Industry Analysts Just Upgraded Their Autolus Therapeutics plc (NASDAQ:AUTL) Revenue Forecasts By -3.3%

Autolus Therapeutics plc (NASDAQ:AUTL) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts have sharply increased their revenue numbers, with a view that Autolus Therapeutics will make substantially more sales than they'd previously expected. The stock price has risen 5.6% to US$12.79 over the past week, suggesting investors are becoming more optimistic. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

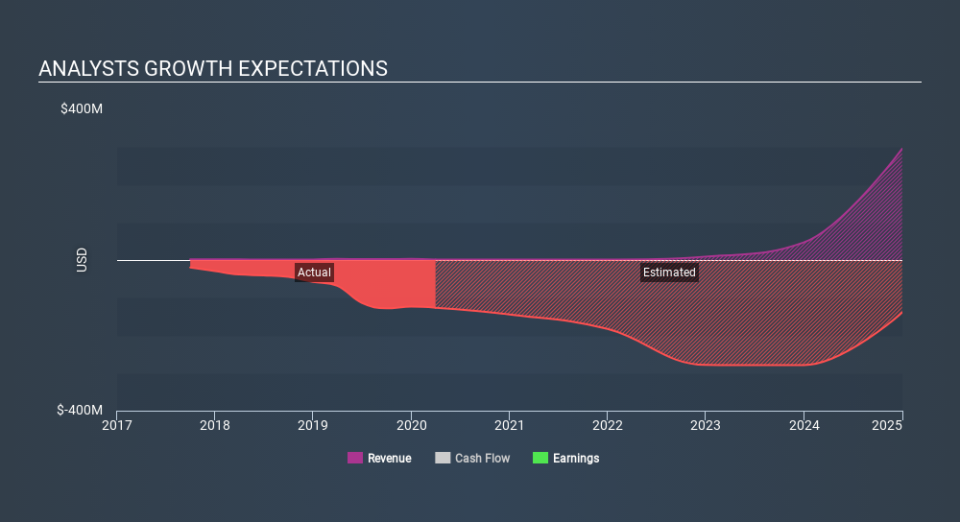

Following this upgrade, Autolus Therapeutics' seven analysts are forecasting 2020 revenues to be US$1.3m, approximately in line with the last 12 months. Before the latest update, the analysts were foreseeing US$1.3m of revenue in 2020. The forecasts seem less optimistic overall, with the slight decrease in revenue estimates in the latest consensus update.

See our latest analysis for Autolus Therapeutics

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing that stands out from these estimates is that shrinking revenues are expected to moderate from the historical decline of 57% per annum over the past year.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also anticipating slower revenue growth than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Autolus Therapeutics.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 5 potential warning signs with Autolus Therapeutics, including dilutive stock issuance over the past year. You can learn more, and discover the 4 other warning signs we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance