Have Insiders Been Buying Burberry Group plc (LON:BRBY) Shares?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So shareholders might well want to know whether insiders have been buying or selling shares in Burberry Group plc (LON:BRBY).

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year.

View our latest analysis for Burberry Group

Burberry Group Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by CFO, COO & Director Julie Brown for UK£427k worth of shares, at about UK£17.75 per share. That implies that an insider found the current price of UK£20.44 per share to be enticing. That means they have been optimistic about the company in the past, though they may have changed their mind. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. The good news for Burberry Group share holders is that insiders were buying at near the current price.

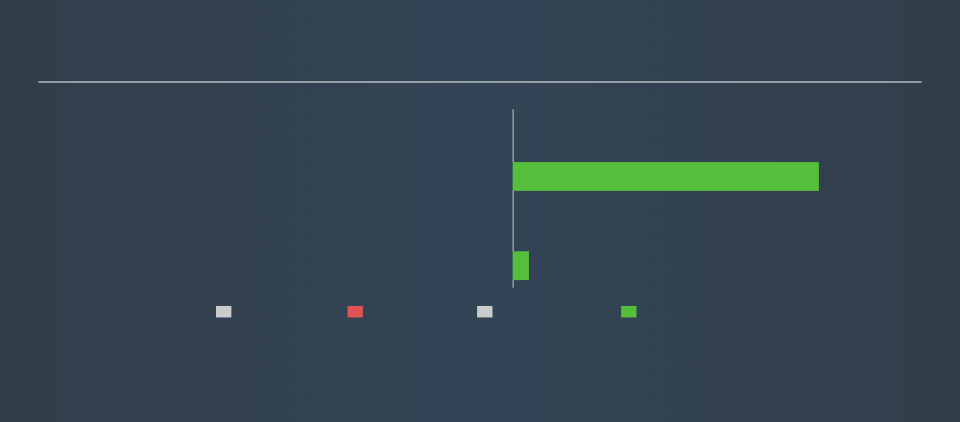

While Burberry Group insiders bought shares last year, they didn't sell. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Burberry Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Burberry Group Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. Our data indicates that Burberry Group insiders own about UK£7.2m worth of shares (which is 0.09% of the company). Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Do The Burberry Group Insider Transactions Indicate?

The fact that there have been no Burberry Group insider transactions recently certainly doesn't bother us. But insiders have shown more of an appetite for the stock, over the last year. We'd like to see bigger individual holdings. However, we don't see anything to make us think Burberry Group insiders are doubting the company. Of course, the future is what matters most. So if you are interested in Burberry Group, you should check out this free report on analyst forecasts for the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance