Infosys (INFY) Q1 Earnings Miss, Revenues Beat Estimates

Infosys INFY reported first-quarter fiscal 2023 earnings of 16 cents per share, missing the Zacks Consensus Estimate of 18 cents per share by 11%. The company’s bottom line declined 1% on a year-over-year basis.

Infosys’ fiscal first-quarter revenues increased 17.5% to $4.44 billion year over year, surpassing the Zacks Consensus Estimate of $4.38 billion. In terms of constant currency (cc), the metric was up 21.4%.

Infosys continued to fortify its industry-leading digital capabilities amid a highly volatile economic scenario. The company witnessed solid traction for its CobaltTM cloud portfolio and other diversified digital solutions through the quarter. Large deal wins and market share expansion, driven by the accelerated digital transformation trend worldwide, remained key catalysts for the company’s growth.

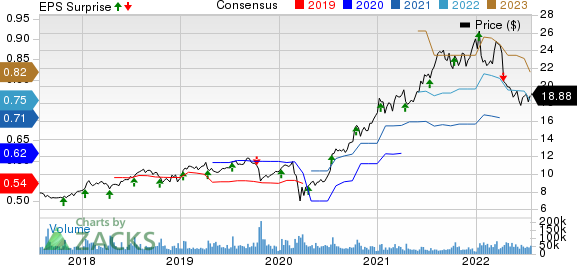

Infosys Limited Price, Consensus and EPS Surprise

Infosys Limited price-consensus-eps-surprise-chart | Infosys Limited Quote

Top-line Details

Digital Revenues (61% of the total) climbed 32.8% year over year (37.5% at cc) to $2.71 billion, while Core Revenues (39%) declined by 0.5% (up 2.4% at cc) to $1.73 billion.

Revenues across India, North America, Europe and the Rest of the World regions recorded year-over-year increases of 2%, 17.8%, 21.9% and 10.5%, respectively, on a reported basis. On a cc basis, India, North America, Europe and the Rest of the World registered growth of 5.8%, 18.4%, 33.2% and 17.8%, respectively.

Segment-wise, Manufacturing registered the highest growth of 46.5%. Life Sciences, Financial Services, Communication and Retail jumped 13.5%, 9%, 24.7% and 14%, respectively. The Energy, Utilities, Resources & Services and Hi-Tech divisions recorded year-over-year revenues of 20.2% and 15.8%, respectively. Sales at the Others business segment increased by 8.1%.

Infosys added 106 clients during the fiscal first quarter. It signed multiple large deals of a contract value worth $1.7 billion.

The company reported that its clients, worth more than $100 million, now add up to 38, up from the year-ago quarter’s 34 but remained flat with the previous quarter.

Other Financial Details

Gross profit climbed 2.1% year over year to $1.30 billion. However, the gross margin contracted by 440 basis points (bps) on a year-over-year basis to 29.3%.

The company’s operating income decreased 0.8% year over year to $888 million. The operating margin declined by 370 bps to 20% year over year.

Infosys ended the fiscal first quarter with cash and cash equivalents of $1.78 billion, down from $2.31 billion recorded at the end of the fourth quarter of fiscal 2022.

During the first quarter, the company’s free cash flow was $656 million.

Raised Outlook

For fiscal 2023, INFYnow expects annual revenues to grow between 14% and 16% year over year at cc compared with the previous estimate of 13% and 15% year over year at cc. However, the company still expects the operating margin to be in the 21-23% range for the full fiscal.

Zacks Rank & Stocks to Consider

Infosys currently carries a Zacks Rank #3 (Hold). Shares of INFY have plunged 13.1% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Axcelis Technologies ACLS, Keysight Technologies KEYS and Baidu BIDU, each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today's Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Axcelis' second-quarter 2022 earnings has been revised 6 cents northward to $1.00 per share over the past 90 days. For 2022, earnings estimates have moved a penny north to $4.38 per share in the past 30 days.

Axcelis' earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 23.5%. Shares of ACLS have soared 71.1% in the past year.

The Zacks Consensus Estimate for Keysight's third-quarter fiscal 2022 earnings has been revised upward by a penny to $1.79 per share over the past 30 days. For 2023, earnings estimates have moved 3 cents north to $7.17 per share in the past 30 days.

Keysight’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 8%. Shares of KEYS have fallen 5.9% in the past year.

The Zacks Consensus Estimate for Baidu's second-quarter 2022 earnings has been revised 4 cents upward to $1.63 per share over the past seven days. For 2022, earnings estimates have moved 3 cents north to $7.88 per share in the past seven days.

Baidu's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 52.9%. Shares of BIDU have decreased 13.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Infosys Limited (INFY) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance