Insights on the Medical Injection Molding Global Market to 2030 - Featuring All-Plastics, Biomerics and HTI Plastics Among Others

Global Medical Injection Molding Market

Dublin, Sept. 08, 2022 (GLOBE NEWSWIRE) -- The "Medical Injection Molding Market Size, Share & Trends Analysis Report by Material (Plastics, Metal, Others), by System (Hot Runner, Cold Runner), by Product, by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

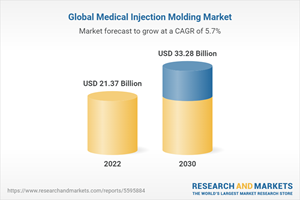

The global medical injection molding market size is anticipated to reach USD 33.28 billion by 2030. The market is projected to advance at a CAGR of 5.7% from 2022 to 2030. The global industry is primarily driven by the increased adoption of plastics in several healthcare products, coupled with rapid technological advancements in the medical sector.

With the advent of the COVID-19 pandemic, the injection molding industry has witnessed an uptick, particularly in the medical field, where it can provide accuracy, a wide range of operations, repeatability, and cleanliness. In addition, it provides cost-effective and efficient ways for producing high-volume parts and products.

In recent years, the industry for medical injection molding has seen a boom with regard to the manufacturing processes of complicated healthcare products. Players are incorporating Industry 4.0 into their processes to optimize their raw material requirements, reduce costs, and increase automation, flexibility, & efficiency, among other things.

The key factors influencing the demand for medical products include availability, awareness, affordability, and adaptability. Increasing demand for better healthcare facilities coupled with the ongoing COVID-19 pandemic has boosted the growth of medical devices manufactured with the help of injection molding machines, thereby augmenting industry growth. Medical injection molding has seen a growth in popularity in the last few years as a manufacturing process for generating complex net form medical devices. It lowers the cost of production and repetition, reducing the number of raw materials needed to develop medical items.

Companies that provide injection molding services are working to acquire the most up-to-date technologies, in order to fulfill the changing demands of the medical industry and expand their manufacturing capacity. For example, in March 2022, Beacon MedTech Solutions increased its medial injection molding capacity with the installation of the SE-EV-A series Sumitomo (SHI) Demag machines.

Medical Injection Molding Market Report Highlights

Plastic accounted for 98.73% of the global revenue share in 2021, owing to its high flexibility, cleanliness, high tensile strength, metal tolerance, & temperature resistance among other factors, making it ideal for the medical injection molding process.

Asia Pacific accounted for around 40.6% of the global revenue share in 2021, owing to the developing healthcare infrastructure such as hospitals, increasing research & development in the medical devices sector, and the easy availability of skilled labor.

The demand for hot runner systems is expected to witness a CAGR of 5.9% from 2021 to 2030, owing to its faster cycle times, elimination of the need for robotics, and increased efficiency as compared to cold runner systems.

In February 2022, Automatic Plastics Ltd. was acquired by Comar, a medical device and packaging solution provider. The company hopes to strengthen its position in the pharmaceutical and medical industries as a result of this acquisition.

In September 2020, HTI Plastics purchased two new Krauss Maffei injection molding machines. This investment helped the company in providing additional capacity and enhanced capabilities.

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Medical Injection Molding Market Variables, Trends, & Scope

3.1. Market Segmentation & Scope

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.4. Regulatory Framework

3.5. Medical Injection Molding Market-Market dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Business Environment Analysis: Medical Injection Molding Market

