Insider Srinivas Tallapragada Sells Shares of Salesforce Inc (CRM)

Srinivas Tallapragada, President and Chief Engineering Officer of Salesforce Inc (NYSE:CRM), sold 942 shares of the company on March 25, 2024, according to a recent SEC Filing. The transaction was executed at an average price of $305.46 per share, resulting in a total value of $287,743.32.

Salesforce Inc (NYSE:CRM) is a global leader in customer relationship management (NYSE:CRM) technology that brings companies and customers together. It is the provider of its namesake solution, Salesforce, which includes a suite of enterprise applications focused on customer service, marketing automation, analytics, and application development.

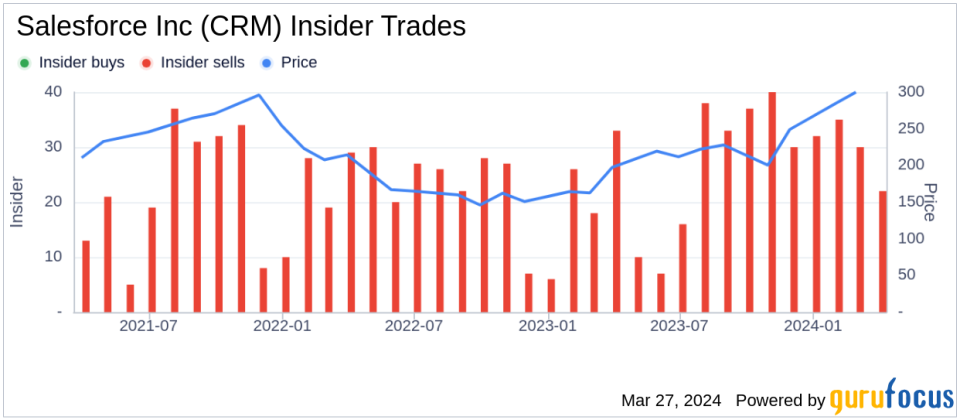

Over the past year, the insider has sold a total of 411,723 shares of Salesforce Inc (NYSE:CRM) and has not made any purchases of the stock. The company's insider transaction history indicates a total of 340 insider sells and no insider buys over the same timeframe.

On the day of the insider's recent sale, shares of Salesforce Inc (NYSE:CRM) were trading at $305.46, giving the company a market capitalization of $296.655 billion. The price-earnings ratio of the company stood at 72.82, which is above the industry median of 27.6 but below the company's historical median price-earnings ratio.

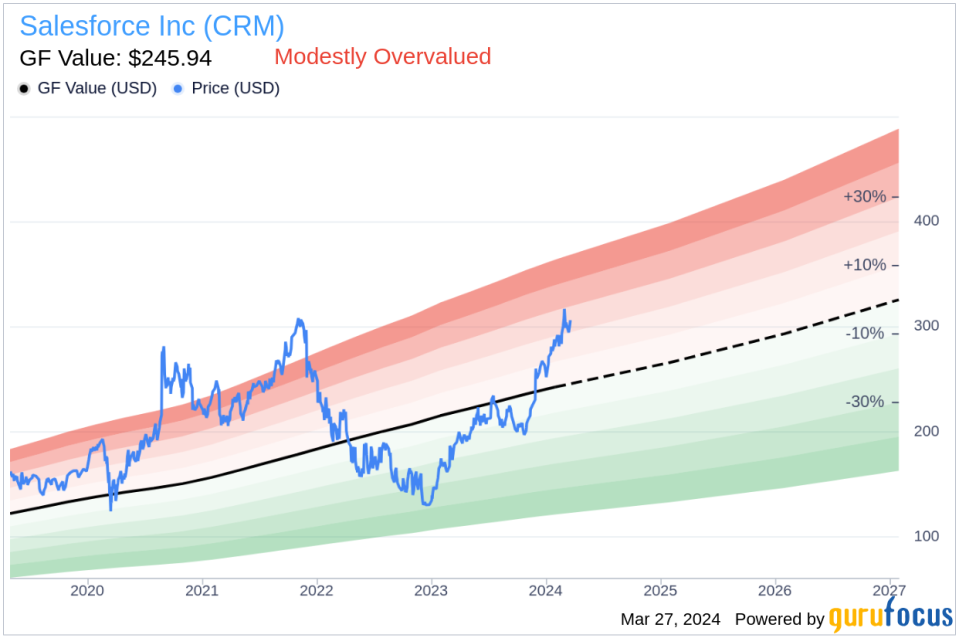

The stock's price-to-GF-Value ratio was 1.24, with a GF Value of $245.94, indicating that Salesforce Inc (NYSE:CRM) was considered modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance