Industrial Stocks' Q4 Earnings on Feb 13: ZBRA, LECO & More

Per the latest Earnings Preview, total earnings and revenues of industrial stocks, grouped under the Zacks Industrial Products sector, are expected to be unchanged on a year-over-year basis in fourth-quarter 2019. Notably, the sector’s earnings and revenues in the third quarter (ended September 2019) decreased 1.6% and 0.5%, respectively.

Key Factors

The industrial sector is likely to have benefited from factors such as low unemployment level, technological advancement in manufacturing processes, massive tax overhaul, deregulatory measures and higher government spending.

Though many industrial companies are likely to have benefited from improved demand across various end markets served, prevalent problems, both on macro and micro levels, might have weighed on the industry’s performance.

Industrial production is one of the key economic indicators for industrial stocks. Notably, industrial production fell 0.5% year over year in the quarter, recording a decline of 0.5% in October, growth of 0.8% in November and a fall of 0.3% in December. Slowdown in the manufacturing sector was evident in the fourth quarter, with output declining 1% year over year.

Moreover, global uncertainties and trade tension between the United States and China are likely to get reflected in the Industrial Products sector’s results.In addition, shortage of skilled labors and forex woes are expected to have affected performance of several companies.

Let’s take a sneak peek at four major Industrial Products stocks scheduled to report fourth-quarter earnings on Feb 13.

Zebra Technologies Corporation ZBRA is scheduled to report results before the opening bell. It recorded better-than-expected results in each of the last four quarters, the average positive earnings surprise being 3.99%. The company’s earnings are likely to have benefited from strength in healthcare, retail, transportation and logistics end markets, along with its recent acquisitions. However, negative impact of currency translation is likely to have dented performance.

Per our proven model, a stock needs a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zebra Technologies Corporation Price and EPS Surprise

Zebra Technologies Corporation price-eps-surprise | Zebra Technologies Corporation Quote

Currently, Zebra has a Zacks Rank #3 and an Earnings ESP of -0.59% as the Most Accurate Estimate is pegged at $3.63, lower than the Zacks Consensus Estimate of $3.65. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the company’s fourth-quarter earnings per share has remained stable in the past 60 days.

Lincoln Electric Holdings, Inc.LECO will report results before market open. It recorded better-than-expected results once in the last four quarters, the average negative earnings surprise being 2.93%.

Lincoln Electric Holdings, Inc. Price and EPS Surprise

Lincoln Electric Holdings, Inc. price-eps-surprise | Lincoln Electric Holdings, Inc. Quote

Presently, the company has a Zacks Rank #3 and an Earnings ESP of +1.01%, as the Most Accurate Estimate is pegged at $1.14, higher than the Zacks Consensus Estimate of $1.13.

Over the past 60 days, the Zacks Consensus Estimate for the company's fourth-quarter earnings has declined 0.9%.

Altra Industrial Motion Corp. AIMC is set to report results before market open. It recorded better-than-expected results twice in the last four quarters, the negative earnings surprise being 0.40%.Continued weakness in several end markets, destocking and soft demand in China are likely to have affected in the company’s top-line performance in the quarter

Altra Industrial Motion Corp. Price and EPS Surprise

Altra Industrial Motion Corp. price-eps-surprise | Altra Industrial Motion Corp. Quote

The company has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%, as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 67 cents.

Over the past 60 days, the Zacks Consensus Estimate for the quarter has remained unchanged.

Chart Industries, Inc. GTLS will report results before market open. It recorded better-than-expected results twice in the last four quarters, the positive earnings surprise being 4.01%. The company is likely to have benefited from robust order level supported by strength in its specialty end market.

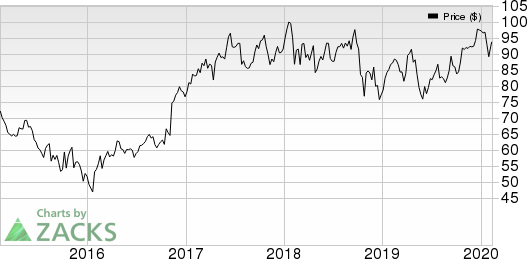

Chart Industries, Inc. Price and EPS Surprise

Chart Industries, Inc. price-eps-surprise | Chart Industries, Inc. Quote

The company has a Zacks Rank #3 and an Earnings ESP of -3.87%, as the Most Accurate Estimate is pegged at 87 cents, lower than the Zacks Consensus Estimate of 91 cents.

Over the past 60 days, the Zacks Consensus Estimate for the quarter has declined 1.1%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance