphic Packaging Holding Company Price, Consensus and EPS Surprise

Graphic Packaging Holding Company price-consensus-eps-surprise-chart | Graphic Packaging Holding Company Quote

Our proven model provides some idea about stocks that are about to release earnings results. Per the model, a stock needs a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Currently, Graphic Packaging has a Zacks Rank #3 and an Earnings ESP of +5.90%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Also, the Zacks Consensus Estimate for the company’s third-quarter earnings per share has been raised 5.6% to 19 cents per share in the past 60 days.

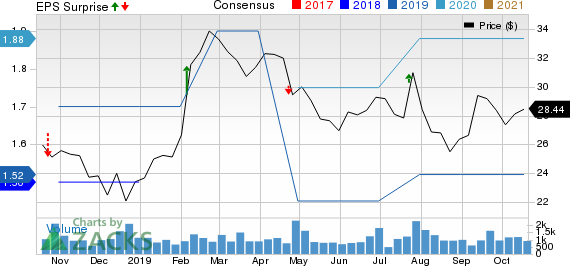

iRobot Corporation IRBT will report results after the market closes. It recorded better-than-expected results in the last four quarters, the average positive earnings surprise being 248.44%.

iRobot Corporation Price, Consensus and EPS Surprise

iRobot Corporation price-consensus-eps-surprise-chart | iRobot Corporation Quote

Presently, the company has a Zacks Rank #4 and an Earnings ESP of -4.06%. The company’s performance is likely to have suffered from tariff and forex woes, issues in connection with promotional and pricing activities in EMEA, and manufacturing diversification.

Over the past 60 days, the Zacks Consensus Estimate for the company's quarter under review has declined 6.9% to 54 cents. (For more please read: Will Tariffs, Weak Margins Hurt iRobot in Q3 Earnings?)

Mueller Industries Inc MLI is likely to report results on Oct 22. It recorded better-than-expected results in two of the last four quarters, while lagged estimates twice. Average earnings surprise was a positive 23.75%.

Mueller Industries, Inc. Price, Consensus and EPS Surprise

Mueller Industries, Inc. price-consensus-eps-surprise-chart | Mueller Industries, Inc. Quote

Presently, the company has a Zacks Rank #3 and an Earnings ESP of 0.00%. Over the past 60 days, the Zacks Consensus Estimate for the quarter under review has remained unchanged at 44 cents.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

Mueller Industries, Inc. (MLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance