Insider Buying: Uranium Energy Corp President and CEO Amir Adnani Acquires 60,000 Shares

On September 6, 2024, Amir Adnani, President and CEO of Uranium Energy Corp (UEC), purchased 60,000 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns 4,242,326 shares of Uranium Energy Corp.

Uranium Energy Corp is engaged in uranium mining and related activities, including exploration, pre-extraction, extraction, and processing of uranium concentrates. The company operates in the United States, with a focus on projects located in regions known for significant uranium mining activities.

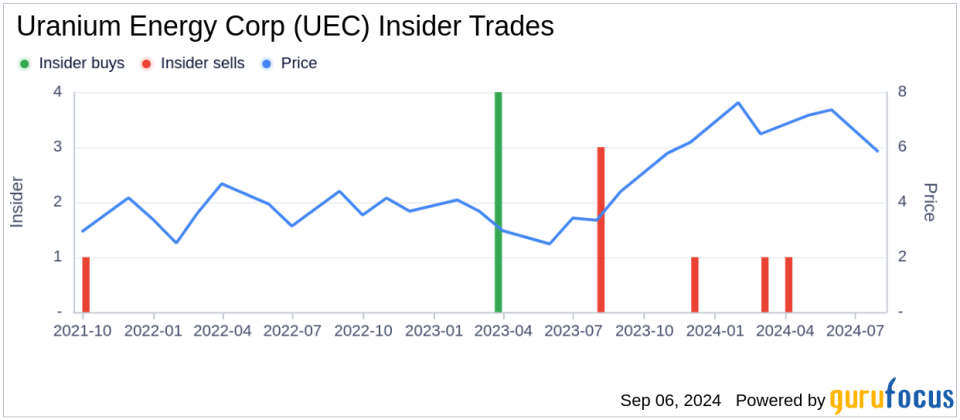

The purchase occurred at a price of $4.1 per share, valuing the transaction at $246,000. This acquisition has contributed to a total of two insider buys over the past year, compared to three insider sells during the same period.

The current market cap of Uranium Energy Corp stands at approximately $1.74 billion. The stock's valuation metrics, including price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, are accessible for further details on the company's financial health and stock valuation.

The insider's recent purchase aligns with the overall trend of insider transactions at Uranium Energy Corp, as depicted in the following insider trend image:

For more detailed information on the insider's historical transactions and the company's financial metrics, refer to the GF Value of the stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.