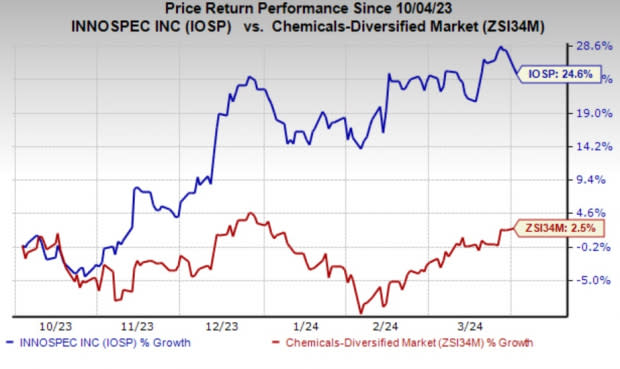

Innospec (IOSP) Shares Rally 25% in 6 Months: What's Driving It?

Innospec Inc.’s IOSP shares have gained 24.6% in the past six months. The company also outperformed the industry’s rise of 2.5% over the same time frame. It has also topped the S&P 500’s nearly 22.6% rise over the same period.

Image Source: Zacks Investment Research

Let’s take a look at the factors behind the stock’s price appreciation.

What’s Driving Innospec?

Innospec, currently carrying Zacks rank #2 (Buy), is reaping significant rewards from its robust Oilfield Services division and strategic expansion efforts. The company is dedicated to advancing technology and bolstering margins to foster organic growth across its diverse business spectrum.

In the fourth quarter, Innospec saw its adjusted earnings per share jump to $1.84 from $1.20 per share a year earlier, surpassing the Zacks Consensus Estimate of $1.59. Despite a 3% drop in revenues to $494.7 million from the previous year’s levels, the company exceeded the Zacks Consensus Estimate of $474 million. The Oilfield Services unit sustained strong performance, while the Performance Chemicals and Fuel Specialties segments saw double-digit growth in operating income and margin expansion.

The recent acquisition of QGP Quimica Geral in Brazil is expanding Innospec's global footprint and strengthening its manufacturing capabilities and customer service in South America. QGP's specialization in specialty chemistries, particularly in burgeoning sectors like Agriculture, complements Innospec's existing portfolio. This acquisition aligns with Innospec's mergers and acquisitions strategy, enhancing the Performance Chemicals segment and establishing a manufacturing presence in South America. Innospec underlined its debt-free balance sheet post-acquisition, positioning itself for future M&A activities, shareholder returns and strategic organic growth investments.

Despite anticipated economic headwinds in 2024, Innospec remains optimistic. The company emphasized its expanding pipeline of technology-driven organic opportunities and the integration of the QGP acquisition as pivotal drivers of growth. Investment in expanding capacity is anticipated to unlock further growth avenues, with new contracts in personal care propelling the Performance Chemicals division forward and technological advancements benefiting the Fuel Specialties unit.

Innospec Inc. Price and Consensus

Innospec Inc. price-consensus-chart | Innospec Inc. Quote

Stocks to Consider

Some other top-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, Denison Mines Corp. DNN and Ecolab Inc. ECL, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $4 per share, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate for earnings in each of the last four quarters, with the average surprise being 12.2%. The company’s shares have increased 59.4% in the past year.

Denison Mines carries a Zacks Rank #1. DNN beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 300%. The company’s shares have soared roughly 105.8% in the past year.

Ecolab has a projected earnings growth rate of 22.65% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 5.4% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 37% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance