Insider-Owned UK Growth Companies To Watch In May 2024

As London markets open with optimism, driven by low valuations that spur momentum, the UK's financial landscape remains a focal point for investors. Amidst this backdrop, companies with high insider ownership stand out as particularly intriguing, suggesting a deep-rooted confidence from those closest to the business operations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 54.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

LSL Property Services (LSE:LSL) | 10.6% | 33.3% |

Plant Health Care (AIM:PHC) | 19.7% | 94.4% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Here's a peek at a few of the choices from the screener.

Equals Group

Simply Wall St Growth Rating: ★★★★☆☆

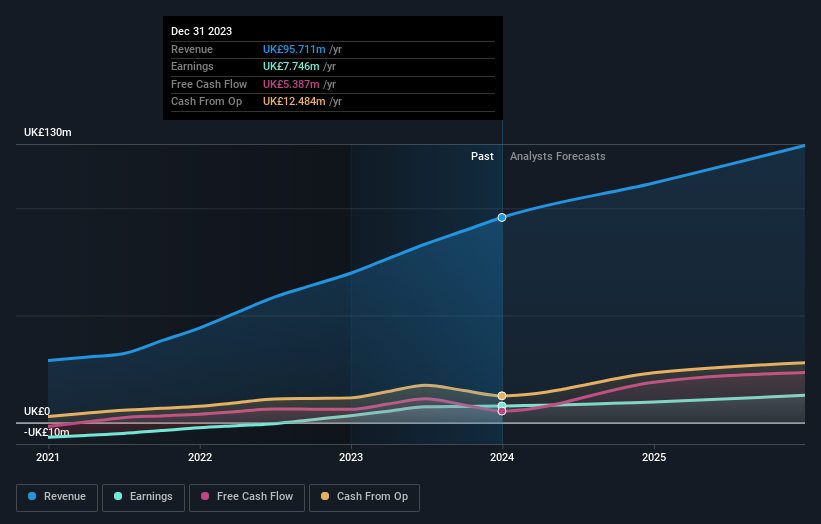

Overview: Equals Group plc operates in the United Kingdom, offering payment processing and banking services such as prepaid currency cards, travel cash, international money transfers, and current accounts to private clients and corporations. The company has a market cap of approximately £234.24 million.

Operations: Equals Group's revenue segments include £39.27 million from international payments, £30.97 million from solutions, £15.23 million from currency cards, £8.35 million from banking services, and smaller amounts from travel cash and European operations.

Insider Ownership: 10.1%

Equals Group has demonstrated robust growth with earnings increasing by 139.3% last year, and forecasts suggest a continuation with an expected 24.71% annual growth rate. Revenue is also on an upward trajectory, growing at 15% annually, surpassing the UK market average of 3.7%. Insider activity bolsters confidence as more shares were bought than sold by insiders recently, indicating strong internal belief in the company's strategy and future performance despite some shareholder dilution over the past year.

Delve into the full analysis future growth report here for a deeper understanding of Equals Group.

Our valuation report here indicates Equals Group may be overvalued.

Foresight Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

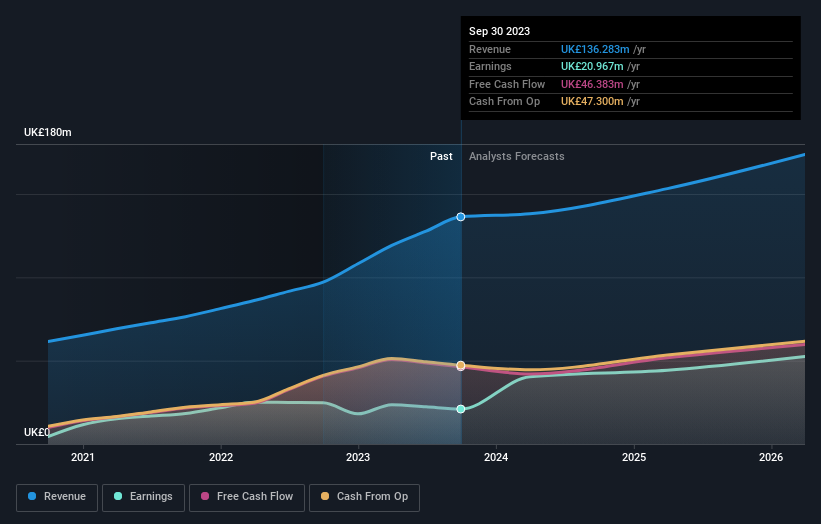

Overview: Foresight Group Holdings Limited is a global infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £0.53 billion.

Operations: The company generates revenue through three primary segments: Infrastructure (£85.68 million), Private Equity (£39.28 million), and Foresight Capital Management (£11.33 million).

Insider Ownership: 31.7%

Foresight Group Holdings is poised for significant growth with earnings expected to increase by 28.86% annually over the next three years, outpacing the UK market's 12.8%. Despite a high forecasted return on equity of 41.5%, its dividend coverage is weak, and revenue growth projections are moderate at 10% annually, slightly above the UK market average of 3.7%. The stock is currently trading at a substantial discount of 39.2% below its estimated fair value, suggesting potential upside according to analysts' targets.

LSL Property Services

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the UK, offering business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders, with a market cap of approximately £313.07 million.

Operations: LSL Property Services generates revenue through three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency excluding Financial Services (£24.89 million).

Insider Ownership: 10.6%

LSL Property Services is set to experience robust earnings growth, projected at 33.3% annually over the next three years, significantly outpacing the UK market average. Despite a high forecasted return on equity of 25.4%, challenges persist with its dividend coverage, which is under pressure from both earnings and cash flow constraints. The stock trades at a considerable discount of 49.5% below estimated fair value, indicating potential for appreciation. Recent strategic board changes and a £7 million share buyback program could further influence performance and investor sentiment.

Turning Ideas Into Actions

Explore the 61 names from our Fast Growing UK Companies With High Insider Ownership screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:EQLS LSE:FSG and LSE:LSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance