Industrials Stocks Q2 Results: Benchmarking Lennar (NYSE:LEN)

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the industrials stocks, including Lennar (NYSE:LEN) and its peers.

Traditionally, industrials companies--while diverse in nature--have built competitive advantages via some combination of economies of scale, brand recognition, and strong relationships with customers such as manufacturers or contractors. In recent decades, secular trends like energy efficiency and automation are driving innovation, leading to incremental demand. However, these companies are still at the whim of macroeconomic health, which tends to be cyclical and can be impacted heavily by factors such as interest rates. Shocks like geopolitical conflicts can also impact this increasingly global industry.

The 10 industrials stocks we track reported a slower Q2; on average, revenues missed analyst consensus estimates by 2.1%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the industrials stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.6% on average since the previous earnings results.

Lennar (NYSE:LEN)

One of the largest homebuilders in America, Lennar (NYSE:LEN) is known for constructing affordable, move-up, and retirement homes across a range of markets and communities.

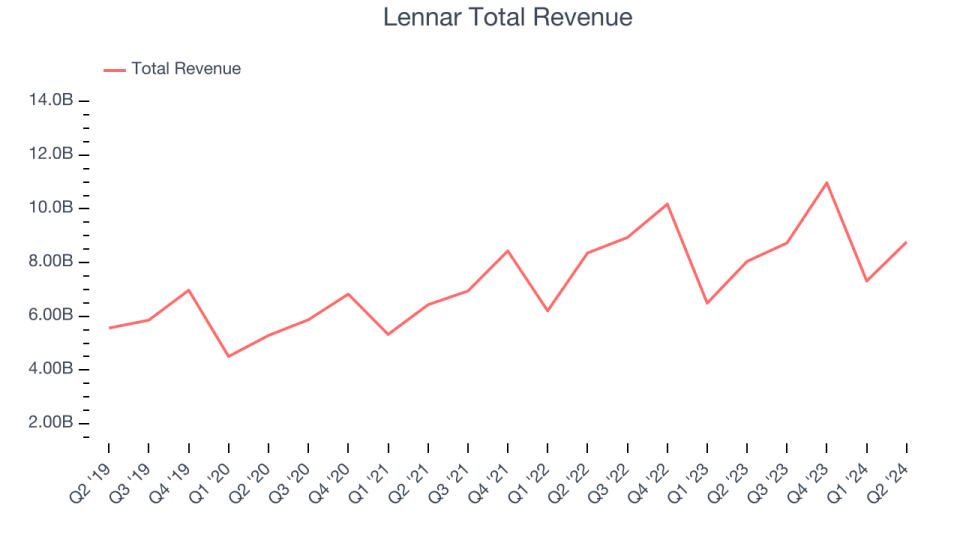

Lennar reported revenues of $8.77 billion, up 9% year on year, topping analysts' expectations by 2.5%. It was an ok quarter for the company, with a decent beat of analysts' earnings estimates but a miss of analysts' backlog sales estimates.

Stuart Miller, Executive Chairman and Co-Chief Executive Officer of Lennar, said, "We are pleased to report another strong quarter against the backdrop of evolving market conditions as interest rates rose for most of the quarter and then subsided as the quarter closed."

Lennar achieved the fastest revenue growth of the whole group. The stock is down 9.6% since the results and currently trades at $141.56.

Is now the time to buy Lennar? Access our full analysis of the earnings results here, it's free.

Best Q2: Apogee (NASDAQ:APOG)

Involved in the design of the Apple Store on Fifth Avenue in New York City, Apogee (NASDAQ:APOG) sells architectural products and services such as high-performance glass for commercial buildings.

Apogee reported revenues of $331.5 million, down 8.3% year on year, in line with analysts' expectations. It was an impressive quarter for the company. Apogee blew past analysts' EPS expectations this quarter, driven by a big operating margin outperformance versus Wall Street's estimates. In addition, the company raised full year EPS guidance to reflect the profit beat and ongoing margin strength.

The stock is up 2.3% since the results and currently trades at $60.49.

Is now the time to buy Apogee? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Worthington (NYSE:WOR)

Founded by a steel salesman, Worthington Enterprises (NYSE:WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

Worthington reported revenues of $318.8 million, down 13.6% year on year, falling short of analysts' expectations by 9.6%. It was a weak quarter for the company, with a miss of analysts' earnings and revenue estimates.

The stock is down 12.3% since the results and currently trades at $43.98.

Read our full analysis of Worthington's results here.

KB Home (NYSE:KBH)

The first homebuilder to be listed on the NYSE, KB Home (NYSE:KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

KB Home reported revenues of $1.71 billion, down 3.1% year on year, surpassing analysts' expectations by 3.4%. It was a very strong quarter for the company, with a solid beat of analysts' earnings estimates.

KB Home scored the biggest analyst estimates beat among its peers. The stock is down 1.6% since the results and currently trades at $66.98.

Read our full, actionable report on KB Home here, it's free.

Greenbrier (NYSE:GBX)

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE:GBX) supplies the freight rail transportation industry with railcars and related services.

Greenbrier reported revenues of $820.2 million, down 21% year on year, falling short of analysts' expectations by 10.9%. It was a slower quarter for the company, with a miss of analysts' earnings estimates and full-year revenue guidance missing analysts' expectations.

Greenbrier had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 9.4% since the results and currently trades at $44.

Read our full, actionable report on Greenbrier here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.