Chapter 4. COVID-19 Impact Analysis

Chapter 5. Medical Injection Molding Market: Product Estimates & Trend Analysis

5.1. Medical Injection Molding Market: Product Movement Analysis, 2021 & 2030

5.2. Medical equipment components

5.2.1. Market estimates and forecasts, 2017-2030 (USD Million)

5.3. Consumables

5.3.1. Market estimates and forecasts, 2017-2030 (USD Million)

5.4. Patient Aids

5.4.1. Market estimates and forecasts, 2017-2030 (USD Million)

5.5. Orthopedics Instruments

5.5.1. Market estimates and forecasts, 2017-2030 (USD Million)

5.6. Dental Products

5.6.1. Market estimates and forecasts, 2017-2030 (USD Million)

5.7. Others

5.7.1. Market estimates and forecasts, 2017-2030 (USD Million)

Chapter 6. Medical Injection Molding Market: System Estimates & Trend Analysis

6.1. Medical Injection Molding Market: System Movement Analysis, 2021 & 2030

6.2. Hot Runner

6.2.1. Market estimates and forecasts, 2017-2030 (USD Million)

6.3. Cold Runner

6.3.1. Market estimates and forecasts, 2017-2030 (USD Million)

Chapter 7. Medical Injection Molding Market: Material Estimates & Trend Analysis

7.1. Medical Injection Molding Market: Material Movement Analysis, 2021 & 2030

7.2. Plastics

7.2.1. Market estimates and forecasts, 2017-2030 (USD Million)

7.3. Metals

7.3.1. Market estimates and forecasts, 2017-2030 (USD Million)

7.4. Others

7.4.1. Market estimates and forecasts, 2017-2030 (USD Million)

Chapter 8. Medical Injection Molding Market: Regional Estimates & Trend Analysis

Chapter 9. Medical Injection Molding Market: Competitive Analysis

9.1. Key Players, Recent Developments & Their Impact on the Industry

9.2. Key Company/Competition Categorization

9.3. Vendor Landscape

9.4. Competitive Dashboard Analysis

9.5. Public Companies

9.5.1. Company Market Position Analysis

9.6. Private Companies

9.6.1. List of Key Emerging Companies and Their Geographical Presence

Chapter 10. Company Profiles

10.1. C&J INDUSTRIES

10.1.1. Company Overview

10.1.2. Financial Performance

10.1.3. Product Benchmarking

10.1.4. Strategic Initiatives

10.2. All-Plastics

10.2.1. Company Overview

10.2.2. Financial Performance

10.2.3. Product Benchmarking

10.2.4. Strategic Initiatives

10.3. Biomerics

10.3.1. Company Overview

10.3.2. Financial Performance

10.3.3. Product Benchmarking

10.3.4. Strategic Initiatives

10.4. HTI Plastics

10.4.1. Company Overview

10.4.2. Financial Performance

10.4.3. Product Benchmarking

10.4.4. Strategic Initiatives

10.5. The Rodon Group

10.5.1. Company Overview

10.5.2. Financial Performance

10.5.3. Product Benchmarking

10.5.4. Strategic Initiatives

10.6. EVCO Plastics

10.6.1. Company Overview

10.6.2. Financial Performance

10.6.3. Product Benchmarking

10.6.4. Strategic Initiatives

10.7. Majors Plastics, Inc

10.7.1. Company Overview

10.7.2. Financial Performance

10.7.3. Product Benchmarking

10.7.4. Strategic Initiatives

10.8. Proto Labs, Inc

10.8.1. Company Overview

10.8.2. Financial Performance

10.8.3. Product Benchmarking

10.8.4. Strategic Initiatives

10.9. Tessy Plastics

10.9.1. Company Overview

10.9.2. Financial Performance

10.9.3. Product Benchmarking

10.9.4. Strategic Initiatives

10.10. Currier Plastics, Inc

10.10.1. Company Overview

10.10.2. Financial Performance

10.10.3. Product Benchmarking

10.10.4. Strategic Initiatives

10.11. Formplast GmbH

10.11.1. Company Overview

10.11.2. Financial Performance

10.11.3. Product Benchmarking

10.11.4. Strategic Initiatives

10.12. H&K Muller GmbH & Co. KG

10.12.1. Company Overview

10.12.2. Financial Performance

10.12.3. Product Benchmarking

10.12.4. Strategic Initiatives

10.13. Hehnke GmbH & Co KG

10.13.1. Company Overview

10.13.2. Financial Performance

10.13.3. Product Benchmarking

10.13.4. Strategic Initiatives

10.14. TR PLAST GROUP

10.14.1. Company Overview

10.14.2. Financial Performance

10.14.3. Product Benchmarking

10.14.4. Strategic Initiatives

10.15. D&M Plastics, LLC

10.15.1. Company Overview

10.15.2. Financial Performance

10.15.3. Product Benchmarking

10.15.4. Strategic Initiatives

For more information about this report visit https://www.researchandmarkets.com/r/p0whpg

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance