Infineon's (IFNNY) Q2 Earnings and Revenues Increase Y/Y

Infineon Technologies AG IFNNY reported second-quarter fiscal 2018 adjusted earnings of 32 cents per share, representing a year-over-year increase of 44.4%.

Revenues increased 3.4% year over year to $2.26 billion in the quarter. Strength in two of the company’s four business segments, namely, Automotive (“ATV”) and Industrial Power Control (“IPC”) drove year-over-year growth.

Infineon Technologies AG Revenue (TTM)

Infineon Technologies AG Revenue (TTM) | Infineon Technologies AG Quote

Segmental Highlights

ATV revenues (48% of total revenues) increased 12.5% year over year to $1.08 billion and noted persistent strong demand for driver assistance systems and electric drive train during the quarter.

IPC revenues (17.3% of total revenues) advanced 8.2% year over year to $389.6 million. The segment is benefiting from strong demand in home appliances. Products used in electric drives, trains and wind power plants witnessed traction. However, sales of photovoltaic applications were flat year over year.

Power Management & Multimarket or PMM (29.6% of total revenues) revenues increased 4.4% on a year-over-year basis to $667.3 million. Strong demand in DC/DC conversion was noticeable in the quarter. The major part of RF power amplifier business, which was divested to Cree negatively impacted the segment. AC/DC conversion products reported a sequential decline. Moreover, the Smartphone component business subsided due to anticipated seasonality.

However, Chip Card & Security or CCS (8.9% of total revenues) revenues declined 3% from the year-ago quarter to $201.5 million. Embedded SIM, government ID, and authentication supported the segment, while SIM cards and payment cards revenues witnessed a decline.

Operational Details

Research & Development (“R&D”) as a percentage of revenues increased 10 basis points (“bps”), while Selling, General & Administrative (“SG&A”) expenses decreased 30 bps on a year-over-year basis.

Moreover, the company recorded a huge amount of (Euro 280 million or $344.1 million) other operating income during the quarter. This led to a massive jump in operating margin which reached to 29% from 12.9% reported in the year-ago quarter.

Balance Sheet & Cash Flow

Infineon ended the second quarter with $892.2 million in cash & cash equivalents and short-term investments down from $1.06 billion reported in the previous quarter.

Total debt outstanding was $1.805 billion down from $1.835 billion in the previous quarter.

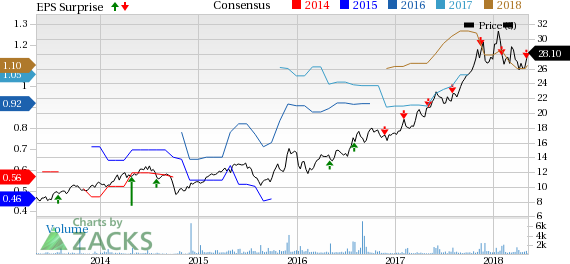

Infineon Technologies AG Price, Consensus and EPS Surprise

Infineon Technologies AG Price, Consensus and EPS Surprise | Infineon Technologies AG Quote

Guidance

For fiscal 2018, revenues are revised to grow almost 4-7% year-over-year. Segment margins are projected to come in at 17% of the mid-point of revenue guidance range.

ATV segment revenues are expected to grow above the group’s average revenue growth rate. IPC revenues are anticipated to have a similar growth rate of group’s average. PMM revenues are projected to grow below the company’s growth average. However, CCS revenues are expected to decline in lieu of difficult market situation and depreciation of US Dollar.

Third-quarter fiscal 2018 revenues are expected to increase 3% (+/- 2%) year over year. At the mid-point of revenue guidance, the segment margin is expected to come in at 17%.

Zacks Rank & Stocks to Consider

Infineon carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector worth considering are Western Digital Corporation WDC, Mellanox Technologies, Ltd. MLNX and Micron Technology, Inc. MU, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Western Digital, Mellanox and Micron are projected at 19%, 15% and 10%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Infineon Technologies AG (IFNNY) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance