Insights on the Commercial Insurance Global Market to 2027 - Adoption of Advanced Technology in Commercial Insurance Presents Opportunities

Global Commercial Insurance Market

Dublin, April 26, 2022 (GLOBE NEWSWIRE) -- The "Global Commercial Insurance Market (2022-2027) by Type, Distribution channel, Enterprise, Industry Vertical, Geography, Competitive Analysis and the Impact of Covid-19 with Ansoff Analysis" report has been added to ResearchAndMarkets.com's offering.

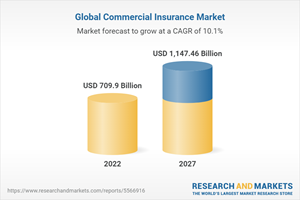

The Global Commercial Insurance Market is estimated to be USD 709.9 Bn in 2022 and is expected to reach USD 1147.46 Bn by 2027, growing at a CAGR of 10.08%.

Market Dynamics

Market dynamics are forces that impact the prices and behaviors of the Global Commercial Insurance Market stakeholders. These forces create pricing signals which result from the changes in the supply and demand curves for a given product or service. Forces of Market Dynamics may be related to macro-economic and micro-economic factors. There are dynamic market forces other than price, demand, and supply. Human emotions can also drive decisions, influence the market, and create price signals.

As the market dynamics impact the supply and demand curves, decision-makers aim to determine the best way to use various financial tools to stem various strategies for speeding the growth and reducing the risks.

Company Profiles

The report provides a detailed analysis of the competitors in the market. It covers the financial performance analysis for the publicly listed companies in the market. The report also offers detailed information on the companies' recent development and competitive scenario. Some of the companies covered in this report are Allianz, - American International Group, AON, AVIVA, AXA, Chubb, Direct Line Insurance Group, Marsh, etc.

Countries Studied

America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of - Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of - Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA.

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Competitive Quadrant

The report includes Competitive Quadrant, a proprietary tool to analyze and evaluate the position of companies based on their Industry Position score and Market Performance score. The tool uses various factors for categorizing the players into four categories. Some of these factors considered for analysis are financial performance over the last 3 years, growth strategies, innovation score, new product launches, investments, growth in market share, etc.

Ansoff Analysis

The report presents a detailed Ansoff matrix analysis for the Global Commercial Insurance Market. Ansoff Matrix, also known as Product/Market Expansion Grid, is a strategic tool used to design strategies for the growth of the company. The matrix can be used to evaluate approaches in four strategies viz. Market Development, Market Penetration, Product Development and Diversification. The matrix is also used for risk analysis to understand the risk involved with each approach.

The analyst analyses Global Commercial Insurance Market using the Ansoff Matrix to provide the best approaches a company can take to improve its market position.

Based on the SWOT analysis conducted on the industry and industry players, the analyst has devised suitable strategies for market growth.

Why buy this report?

The report offers a comprehensive evaluation of the Global Commercial Insurance Market. The report includes in-depth qualitative analysis, verifiable data from authentic sources, and projections about market size. The projections are calculated using proven research methodologies.

The report has been compiled through extensive primary and secondary research. The primary research is done through interviews, surveys, and observation of renowned personnel in the industry.

The report includes an in-depth market analysis using Porter's 5 forces model and the Ansoff Matrix. In addition, the impact of Covid-19 on the market is also featured in the report.

The report also includes the regulatory scenario in the industry, which will help you make a well-informed decision. The report discusses major regulatory bodies and major rules and regulations imposed on this sector across various geographies.

The report also contains the competitive analysis using Positioning Quadrants, the analyst's competitive positioning tool.

Key Topics Covered:

1 Report Description

2 Research Methodology

3 Executive Summary

4 Market Dynamics

4.1 Drivers

4.1.1 Increase in need for insurance policies among the enterprises

4.1.2 Increase Trend of Start-Up Business

4.1.3 Increasing Digitization in Insurance Industry

4.2 Restraints

4.2.1 Varied Insurance Regulations across the Globe

4.2.2 High insurance premium

4.2.3 Lack of Awareness among Small Sizes Enterprises

4.3 Opportunities

4.3.1 Rising Usage of Automatic and Complex Devices In The Retail, Construction and Healthcare Industries

4.3.2 Adoption of Advanced Technology in Commercial Insurance

4.4 Challenges

4.4.1 Data Security and Privacy Concerns Due to Increasing Cyber-Attacks

5 Market Analysis

5.1 Regulatory Scenario

5.2 Porter's Five Forces Analysis

5.3 Impact of COVID-19

5.4 Ansoff Matrix Analysis

6 Global Commercial Insurance Market, By Type

6.1 Introduction

6.2 Commercial motor insurance

6.3 Commercial property Insurance

6.4 Liability Insurance

6.5 Marine Insurance

6.6 Others

7 Global Commercial Insurance Market, By Distribution channel

7.1 Introduction

7.2 Agents and Brokers

7.3 Direct Response

7.4 Others

8 Global Commercial Insurance Market, By Enterprise

8.1 Introduction

8.2 Small Scale Enterprise

8.3 Medium scale Enterprise

8.4 Large scale Enterprise

9 Global Commercial Insurance Market, By Industry Verticle

9.1 Introduction

9.2 Manufacturing

9.3 Energy and Utilities

9.4 Construction

9.5 IT and Telecom

9.6 Healthcare

9.7 Others

10 Americas' Commercial Insurance Market

10.1 Introduction

10.2 Argentina

10.3 Brazil

10.4 Canada

10.5 Chile

10.6 Colombia

10.7 Mexico

10.8 Peru

10.9 United States

10.10 Rest of Americas

11 Europe's Commercial Insurance Market

11.1 Introduction

11.2 Austria

11.3 Belgium

11.4 Denmark

11.5 Finland

11.6 France

11.7 Germany

11.8 Italy

11.9 Netherlands

11.10 Norway

11.11 Poland

11.12 Russia

11.13 Spain

11.14 Sweden

11.15 Switzerland

11.16 United Kingdom

11.17 Rest of Europe

12 Middle East and Africa's Commercial Insurance Market

12.1 Introduction

12.2 Egypt

12.3 Israel

12.4 Qatar

12.5 Saudi Arabia

12.6 South Africa

12.7 United Arab Emirates

12.8 Rest of MEA

13 APAC's Commercial Insurance Market

13.1 Introduction

13.2 Australia

13.3 Bangladesh

13.4 China

13.5 India

13.6 Indonesia

13.7 Japan

13.8 Malaysia

13.9 Philippines

13.10 Singapore

13.11 South Korea

13.12 Sri Lanka

13.13 Thailand

13.14 Taiwan

13.15 Rest of Asia-Pacific

14 Competitive Landscape

14.1 Competitive Quadrant

14.2 Market Share Analysis

14.3 Strategic Initiatives

14.3.1 M&A and Investments

14.3.2 Partnerships and Collaborations

14.3.3 Product Developments and Improvements

15 Company Profiles

15.1 Allianz

15.2 American International Group

15.3 AON

15.4 AVIVA

15.5 AXA

15.6 Chubb

15.7 Direct Line Insurance Group

15.8 Marsh

15.9 Willis Towers Watson

15.10 Zurich

15.11 Travelers Group

15.12 USAA Group

15.13 Nationwide Group

15.14 American Intl Group

15.15 Famers Ins Group

15.16 Hartford Ins Group

15.17 Tokio Marine US PC Group

15.18 CAN Ins Cos

15.19 Munich-American

15.20 W.R. Berkley Group

16 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/ypdky1

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance