Our infrastructure trusts have taken a pounding but now is a time to buy, not sell

We described in last Friday’s column how widening discounts on investment trusts over the past couple of years had done severe damage to the performance of our Wealth Preserver portfolio and it is a similar story when it comes to the infrastructure trusts tipped here in the past.

For example, the Bluefield Solar Income was tipped here in October 2021 at a small premium to the value of its net assets but now trades at a discount of 18pc.

While the net asset value (NAV) has risen nicely, the increase is not enough to overcome the change in the discount and as a result we have lost 7.4pc in share price terms.

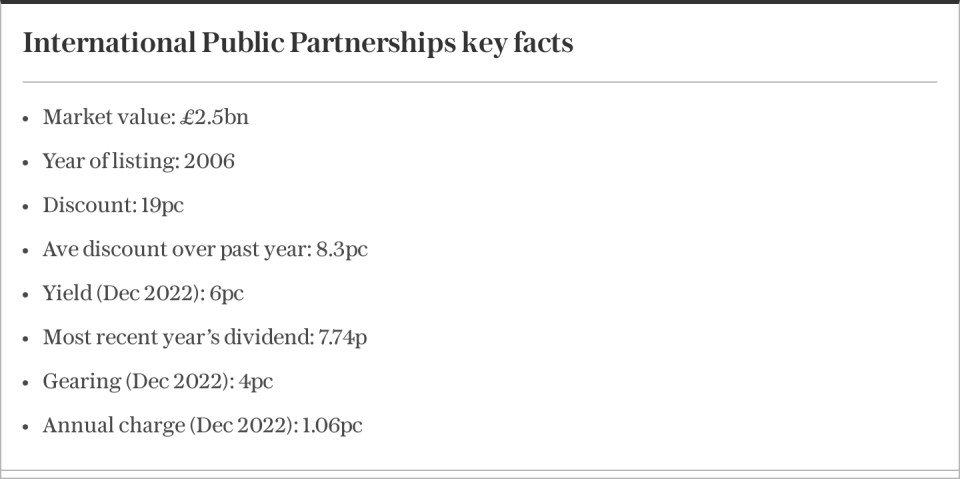

International Public Partnerships likewise traded at a double-digit premium when we advised readers to buy it in May last year. There is now a discount of 19pc and again the rise in the NAV over the period has not been enough to avoid a fall in the share price, in this case of 22.8pc.

In fact, the average infrastructure trust on which our rating is buy or hold has suffered a share price fall of 13pc since first tipped.

We can curse ourselves for having broken our normal rule to invest in trusts only at a discount but it will be more useful to consider our best course of action now. We need to look at what is behind the steep discounts and decide whether they are likely to prove temporary or lasting.

As is the case with almost any asset you could name, the underlying reason for these big changes has been the return of high inflation and interest rates.

When both were close to zero, any asset that paid a decent income was in demand, especially when, as is the case with these trusts, there was the chance of income growth too.

Now that you can get a risk-free return on cash savings of more than 6pc, and not much less on government bonds or gilts, there is a great deal more competition for investors’ money.

In fact, some of the money now in cash will have been taken out of riskier investments such as these infrastructure trusts and as a result their share prices have suffered, no matter if their net asset values have held up or even increased. Big discounts are the result.

All this is entirely logical.

But perhaps those investors who sold infrastructure trusts – which yielded, let’s say, 5pc, but as quoted companies naturally came with risks – and put the money into cash accounts were overlooking one thing.

The income you’ll get on cash is unlikely to rise from one year to the next, at least if we assume that this series of interest rate rises is nearing its end.

Bonds pay a fixed return. Infrastructure investment trusts, by contrast, have the scope to increase their dividends, and indeed have been doing so, not least because the income they themselves receive on their assets tends to be linked to inflation.

It is the scope for growth in their income, as well as the secure nature of their income streams, which often derive from governments, that make these trusts stand out.

“The investment case for the listed infrastructure sector remains predicated on access to high-quality, predictable long-term total returns including a healthy, growing dividend yield – with most funds reporting robust dividend cover – and with relatively low NAV volatility, compared with other asset classes,” says Colette Ord, an investment trust analyst at Numis, the broker.

And she offers a reassuring perspective on discounts.

“Since the birth of the sector in 2006, incorporating periods of both high and low interest rates and inflation as well as periods of political instability, there has been only one period when double-digit discounts have persisted: between October 2008 and June 2009, when the average discount was 14.7pc.

“When deep discounts have appeared, history has shown it to be an attractive entry point, and we believe it will again. The average rating for the peer group since 2006 is a premium of 5.2pc.

“Discounts appeared across the listed infrastructure peer group in the fourth quarter of 2022 and have persisted and widened throughout this year to an average of 18.8pc currently. This largely reflects investor concern around the impact of rising interest rates.”

We advise readers to hold on to their infrastructure trusts. For new money, our pick would be International Public Partnerships.

Questor says: buy

Ticker: INPP

Share price at close: 128.8p

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance