Inside IBM's Zurich lab, where scientists are creating technology that could break the bank

Deep in the bowels of a Swiss laboratory lies a machine that promises to transform the world of banking.

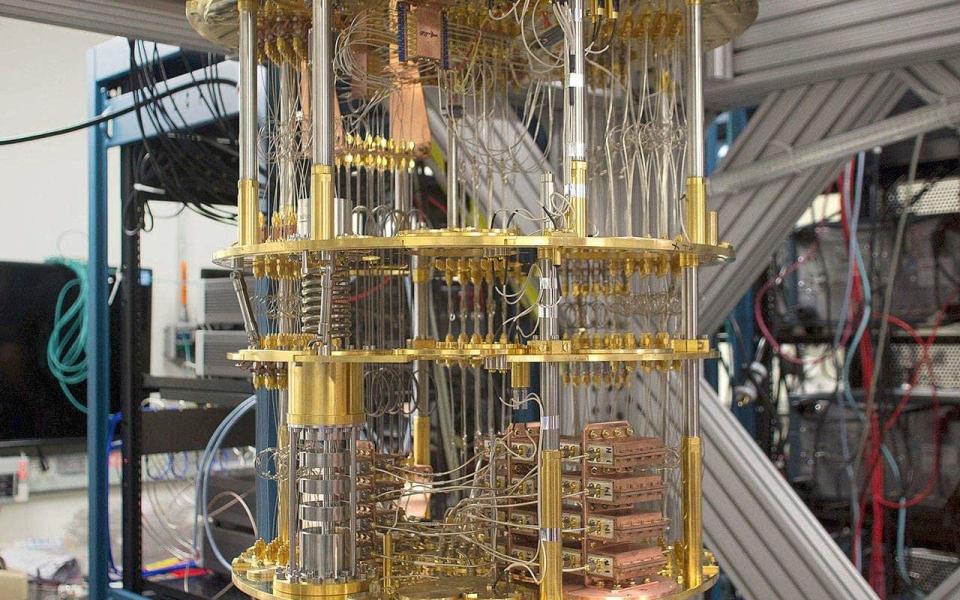

In the basement of a low-rise building overlooking Lake Zurich and through a door accessible to only a select few, IBM is building a device that can unlock even the most sophisticated forms of modern computer security.

Step inside and the first thing you notice is the noise: constant, clamouring, whirring. It emanates from two white canister-shaped refrigeration units, where tiny copper wiring and chips that can fit in the palm of a hand are cooled to temperatures lower than in outer space.

Standing just a few centimetres away from them, the heat inside the room - like the back of a fridge at home - is palpable.

“Don’t touch anything,” an IBM scientist warns. Even if I wanted to, that would be difficult. The machinery is surrounded by a two and a half metre metal cage, and sealed off with neon yellow “warning” tape.

The quantum computers being developed here in Zurich, one of the world’s oldest financial centres, are master code breakers, able to solve problems and crack codes in hours that traditional computers would take thousands of years to work out.

That makes them potentially incredibly valuable and explains why the world’s biggest banks, most of which have operations just a short distance away, are taking a keen interest in the work underway here. Barclays and JP Morgan Chase are among a cohort of businesses to have started testing out IBM’s quantum technology this year.

For now, the technology remains temperamental. But in the next ten to 20 years, experts believe that the power of quantum computers will leave the lab and enter the world of business and finance - with huge ramifications.

If this technology falls into the wrong hands, the systems that control the movement of money would no longer be secure. Bank transfers could be intercepted and accounts emptied, causing chaos. Advanced new technologies like blockchain could be made obsolete. When unleashed, this technology could trigger financial chaos.

As the quantum threat goes from science fiction to reality, IBM experts say companies - including banks - are running out of time to change their systems in time to survive the jump. In order to protect data in future, they have to start changing their systems now, says Dr Vadim Lyubashevsky, cryptographer at IBM Research.

“The window is getting smaller for introducing cryptography that is not quantum resistant,” he says.

“Even though we don’t have quantum computers yet, we still need to do something today. If someone predicts that they will have a quantum computer 20 years from now and they think your data is interesting enough [..] they will just record your data. They will store it and then decrypt it when they have a quantum computer.”

Alongside the competition to produce quantum computers, there is another unseen race underway - between companies vying to produce the technologies to protect banks from them.

In the old days, Zurich’s bank vaults were precision engineered by Swiss manufacturers.

These days it is companies like BT, Toshiba, MagiQ Technologies and Raytheon who are among the companies investing in strengthening cryptography, the coding behind any online interaction which offers protection for customers’ cash. And so is IBM.

While scientists work in one IBM lab to improve quantum computers, others are working on quantum-safe cryptography to protect companies from them.

The main problem for banks is that the timeline for a quantum reality is unknown.

“Some says it is three to five years away,” says Lee Braine, chief technology officer at Barclays Investment Bank. “If you look at [the National Institute of Standards and Technology] in the US, they have a view that financial institutions should start planning ahead assuming over 10 years for a quantum computer that is powerful enough to crack cryptography.”

Barclays is “getting up to speed” with the threat and the opportunity of quantum computing, Braine says.

“At the moment we are just experimenting,” he says. “We are trying different algorithms which represent complex problems. We are constructing quantum algorithms and running them through a simulator.”

Outside of the internal workings of a financial institution’s systems, a huge problem is online bank transfers - which could be intercepted or blocked through users’ online connection.

Enter BT, one of the biggest players in internet infrastructure in the UK. The company got involved in post-quantum cryptography a year ago because of concerns that quantum computing was “hanging over” them, according to Professor Andrew Lloyd, a senior consultant at the company.

“We have always been concerned that quantum computing could crack RSA, the public private key code that underpins a lot of security worldwide,” he says.

“We need to be ready. We need to make sure that data that we are protecting at the moment stays protected and stays encrypted should a quantum computer come along in the next five years or so.”

The UK telecoms giant is exploring quantum key distribution, which would allow computers to share information with each other by using a random, secret key that quantum computers could not steal.

“The physics of making single photons, detecting them and making them secure has already been done,” Lloyd says. “The next thing is to make an engineering solution that is completely watertight. Then the second phase is that when you implement it you haven’t let in any loopholes.”

Experts cite the financial services sector as one of the savviest when it comes to quantum technology awareness.

“Banking and finance is the most advanced because of the need for security,” says Rhys Lewis, director of the Quantum Metrology Institute, part of the National Physics Laboratory.

“There needs to be a Government-led development of solutions in the UK, the US and many other places as well.”

The UK has thus far been on the front foot when it comes to quantum computing. With £235m of investment from the Government to develop this technology, the hope is to produce the first ever commercial quantum computer first. Also in the running are Switzerland, Germany, the US and China.

UK university quantum projects have achieved significant breakthroughs using quantum technology in the last two weeks.

The University of Sussex’s lab found a way to work on quantum computers outside of the refrigeration canisters by using microwave technology similar to mobile phones. Imperial College London and MC Squared have created a quantum-powered ultra-accurate GPS system that can find the positioning of objects anywhere in the world without incoming or outgoing signals.

Meanwhile, IBM’s quantum scientists work to increase the life expectancy of the “qubits” that power their quantum computers, which currently last only 100 microseconds before it has to be reset and restarted.

“It sounds like it’s a small number but it’s only one part of the story,” one scientist says. “What counts is the calculation that you can make in that time. You can do 500 to 1,000 operations before the qubit loses its lifetime.”

If they succeed, it will be another giant leap in the Quantum game. The challenge for IBM’s cryptographers is to beat them.

Yahoo Finance

Yahoo Finance