Insider Buying Alert: EVP & GENERAL COUNSEL Scott Lerner Acquires Shares of B&G Foods ...

On May 13, 2024, Scott Lerner, EVP & GENERAL COUNSEL of B&G Foods Inc (NYSE:BGS), purchased 11,755 shares of the company, as reported in the SEC Filing. This transaction indicates a positive sentiment from the insider towards the company's future prospects.

B&G Foods Inc, known for its portfolio of shelf-stable and frozen foods, aims to provide high-quality products across the United States, Canada, and Puerto Rico. The company's brands include a variety of well-known names in the food industry, ensuring a stable presence in the market.

Over the past year, the insider has consistently shown confidence in B&G Foods Inc, purchasing a total of 11,755 shares and not selling any. This pattern of insider activity can often provide insights into the company's health and future performance.

The recent purchase by the insider was made when shares were priced at $8.51, valuing the transaction at approximately $100,035.05. Following this transaction, B&G Foods Inc's market cap stands at $675.094 million.

According to the GF Value, the intrinsic value of B&G Foods Inc is estimated at $13.36 per share, suggesting that the stock is currently undervalued with a price-to-GF-Value ratio of 0.64. This valuation indicates that the stock might be a Possible Value Trap, and potential investors should think twice.

The GF Value is calculated considering historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted for the company's past performance and expected future business outcomes.

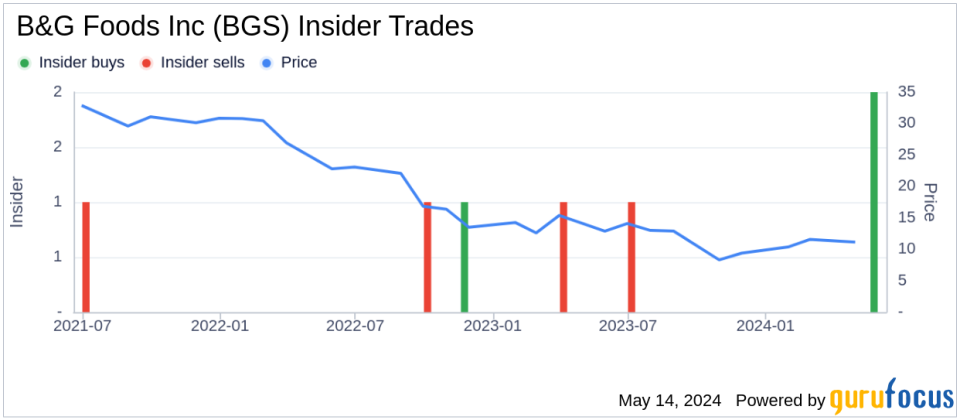

The insider transaction history for B&G Foods Inc shows a trend of more insider buying than selling over the past year, with 2 insider buys and 1 insider sell. This could be interpreted as a positive signal about the company's internal expectations.

Investors and stakeholders in B&G Foods Inc may find these insider transactions and valuation metrics useful for making informed decisions regarding their investment in the company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance