Insider Sell: EVP & Chief People Officer Deeanne King Sells 24,328 Shares of T-Mobile US ...

In a notable insider transaction, Deeanne King, the Executive Vice President & Chief People Officer of T-Mobile US Inc (NASDAQ:TMUS), sold 24,328 shares of the company on December 15, 2023. This move has caught the attention of investors and market analysts, as insider trades can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Deeanne King?

Deeanne King serves as the EVP & Chief People Officer at T-Mobile US Inc, a leading telecommunications company. In her role, King is responsible for overseeing the company's human resources strategies, including talent management, leadership development, and employee experience. Her position places her at the heart of the company's operations, making her trading activities particularly noteworthy for investors.

T-Mobile US Inc's Business Description

T-Mobile US Inc is a major player in the telecommunications industry, providing wireless voice and data services in the United States. The company is known for its innovative approach to customer service and marketing, as well as its competitive pricing strategies. T-Mobile has been a driving force behind the industry's shift towards more customer-friendly policies and has recently completed a significant merger with Sprint Corporation, further solidifying its position in the market.

Analysis of Insider Buy/Sell and Relationship with Stock Price

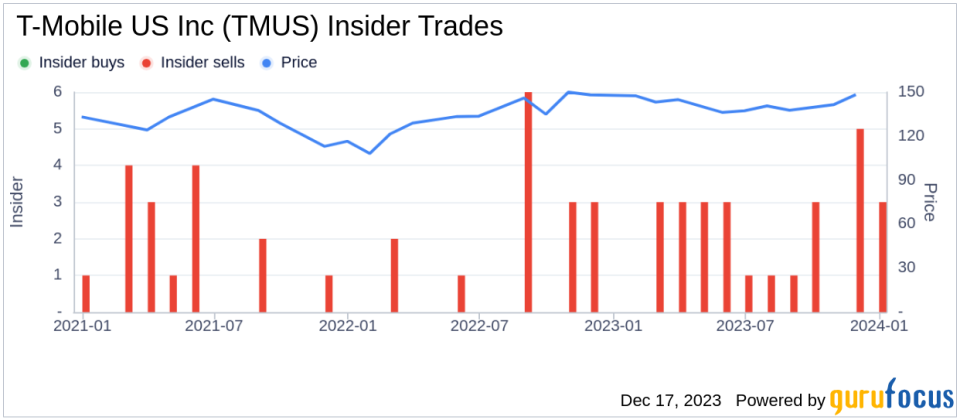

Insider transactions can be a valuable indicator of a company's health and future performance. When insiders sell shares, it can sometimes signal a lack of confidence in the company's future prospects or that the insiders believe the stock is overvalued. However, it's important to consider the context of the sale, as insiders may sell shares for personal reasons unrelated to their outlook on the company.In the case of Deeanne King's recent sale of 24,328 shares, it is part of a broader pattern of insider selling at T-Mobile US Inc. Over the past year, King has sold a total of 37,550 shares and has not made any purchases. This trend is consistent with the overall insider transaction history for T-Mobile, which shows 26 insider sells and no insider buys over the same timeframe.

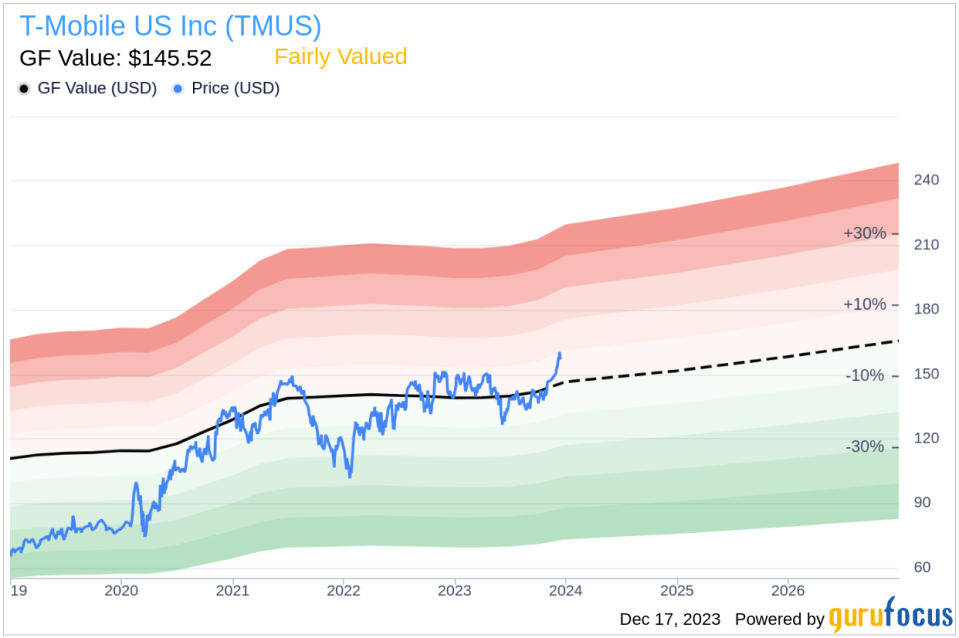

The relationship between insider selling and the stock price of T-Mobile US Inc is not straightforward. While the company's stock was trading at $158.43 on the day of King's recent sale, giving it a market cap of $180.583 billion, this price is within the range of what could be considered fair value based on the company's GF Value.

Valuation and GF Value Analysis

The price-earnings ratio of T-Mobile US Inc stands at 24.25, which is higher than the industry median of 16.35 but lower than the company's historical median price-earnings ratio. This suggests that the stock is priced higher than many of its peers but is not necessarily overvalued based on its own historical standards.With a trading price of $158.43 and a GuruFocus Value of $145.52, T-Mobile US Inc has a price-to-GF-Value ratio of 1.09. According to GuruFocus, this indicates that the stock is Fairly Valued.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation suggests that T-Mobile's stock price is in line with its intrinsic value, despite the recent insider selling activity.

Conclusion

The recent sale of shares by EVP & Chief People Officer Deeanne King may raise questions among T-Mobile US Inc's investors. However, when considering the company's valuation metrics and the GF Value, the stock appears to be fairly valued. Investors should weigh insider selling as one of many factors in their investment decisions and consider the broader context of the company's performance and market position.As always, it's important for investors to conduct their own due diligence and consider multiple sources of information when evaluating the potential impact of insider transactions on their investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance