Innospec Inc. (IOSP) Q1 2024 Earnings: Surpasses EPS Estimates with Strong Performance ...

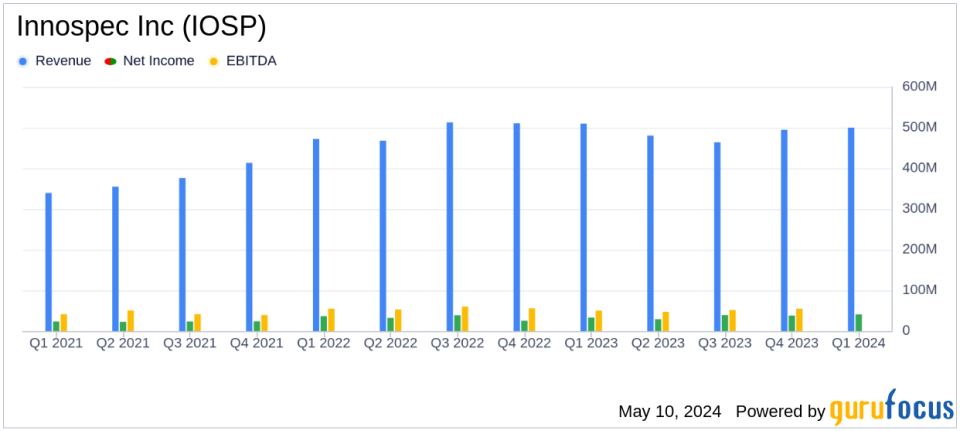

Revenue: Reported at $500.2 million, a slight decrease of 2% year-over-year, falling short of estimates of $504.13 million.

Net Income: Achieved $41.4 million, up from $33.2 million in the prior year, exceeding estimates of $40.90 million.

Earnings Per Share (EPS): GAAP EPS was $1.65, surpassing exceeding the estimated $1.64, with adjusted non-GAAP EPS at $1.75.

Cash Flow: Operating activities generated $80.6 million in cash, significantly higher compared to $21.8 million in the previous year.

Dividend: Increased by 10%, with a semi-annual dividend declared at 76 cents per common share.

Net Cash Position: Improved to $270.1 million, up from $203.7 million at the end of the previous period.

Debt Status: Maintains a strong debt-free balance sheet, enhancing financial flexibility for future opportunities.

Innospec Inc. (NASDAQ:IOSP) disclosed its financial outcomes for the first quarter of 2024 on May 9, 2024, revealing a robust start to the year with notable growth in operating income and earnings per share (EPS). The detailed financial results are available in the company's recent 8-K filing.

Innospec, a global specialty chemicals company, operates through three primary segments: Fuel Specialties, Performance Chemicals, and Oilfield Services. Each segment contributes uniquely to the firm's overall success, leveraging specialized products ranging from fuel additives that enhance efficiency and performance to chemicals used in personal care products.

Financial Highlights and Segment Performance

For Q1 2024, Innospec reported revenues of $500.2 million, a slight decrease from $509.6 million in the previous year. However, the company saw a significant increase in net income to $41.4 million, or $1.65 per diluted share, up from $33.2 million, or $1.33 per diluted share in Q1 2023. Notably, adjusted non-GAAP EPS was $1.75, surpassing the analyst estimate of $1.64 and reflecting a robust improvement from $1.38 a year ago.

The Performance Chemicals segment was particularly strong, with operating income more than doubling due to higher sales and improved gross margins. This segment reported a 6% increase in revenue to $160.8 million. Fuel Specialties and Oilfield Services also demonstrated resilience, though with mixed results in revenue performance.

Operational and Strategic Developments

Operational cash flow was impressive at $80.6 million, significantly higher than the $21.8 million recorded in the same quarter last year. The company ended the quarter with a strong cash position of $270.1 million, up from $203.7 million at the end of 2023, indicating robust financial health and strategic financial management.

President and CEO Patrick S. Williams highlighted the strategic acquisitions and operational efficiencies driving the quarter's success. The recent acquisition of QGP Quimica Geral S.A. is performing well and aligns with Innospec's growth strategies in the specialty chemicals sector.

Challenges and Market Conditions

Despite the positive outcomes, the company faces challenges such as fluctuating market demands and the need to continuously innovate in a competitive landscape. The disciplined order patterns from customers and potential volatility in global markets could impact future performance. However, the company's strong financial position provides a cushion against potential downturns and facilitates continued investment in growth and innovation.

Conclusion and Outlook

Innospec's first-quarter results demonstrate a solid start to 2024, underscored by strategic expansions and strong segment performance. With a focus on technological advancements and market expansion, Innospec is well-positioned to maintain its growth trajectory and continue delivering value to its shareholders, evidenced by a 10% increase in its semi-annual dividend.

The company's proactive management and diversified business model enable it to navigate market uncertainties while capitalizing on growth opportunities. As Innospec continues to execute its business strategies effectively, it remains a notable player in the specialty chemicals industry, poised for further success in 2024.

Explore the complete 8-K earnings release (here) from Innospec Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance