Insights on the Pet Sitting Global Market to 2030 - Increasing Adoption of Subscription-Based Pet Services is Driving Growth

Global Pet Sitting Market

Dublin, Sept. 19, 2022 (GLOBE NEWSWIRE) -- The "Pet Sitting Market Size, Share & Trends Analysis Report by Pet Type (Dogs, Cats), by Service Type (Care Visits, Drop-in Visits), by Region (Asia Pacific, North America, MEA, Europe, LATAM), and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

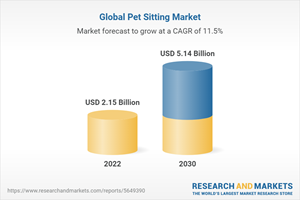

The global pet sitting market size is anticipated to reach USD 5.14 billion by 2030, according to this report. The industry is estimated to expand at a CAGR of 11.52% from 2022 to 2030.

An increasing number of initiatives by key players, the emergence of start-ups, rising pet expenditure, and multi-service offerings by major companies are some of the key factors driving the industry growth. In February 2022, Petco partnered with Rover.com to connect Petco's customers to pet boarding, sitting, and dog walking services. The COVID-19 pandemic had a negative impact on the global industry with low demand and sales. Several businesses were shut down temporarily or permanently due to pet parents working from home, movement restrictions, and concerns over zoonoses.

For example, around 85% of members of the Pet Sitters International community reported a more than 50% decline in business during the peak of the pandemic. The frequent changes of rules for pet sitting and other businesses further added to the confusion and uncertainty throughout 2020. However, with the easing up of the restrictions and back-to-office conditions, the industry has recovered gradually. The growing pet adoption across the globe is boosting the demand for pet care services, such as pet sitting. In addition, increasing spending of pet owners on various services and growing disposable income levels, particularly in developing economies, are expected to propel the adoption of pet sitting services in the coming years.

As more and more pet parents view their pets as family members, they are more willing to spend on their pet's health, grooming, and care. This has led to an increase in the uptake of pet services. The trend is expected to continue as pet parents return to offices and thus opt for such services to ensure pet safety. The industry is highly competitive with the presence of several independent business owners offering competitive pricing and implementing various sales & marketing strategies. Emma Seaney, for example, is an independent pet sitter and a qualified veterinary nurse in the U.K. offering pet care visits for rabbits, rodents, birds, cats, chickens, fish, and other animals. This includes house sitting service as well as medicine administration, nail clipping, tick removal, and de-matting services.

Pet Sitting Market Report Highlights

The key drivers of the industry include a growing number of companies, back-to-office trends post-COVID-19 restrictions, and rising pet health concerns

Pettner Co., Ltd. for instance, is a South Korean start-up founded in 2017, that offers multi-category pet services via its online platform. This includes services such as pet boarding, house sitting, and dog walking

By pet type, the dogs pet type segment held the highest revenue share in 2021 while the cats segment is expected to grow at the fastest CAGR over the forecast period

The care visits segment dominated the industry in 2021. The drop-in visits segment, on the other hand, is projected to grow at the highest CAGR from 2022 to 2030

North America accounted for the largest share of the global revenue in 2021 and is expected to continue to dominate the industry over the forecast period

This is attributed to the presence of numerous pet sitting service providers, high pet expenditure, and growing pet humanization in the region

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Pet Sitting Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Penetration & Growth Prospect Mapping, 2021

3.3 Pet Sitting Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Increasing expenditure on pets

3.3.1.2 Rising pet humanization

3.3.1.3 Increasing initiatives by public and private organizations

3.3.1.4 Rising expansion of pet service offerings

3.3.1.5 Increasing adoption of subscription-based pet services

3.3.2 Market restraint analysis

3.3.2.1 Rising pet care costs

3.3.2.2 Pet abandonment

3.3.3. Market opportunity analysis

3.3.4. Market challenge analysis

3.4 Pet Sitting Market Analysis Tools: Porters

3.5 Pet Sitting Industry Analysis - PEST (Political & Legal, Economic, Social, and Technological)

3.6. Estimated Pet Population, by geographies & Key Species

3.7 Consumer Trend & Preferences

3.8 Service Pricing Analysis

3.9 Business Plan Analysis

3.9.1 STP Analysis (Segmentation, Targeting, and Positioning)

3.10 COVID -19 Impact Analysis

Chapter 4 Pet Sitting Market: Segment Analysis, By Pet Type, 2017 - 2030 (USD Million)

4.1 Pet Type Market Share Analysis, 2021 & 2030

4.2 Pet Sitting Market, by Pet Type, 2017 to 2030

4.3 Dogs

4.3.1 Dogs market, 2017 - 2030 (USD Million)

4.4 Cats

4.4.1 Cats market, 2017 - 2030 (USD Million)

4.5 Others

4.5.1 Others market, 2017 - 2030 (USD Million)

Chapter 5 Pet Sitting Market: Segment Analysis, By Service Type, 2017 - 2030 (USD Million)

5.1 Service Type Market Share Analysis, 2021 & 2030

5.2 Pet Sitting market, by Service Type, 2017 to 2030

5.3 Care Visits

5.3.1 Care Visits market, 2017 - 2030 (USD Million)

5.4 Drop-in Visits

5.4.1 Drop-in Visits market, 2017 - 2030 (USD Million)

Chapter 6 Pet Sitting Market: Regional Market Analysis 2017 - 2030 (USD Million)

Chapter 7 Pet Sitting Market - Competitive Analysis

7.1 Market Participant Categorization

7.1.1. Company Market Position Analysis

7.1.2. Synergy Analysis: Major Deals & Strategic Alliances

7.1.3. Market Leaders & Innovators

7.2. List of Key Companies/ Service Providers

Chapter 8 Pet Sitting Market - Company Profiles

8.1 A Place for Rover, Inc.

8.1.1 Company overview

8.1.2 Financial Performance

8.1.3 Service type benchmarking

8.1.4 Strategic initiatives

8.2 Pets at Home, Inc.

8.2.1 Company overview

8.2.2 Financial performance

8.2.3 Service type benchmarking

8.2.4 Strategic initiatives

8.3. Wag! Group Co.

8.3.1 Company overview

8.3.2 Financial performance

8.3.3 Service type benchmarking

8.3.4 Strategic initiatives

8.4 PetBacker

8.4.1 Company overview

8.4.2 Financial performance

8.4.3 Service type benchmarking

8.4.4 Strategic initiatives

8.5 Careguide Inc.

8.5.1 Company overview

8.5.2 Financial performance

8.5.3 Service type benchmarking

8.5.4 Strategic initiatives

8.6 Fetch! Pet Care

8.6.1 Company overview

8.6.2 Financial performance

8.6.3 Service type benchmarking

8.6.4 Strategic initiatives

8.7 Holidog.com

8.7.1 Company overview

8.7.2 Financial performance

8.7.3 Service type benchmarking

8.7.4 Strategic initiatives

8.8 PetSmart LLC

8.8.1 Company overview

8.8.2 Financial performance

8.8.3 Service type benchmarking

8.8.4 Strategic initiatives

8.9 Dogtopia Enterprises

8.9.1 Company overview

8.9.2 Financial performance

8.9.3 Service type benchmarking

8.9.4 Strategic initiatives

8.10 Swifto Inc.

8.10.1 Company overview

8.10.2 Financial performance

8.10.3 Service type benchmarking

8.10.4 Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/wm4kzt

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance