Insiders Are Diving Into These 3 Stocks

Insider action is closely monitored among investors. After all, it’s easy to understand why these transactions receive so much attention, as it’s a confidence booster for investors when an insider swoops in for a buy.

But who is considered an insider?

An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company. Of course, many strict rules apply.

As of late, three stocks – Lockheed Martin LMT, Lennar LEN, and Exxon Mobil XOM – have all seen insider activity. Let’s take a closer look at each.

Exxon Mobil

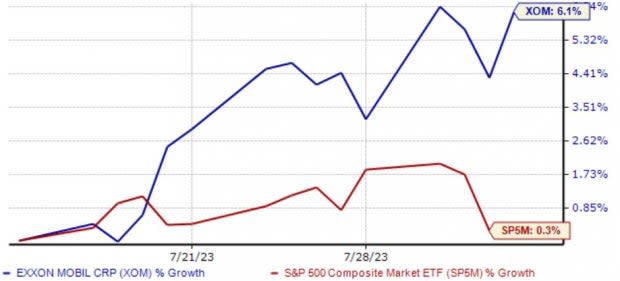

Jeffrey Ubben, a director, made a big splash very recently, acquiring 458,000 XOM shares at a total transaction value of nearly $50 million. XOM shares have found themselves back in attention following the recent rise in oil prices, up 6% since Mid-July and widely outperforming the general market.

Image Source: Zacks Investment Research

The company’s growth has significantly cooled from 2022’s euphoria, with earnings forecasted to decline 37% on 21% lower revenues in its current year. Still, income-focused investors stand to reap solid payouts, with XOM shares yielding 3.5% annually currently.

Image Source: Zacks Investment Research

In addition, the company continues to be a cash-generating machine; operating cash flow totaled $9.4 billion throughout its latest quarter, with free cash flow reaching $5 billion.

Lockheed Martin

John Donovan, a director, purchased 548 LMT shares in July, with the transaction totaling approximately $250,000. The company recently reported quarterly results, exceeding the Zacks Consensus EPS Estimate by 4.6% and sales expectations by 5%.

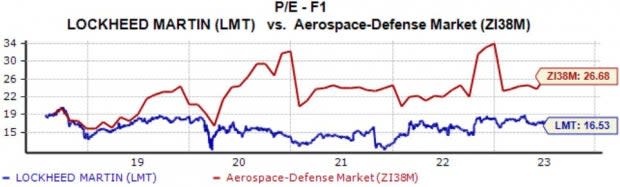

LMT shares appear attractive from a valuation standpoint, with the current 16.5X forward earnings multiple reflecting a 38% discount relative to the Zacks Aerospace – Defense industry and beneath 2022 highs of 18.4X.

The stock carries a Style Score of ‘B’ for Value.

Image Source: Zacks Investment Research

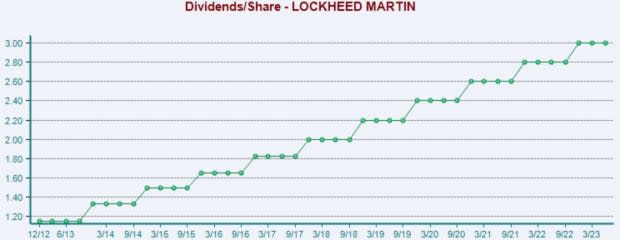

The company also boasts a shareholder-friendly nature, with its dividend payout growing more than 8% over the past five years. Shares currently yield 2.7% annually, nearly double that of its Zacks industry average.

Image Source: Zacks Investment Research

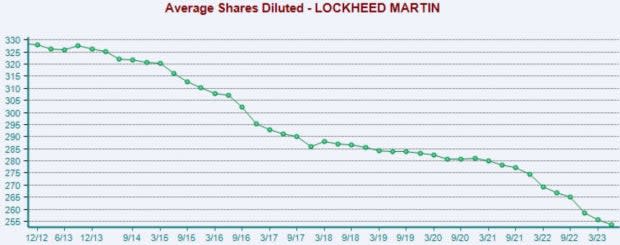

Further stating its shareholder-friendly nature, LMT purchased $500 million worth of shares and delivered $784 million in dividends throughout its latest release, with the former helping put a floor in for shares.

Image Source: Zacks Investment Research

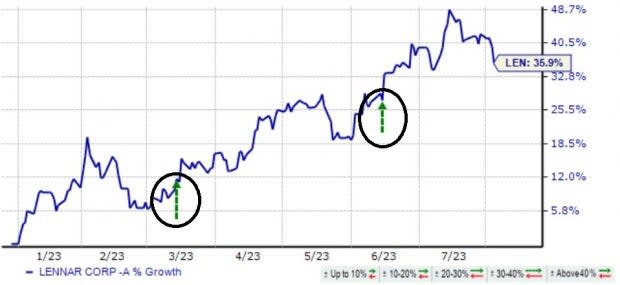

Lennar

Amy Banse, a director, recently purchased roughly $100k in Lennar shares at a price tag of $126.42 per share. The company’s earnings expectations have turned highly positive over the last several months, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Lennar posted results that blew away expectations in its latest release, exceeding the Zacks Consensus EPS Estimate by nearly 30% and reporting sales 10% ahead of expectations. Impressively, the company has exceeded EPS expectations by an average of 20% across its last four quarters.

As we can see below, shares have gotten a boost post-earnings following back-to-back releases.

Image Source: Zacks Investment Research

The company’s growth is slated to taper in its current year, with estimates suggesting a 28% decline in earnings on 3% lower revenues. Still, growth resumes in FY24, as expectations allude to a 3% recovery in the bottom line and a 2.3% bump in sales year-over-year.

Bottom Line

Investors closely follow insider transactions. After all, if an insider is buying, it sends a positive message to shareholders, whereas selling could convey negative sentiment in certain circumstances.

And insiders of all three companies above – Lockheed Martin LMT, Lennar LEN, and Exxon Mobil XOM – have recently made splashes.

Importantly, insiders have a longer-term holding horizon than most, a critical aspect that market participants should be aware of.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance